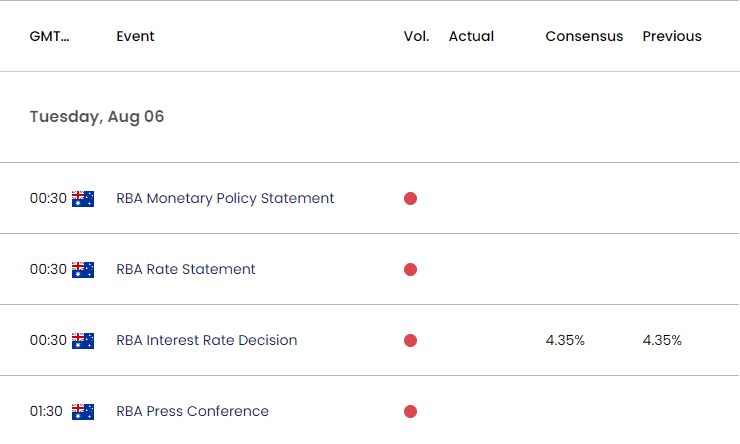

Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) kept the cash rate at 4.35% in June, with the central bank acknowledging that ‘inflation is easing but has been doing so more slowly than previously expected.’

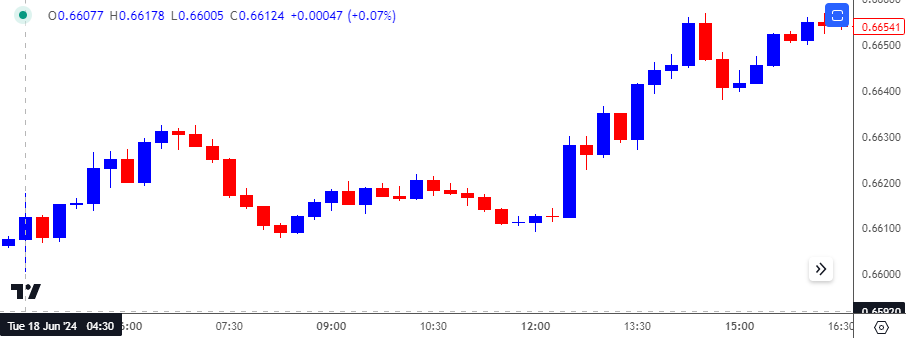

Australia Economic Calendar – June 18, 2024

In turn, the RBA warned that ‘it will be some time yet before inflation is sustainably in the target range,’ and reiterated that the ‘Board is not ruling anything in or out’ as the central bank continues to combat inflation. The comments suggest the RBA is in no rush to switch gears as Governor Michele Bullock and Co. promote a data-dependent approach in managing monetary policy, and the central bank may stick to the sidelines at its next meeting as the ‘Board remains resolute in its determination to return inflation to target.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

AUD/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

AUD/USD edged higher as the RBA kept Australia interest rates on hold, with the exchange rate rallying to fresh weekly highs as it closed the day at 0.6658. However, AUD/USD struggled to extend the advance following the RBA meeting as it ended the week at 0.6642.

Looking ahead, the RBA is expected to retain the current policy in August, and more of the same from the Governor Bullock and Co. may generate a bullish reaction in the Australian Dollar as the central bank remains reluctant to implement lower interest rates.

However, the RBA may adjust its forward guidance for monetary policy as the recent update to Australia’s Consumer Price Index (CPI) reveals easing inflation, and the meeting may produce headwinds for the Australian Dollar should the central bank start to discuss a rate-cut.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Selloff Pushes RSI into Oversold Zone

US Dollar Forecast: EUR/USD Opening Range for August in Focus

British Pound Forecast: GBP/USD Pending Breakout

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong