- The US interest rate outlook has been driving USD/JPY and Nikkei 225 movements recently

- BOJ rate hike speculation has generated ample noise but not much market movement

- After a hot January CPI print, today’s US inflation report screens as particularly important for US yields, USD/JPY and Nikkei

USD/JPY and Nikkei 225 futures have been heavily influenced by US bond yields recently, meaning Tuesday’s US consumer price inflation report looms as critical for how Japanese markets may fare over the short to medium term. The bias for each remains lower in the absence of another hot inflation number.

BOJ “fears” not behind USD/JPY, Nikkei 225 weakness

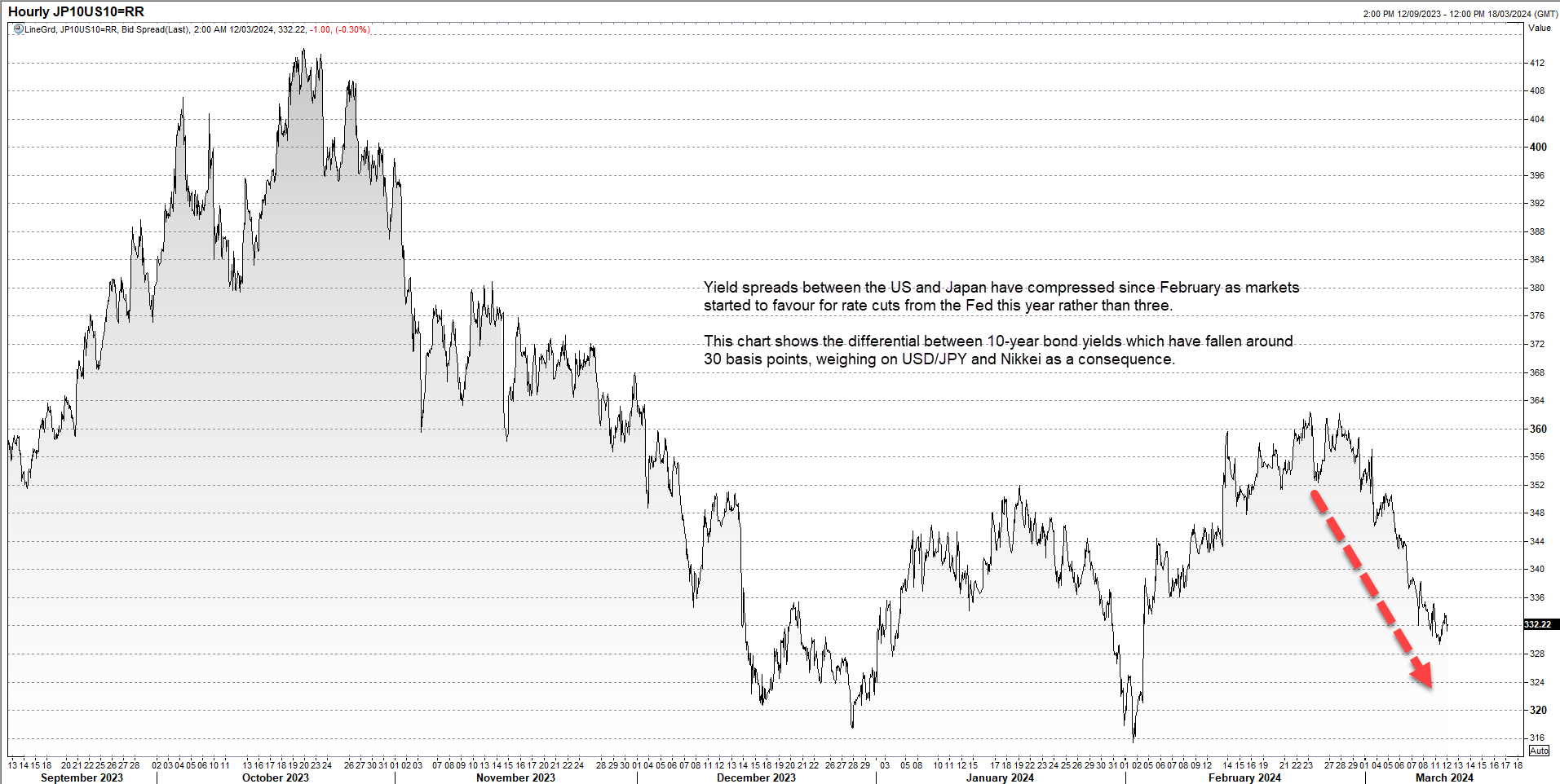

Rather than Bank of Japan rate rise fears rattling Nikkei 225 futures and USD/JPY in March, it’s really the US interest rate outlook that’s been moving these markets. USD/JPY has been closely correlated to US 10-year yields on a rolling one-month basis dating back to late 2023.

Over a shorter timeframe, the correlation between USD/JPY and Nikkei futures has been strong and positive, completing the linkage between the three markets: US rates are driving USD/JPY and USD/JPY is dictating the performance of the Nikkei. This video explains in more detail.

While the Bank of Japan has been a factor, it’s a stretch to suggest the pullback in Japanese markets has been driven by concerns it’s about to abandon negative interest rates. Such an outcome has been priced into money markets for months. The only real uncertainty was the timing, March, April or later. It now looks to be swinging towards the former, generating plenty of headlines but not much movement in Japanese short-end rates.

Look at Japanese one-year overnight index swaps – which measure where markets see overnight interest rates sitting in one year’s time – they have risen by only four basis points over the past six weeks to around 25 basis points, underlining that rate hikes have been priced in months. It’s just the expected magnitude of the increase that has been bumped up a touch.

Source: Refinitiv

With US yields pulling back while Japanese yields have continued to inch higher, it’s seen 10-year yield spreads between the two nations compress by around 30 basis points, driving USD/JPY lower.

Source: Refinitiv

Hot January CPI report makes today’s number even more significant

Armed with knowledge that USD/JPY and Nikkei are being heavily influenced by the US rate outlook right now, it means the February consumer price inflation (CPI) report out Tuesday looms as a major risk event.

Looking at market moves heading into the event, there’s an obvious degree of scepticism among traders, strategists and economists about the strength seen in the January CPI report given the exact same thing occurred in prior years, strengthening the argument that the acceleration was a seasonal quirk. If that proves to be the case with a soft February reading, it may exacerbate downside risks for US yields, USD/JPY and Nikkei.

The bar for an upside surprise has been set high with headline CPI expected to increase 0.4% with core tipped to print at 0.3%. Neither would be compatible with the Fed achieving its 2% mandate yet that’s what markets expect, creating what I see as asymmetric risks to the downside should the January heat reverse in February. Only another upside surprise would likely be enough to spark a bounce in US yields, heightening the risk the Fed may have to keep rates unchanged well into the second half of the year. For a pair that’s been so heavily influenced by interest rate differentials recently, further weakness in US yields would likely act as a gravitational pull on USD/JPY.

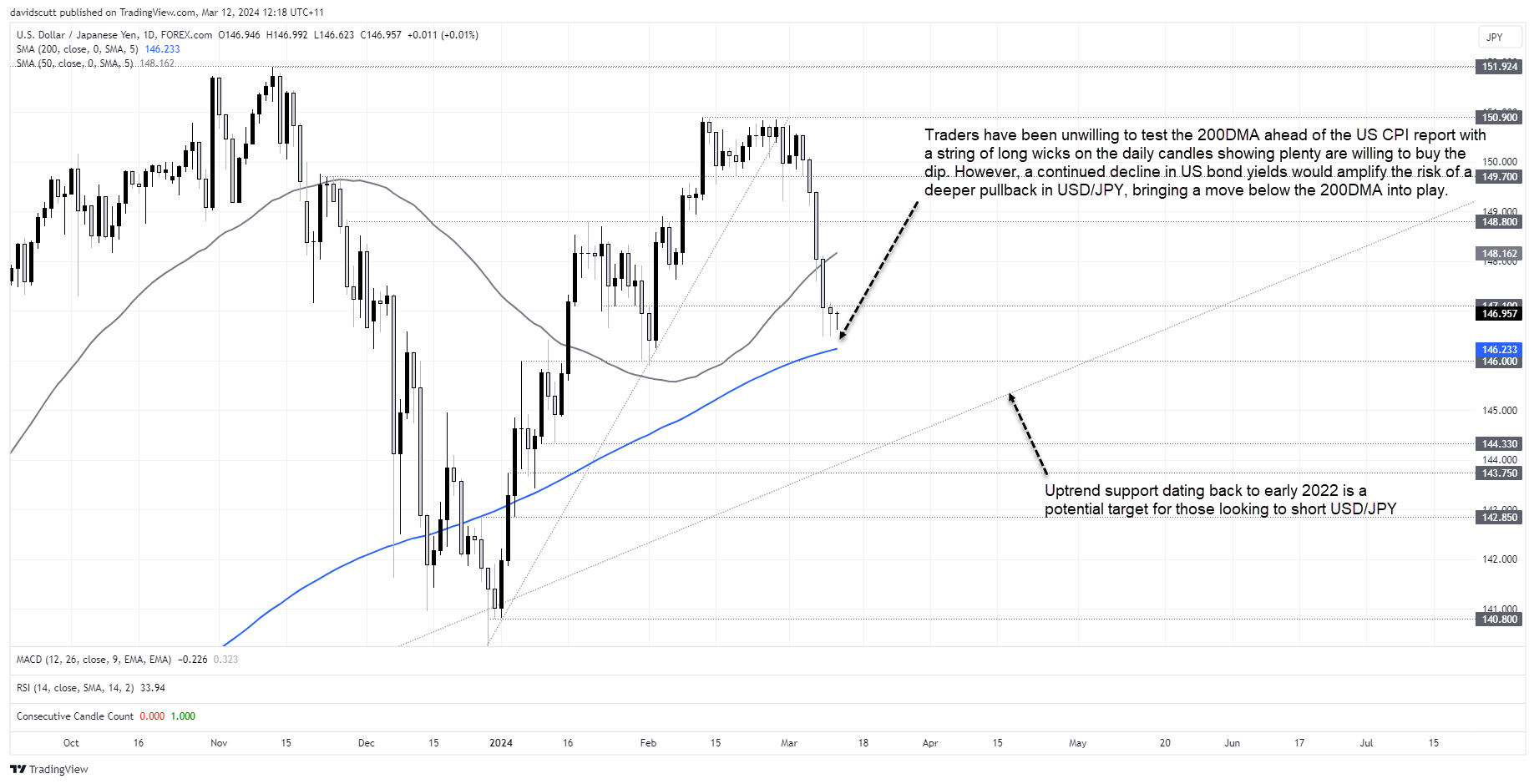

USD/JPY unwinds stalls at 200DMA

The USD/JPY reversal stalled ahead of the 200-day moving average on the daily chart, an unsurprising outcome given how often it’s been respected in the past forgiving the messy price action seen either side of the calendar year turn. The hammer candle on Monday, followed by further dip buying in early Asia on Tuesday, suggests near-term upside risk, perhaps driven by positioning adjustments ahead of the CPI report.

But it’s what happens next that’s most important.

Should the CPI data undershoot it could easily spark renewed downside for USD/JPY, leading to a test of the 200DMA and horizontal support at 146.00. Should those levels go, it may open the door to a retest of uptrend support dating back to early 2022.

Should US yields continue to fall, the path of least resistance would likely be lower for USD/JPY. Should that materialise, traders could sell USD/JPY below 147.10 -- with a stop above – targeting a move towards uptrend support indicated on the chart.

However, should we receive another hot inflation print , the likely uplift in US yields could spark a reversal back above 147.10, putting the 50DMA and horizontal resistance at 148.80 into play. Such an outcome screens as unlikely but would be significant for broader markets if it were to occur

Nikkei directional risks skewing lower

Given the implications for USD/JPY, whatever happens next for US yields also looms as crucial for the Nikkei 225 which sits on a precarious position on the charts.

Nikkei futures have broken the uptrend dating back to the start of the year and are now threatening to do the same with horizontal support at 38250, adding to losses on the resumption of physical trade on Tuesday. Looking at the daily chart, having run so hard so fast, there’s not a lot of major supports evident until around 37000 where the 50-day moving average intersects with minor horizontal support. That looms as the first downside target for those considering shorts.

Patience points to deliver higher probability trades

While some may be willing to initiate positions before the CPI report, I’m more inclined to see how the dust settles before looking at higher probability trades. The price action hints we’ll see softness but it’s not a given. And today’s report carries the potential to influence price action well beyond the short-term.

Written by David Scutt

Follow David on Twitter @scutty