US futures

Dow futures -0.37% at 37206

S&P futures -0.43% at 4780

Nasdaq futures -0.55% at 16740

In Europe

FTSE -1.66% at 7424

Dax +0.01% at 16395

- Retail sales rose 0.6% MoM vs 0.4% exp.

- Hawkish Fed speakers spook the market

- Tesla falls after price cuts

- Oil tumbles after weak Chinese data & on concerns over global growth

Fed speakers & retail sales spook the market

US stocks are pointing to a weaker start, extending losses from the previous session on renewed concerns that the Federal Reserve could keep interest rates high for longer than the market had been expecting.

Risk appetite has been hit after Federal Reserve governor Christopher Waller indicated that while inflation was moving in the right direction, the central bank should not be in any rush to consider cutting rates in the near term. He highlighted the resilience of the US economy while downplaying expectations of a rate cut soon.

His comments come after US retail sales rose by more than forecast is December, increasing 0.6% MoM. This was ahead of the 0.4% forecast and up from 0.3% in November. The data highlights the resilience of the US consumer despite interest rates being at a 22-year high and supports the view that the U.S. economy is heading for a soft landing, supporting the Federal Reserve's less dovish view.

After dovish rate cut euphoria drove stocks to record highs at the end of last year, money markets are repricing expectations, bringing them more in line with Federal Reserve commentary and more in line with a soft landing outlook.

Looking ahead, more Fed speakers are due today, including New York Federal Reserve President John Williams. Any comments regarding the outlook for inflation or interest rates could influence sentiment.

Corporate news

Tesla falls after cutting the price of its Model Y cars in Germany, where it lost its top EV seller crown to Volkswagen. The move comes a week after it reduced Model Y prices in China.

Charles Schwab rose 1.2% after the broker’s Q4 profits beat expectations, and revenue fell short of estimates.

Chinese ADRs are set to open lower after weaker than expected China growth data. Alibaba is set to fall 2.8%, JD points to a 4.3% fall on the open.

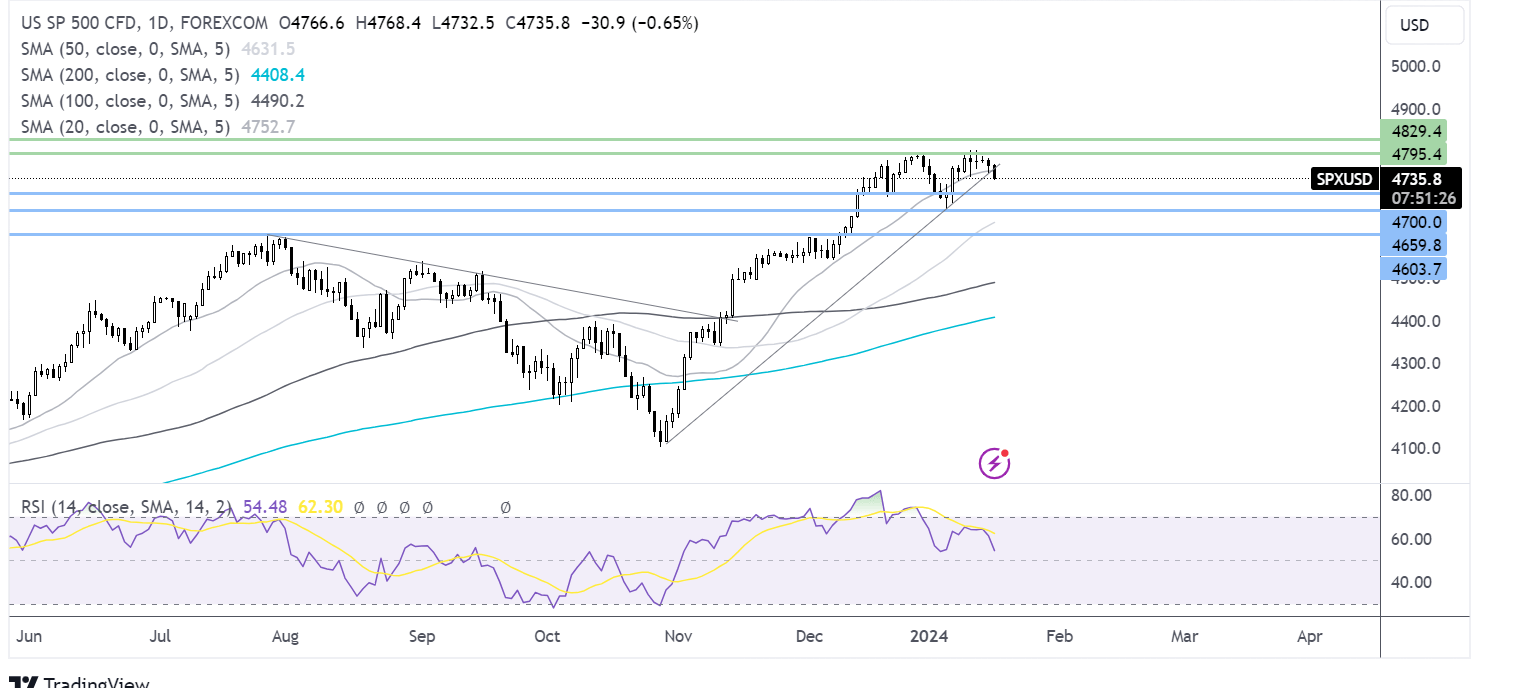

S&P 500 forecast – technical analysis

The S&P 500 faces rejection at 4800 and has rebounded lower, breaking below the 20 SMA and the rising trendline resistance. Support can be seen at 4700, the mid-December low. A break below here brings 4660, the 2024 low, into focus. Any recovery must retake the 20 SMA at 4750 to extend gains back to 4800.

FX markets – USD rises GBP/USD rises

The USD is rising, giving back earlier gains. The US dollar had risen to a monthly high versus its major peers after hawkish comments from Fed speakers who have downplayed the need for an early rate cut, while robust retail sales data supports the Fed’s more hawkish view.

EUR/USD is rising after ECB president Christine Lagarde said that a summer rate cut was likely further back than the March rate cut that the market had been expecting. Eurozone inflation data also confirmed a rise to 2.9%, up from 2.4% in November.

GBP/USD is rising, recovering from a monthly low after hotter-than-expected UK CPI data. UK inflation rose to 4%, up from 3.9%, and core inflation remained sticky at 5.1%. The market pushed back rate cut bets with the first rate cut now fully priced in June, and the probability of a May rate cut has been downwardly revised to 50% from 65%.

Oil tumbles after weak Chinese data & on concerns over global growth

Oil prices are falling sharply lower amid rising concerns over future demand following weaker-than-expected economic growth in China, the world's largest oil importer. The Chinese economy expanded by 5.2% year on year, missing expectations and raising doubts over China’s oil demand in 2024.

Meanwhile, the prospect of higher interest rates for longer in the US and Europe was also dampening the outlook for global growth and oil demand.

The fragile and patchy recovery in the Chinese economy and the prospect of high US rates have unnerved the oil market, particularly given the ample global supply picture. The latest OPEC report in which the group sees robust demand has been shrugged off in light of today’s data, and the concerns over the demand outlook have also overshadowed ongoing tensions in the Red Sea as more tankers re-route away from the Red Sea.