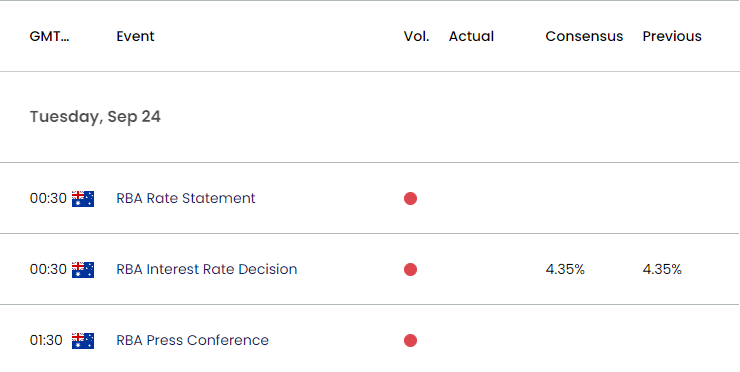

Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) kept the cash rate at 4.35% for the sixth consecutive meeting in August.

Australia Economic Calendar – August 6, 2024

The RBA acknowledged that ‘inflation has fallen substantially since its peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance,’ but it seems as though the central bank is in no rush to switch gears as ‘inflation is still some way above the midpoint of the 2–3 per cent target range.’

In turn, the minutes from the August meeting highlighted that ‘holding the cash rate target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe,’ with Governor Michele Bullock and Co. going onto say that ‘monetary policy will need to be sufficiently restrictive until members are confident that inflation is moving sustainably towards the target range.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

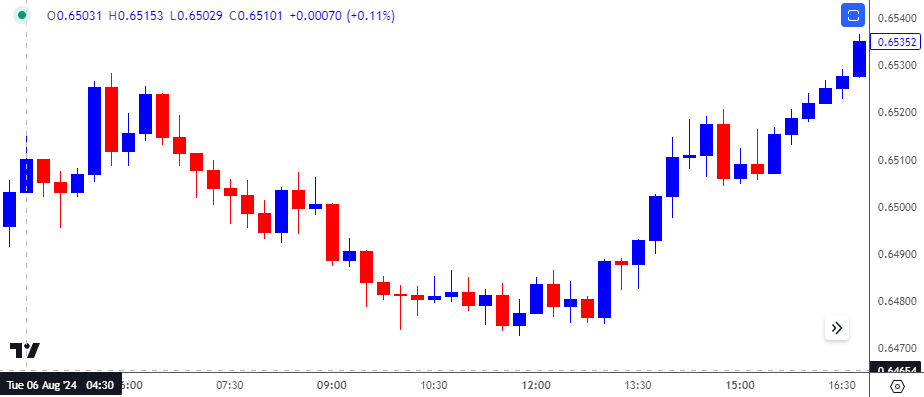

AUD/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

Despite the limited reaction to the RBA announcement, AUD/USD bounced back from the session low (0.6473) to close the day at 0.6520. AUD/USD continue to appreciate over the remainder of the week to close at 0.6572.

Looking ahead, the RBA is anticipated to retain its current policy, with the central bank expected to keep the cash rate at 4.35% in September.

With that said, more of the same from the RBA may generate a bullish reaction in the Australian Dollar as the central bank continues to combat inflation, but the Aussie may face headwinds should Governor Bullock and Co. start to show a greater willingness to unwind its restrictive policy.

Additional Market Outlooks

USD/JPY Forecast: RSI Moves Away from Oversold Zone Ahead of BoJ

USD/CAD Vulnerable as Post-Fed Weakness Persists

AUD/USD on Cusp of Testing August High following Fed Rate Cut

EUR/USD Struggles to Test Monthly High Ahead of Fed Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong