US futures

Dow futures +0.08% at 33593

S&P futures +0.25% at 4133

Nasdaq futures +0.3% at 13183

In Europe

FTSE +0.18% at 7685

Dax +0.96% at 15715

- US factor orders & JOLTS job opening in focus

- Oil prices extend gains

- GBP rises with BoE Hue Pill due to speak

JOLTS job openings & US factory orders due

US stocks are pointing to a modestly higher start after a mixed closed yesterday, as investors continue to digest rising oil prices which could impact the Fed’s path for interest rates and look ahead to more data.

The rise in oil prices makes the Fed’s job to rein in inflation more complicated. This could ultimately mean higher interest rates for longer. That said, the market is still pricing in two rate cuts by the end of the year. Although the market is pricing in a 58% chance of a rate hike in May, following the OPEC cut.

Looking ahead, attention is on US factory orders which are expected to fall -0.5% MoM in February, down from -1,5% in January. The data comes after the US manufacturing PMI fell to an almost 2-year low.

US JOLTS job openings are also in focus and are expected to show a small decline to 10.4 million, down from 10.8 million. The data is inline with a tight labour market and comes ahead of Frida’s non-farm payroll report.

Corporate news

Virgin Orbit drops 24% pre-market after the cash-strapped space-launch firm filed for Chapter 11 bankruptcy.

Walmart will be under the spotlight as a two-day investor and analyst meeting begins. This comes amid reports that the retail giant is set to cut 2000 jobs.

Tesla rises 0.8% after steep losses yesterday and after the EV maker sold 88,869 China-made vehicles in March, up 35% year on year.

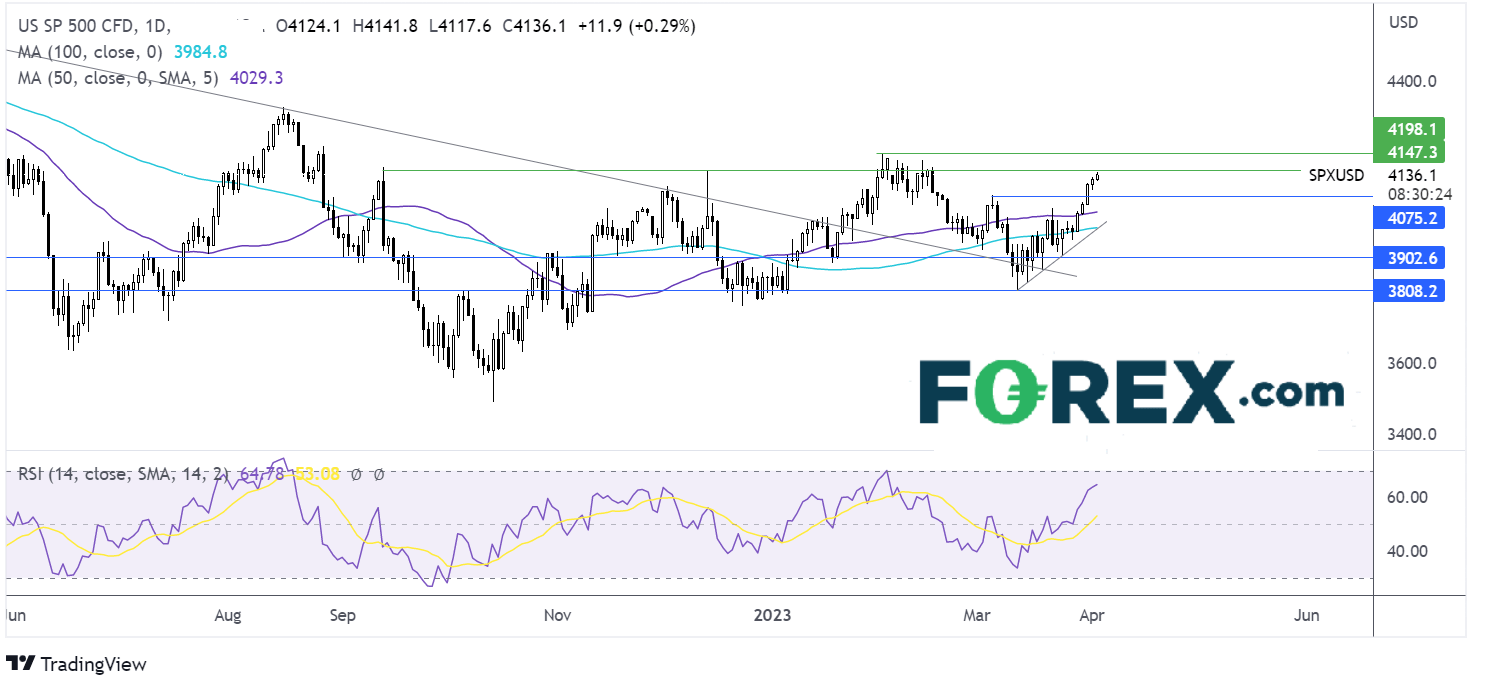

Where next for the S&P?

The S&P500 is approaching a key resistance level at 4145, the December high. Break above here is needed to bring 4200, the 2023 high into target. Meanwhile, a break below the 50 sma at 4030 opens the door to 3980, the 100 sma, and the rising trendline resistance. A break below here negates the near-term uptrend.

FX markets – USD falls, GBP jumps

The USD is falling, extending losses from yesterday as the markets bet that the end of the Fed’s rate hiking cycle is near. US data and Fed speakers will provide further clues.

EUR/USD is flat around 1.09 after the eurozone PPI cooled by more than expected to 13.2% YoY in February, down from 15% in January. Eurozone consumer inflation expectations fell to a one-year low at 4.6%, and inflation in three years’ time to be 2.4%.

GBP/USD is rising, adding to 1% gains from yesterday, supported by BoE – Fed divergence. April is also typically a strong month for the cable, given it has risen 8 of the past 10 years in April. BoE Chief Economist Huw Pill is due to speak today.

EUR/USD +0.08% at 1.09

GBP/USD +0.5% at 1.2482

Oil extends gain

Oil prices are extending gains after the OPEC+ oil production cut announcement at the weekend. Oil prices trade over 7% higher this week and are up 16% across the past 10 days.

UBS is forecasting Brent will rise to $100 the barrel by the end of the coming quarter. Goldman Sachs also upwardly revised the oil prices forecast.

WTI crude trades +0.8% at $81.05

Brent trades at +0.8% at $85.44

Looking ahead

15:00 US factory orders

15:00 Job openings