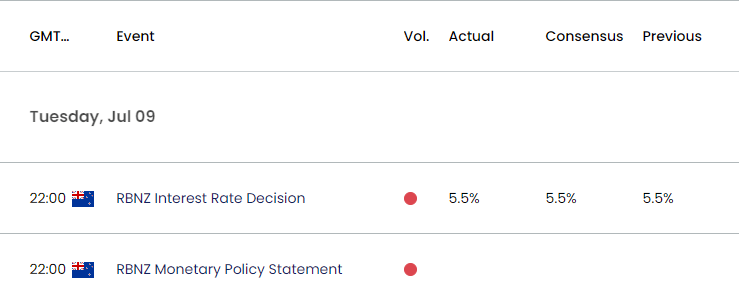

Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) kept the official cash rate (OCR) at 5.50% in July, with the central bank stating that ‘restrictive monetary policy has significantly reduced consumer price inflation.’

New Zealand Economic Calendar – July 10, 2024

The summary of the RBNZ meeting revealed that ‘the Committee is confident that inflation will return to within its 1-3 percent target range over the second half of 2024,’ and the central bank may start to discuss a less-restrictive policy as ‘the extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures.’

Nevertheless, it seems as though the RBNZ is in no rush to switch gears as ‘members noted a risk that domestically driven inflation could be more persistent in the near term,’ and Governor Adrian Orr and Co. may stick to the sidelines over the remainder of the year as ‘the Committee agreed that monetary policy will need to remain restrictive.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

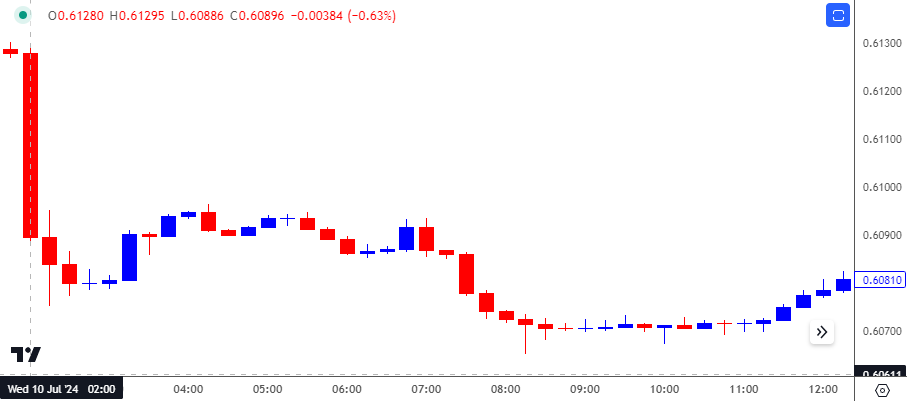

NZD/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; NZD/USD on TradingView

The New Zealand Dollar came under pressure following the RBNZ meeting, with NZD/USD failing to retrace the market reaction as it closed the day at 0.6082. Nevertheless, the decline in NZD/USD was short-lived as the exchange rate ended the week at 0.6119.

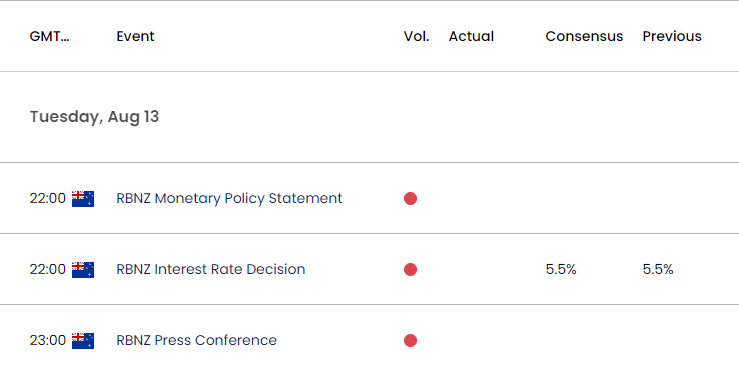

Looking ahead, the update to the quarterly Monetary Policy Statement (MPS) may sway the New Zealand Dollar as the RBNZ is anticipated to keep the official cash rate (OCR) at 5.50%, and the fresh forecasts may keep NZD/USD afloat should the central bank talk down speculation for a rate-cut in 2024.

However, Governor Orr and Co. may adjust the forward guidance for monetary policy as the committee anticipates further progress in bringing down inflation, and NZD/USD may struggle to retain the advance from earlier this month if the RBNZ shows a greater willingness to implement a rate-cut in 2024.

Additional Market Outlooks

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

Canadian Dollar Forecast: USD/CAD Flirts with 50-Day SMA

US Dollar Forecast: USD/JPY Continues to Defend January Low

Gold Price to Eye Monthly High on Failure to Close Below 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong