Gold and silver were both weaker at the start of this week, after silver posted its best weekly gain since mid-May, rising about 7%, while gold rose a solid 2.2%, last week. Silver’s more impressive gains came as the metal broke out of a technical continuation pattern and with the dollar falling against a basket of foreign currencies thanks to weakness in US data, raising investor expectations about a September rate cut by the US Federal Reserve. Concerns about the French elections on Sunday had also played a part in boosting precious metals’ appeal last week. But after a surprise win for left-wing alliance, which helped to keep Le Pen’s far right from power, this meant that some haven demand would drop out of the equation and explains why both gold and silver have started this week on the backfoot, with European shares rebounding in a mild risk-on session. This week, it is all about US inflation, which puts the dollar and dollar-denominated assets like gold and silver in sharp focus. Despite their weaker start to the week, gold and silver may have long ways to go on the upside, I reckon. Our gold and silver forecast both remain positive.

Dollar drops on weak US data ahead of CPI

Following weakness in US data last week, including the ISM manufacturing and services PMIs and a not-so-great nonfarm payrolls report, the US dollar fell, boosting the appeal of precious metals and supporting our bullish silver forecast. The focus will now turn to the latest Consumer Price Index measure of inflation, which will be released on Thursday, July 11. After a weak-than-expected rise of 0.2% in monthly core CPI and a flat headline reading, the US dollar bears were hoping to see a more pronounced US dollar drop last month. Instead, the greenback held its own rather well, especially against the yen and euro in the past few weeks until dropping on the back of weak US economic data last week, something which supported currencies where the central bank is more hawkish than the Fed e.g., AUD. If we see another weaker-than-expected CPI print, then this may lead to expectations that the disinflation process has resumed after what has been a bumpy road to inflation returning to normalcy.

Silver forecast: technical analysis and key levels to watch

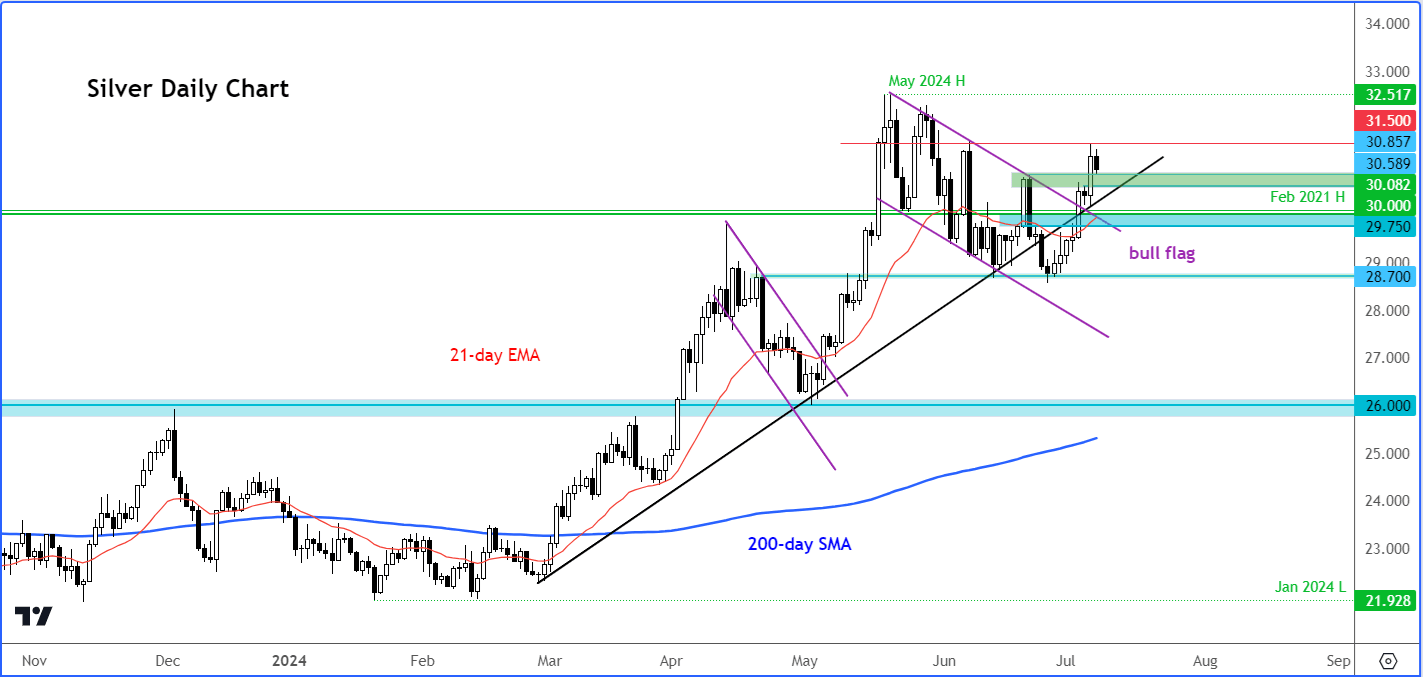

In recent weeks, silver had been declining, but last week's recovery marked a change. The gold chart is also turning positive after a lengthy consolidation. For silver, after testing a major support area around $28.70 to $29.00, buyers have stepped in, pushing silver above several short-term resistance levels. These levels must hold to maintain the renewed bullish trend.

Key points in the current silver forecast:

- Bullish Trend: Silver reclaimed its bullish trend line from February, climbed above the 21-day exponential average, and broke through a key resistance range around $30.00 to $30.20.

- Support Levels: The abovementioned $30.00-$30.20 range is crucial support to watch this week, especially with upcoming CPI data. Additional short-term support levels to watch include $30.85 and $30.58.

- Upside Targets: Potential resistance levels and bullish targets for silver are at $31.50 (last week’s high), $32.00 (prior resistance), and $32.50 (approx. May’s high).

- Line in the sand: The essential support level is around $28.70. A break below this would challenge the bullish silver forecast outlook.

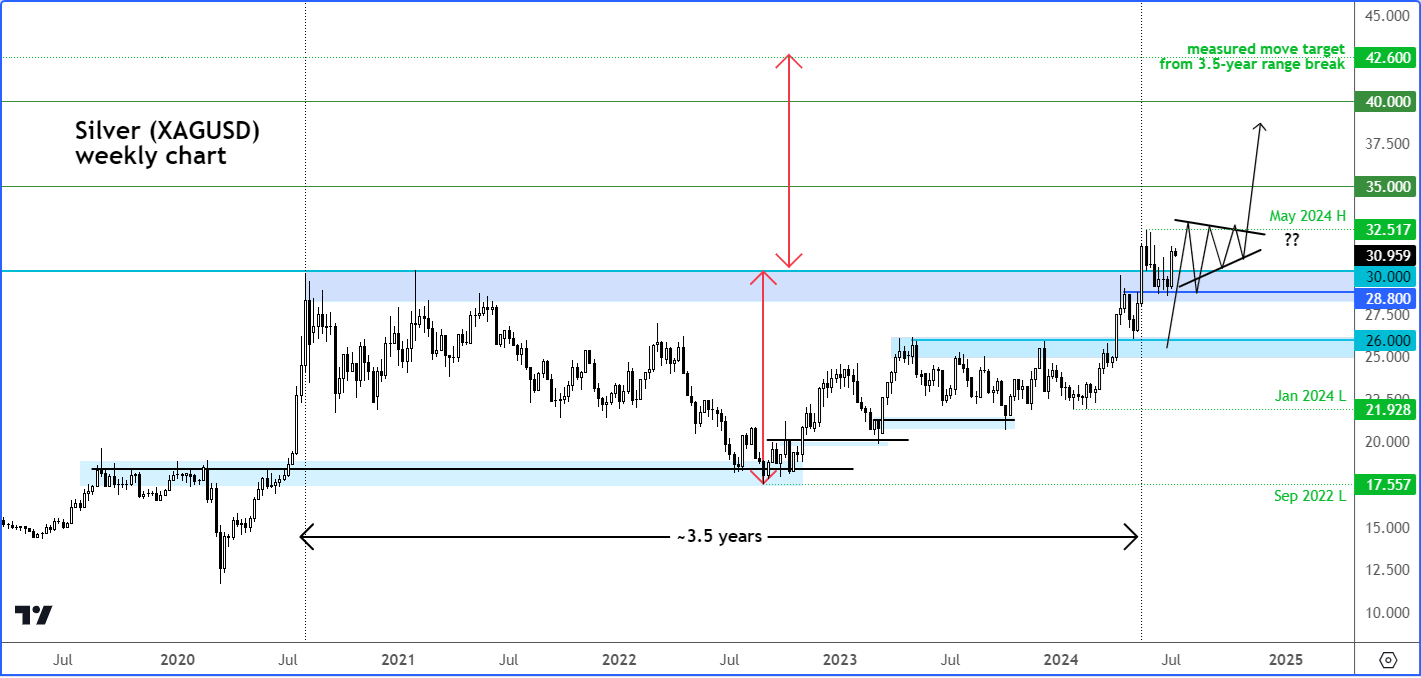

Looking at the long-term chart, silver might be on the verge of a significant move. The recent breakout suggests that silver could rise towards $35.00 in the coming weeks, possibly even higher, if and when it climbs through the recent consolidation range. So, on the long-term charts, the bullish silver forecast is even more relevant.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R