FOMC, USD, EUR/USD, GBP/USD Talking Points:

- This is an archived webinar in which I looked at a number of major FX pairs ahead of tomorrow’s FOMC rate decision.

- In this article I highlight both EUR/USD and GBP/USD but in the archive more pairs are addressed with some additional context.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The next few days are loaded on the economic calendar , with rate decisions from the Federal Reserve, European Central Bank and Bank of Japan all set to be announced this week. And we’ve already had the release of US CPI with headline showing another move lower to 4.0% while Core CPI remained elevated at 5.3%.

That 5.3% marker for core inflation is still well-above the Fed’s goal of 2% but markets are nonetheless expecting the Fed to skip a rate hike at tomorrow’s meeting. This could be coupled with a nod towards another hike in July, which markets are currently expecting with a 62.5% probability (per CME Fedwatch).

This sets the backdrop for the Summary of Economic Projections and the accompanying press conference to be the big movers at tomorrow’s announcement.

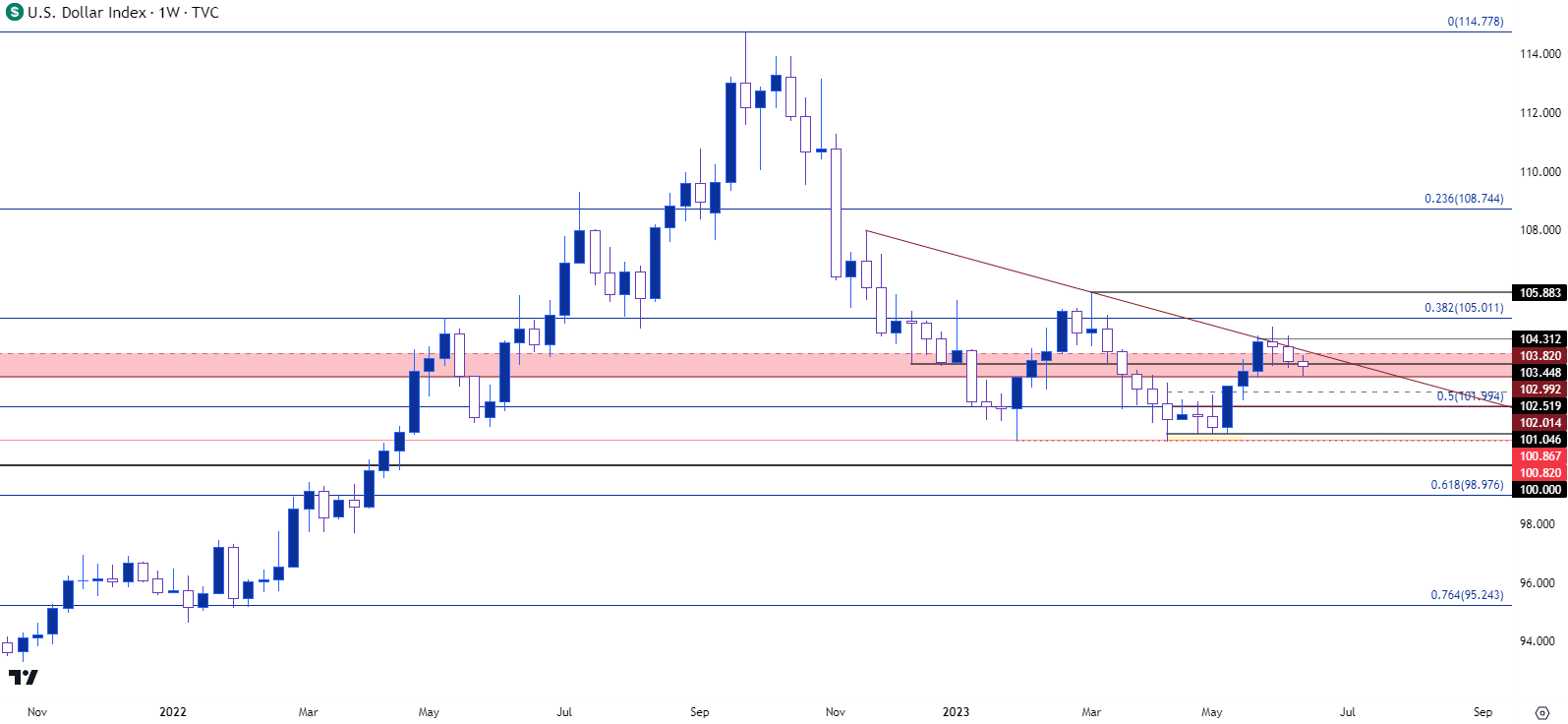

In the US Dollar, prices pulled back after the initial release of CPI but sellers have been unable to elicit a test below the 103.00 handle. This was the swing high in 2020 and more recently, came in as support a couple of weeks ago as DXY strength pushed up to a fresh two month high.

That’s around the time that the bearish trendline came into the picture, and this held DXY resistance for nine of ten trading days before last Thursday saw a push from bears.

US Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

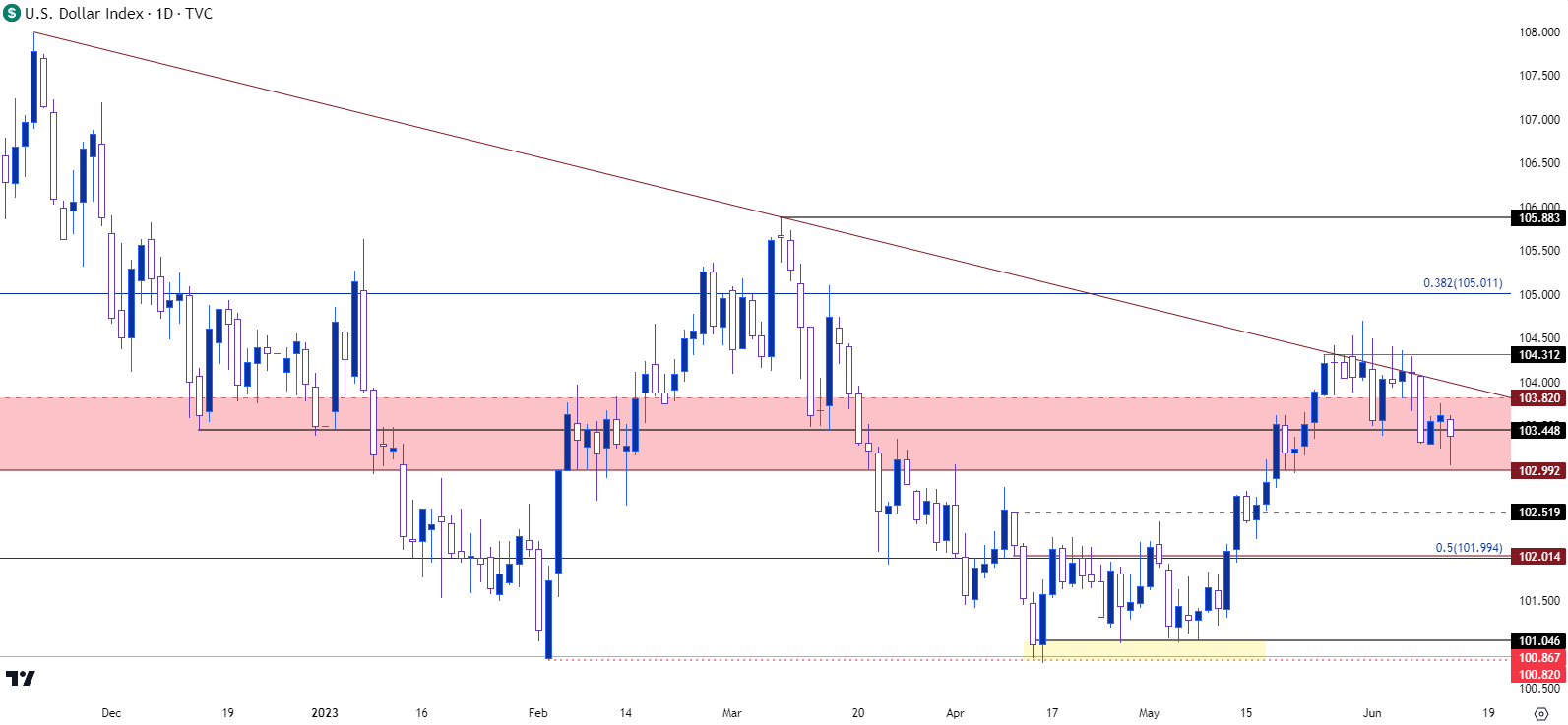

From the daily chart below we can get a better picture of near-term structure. That 103.00 level remains of interest and below that is another swing around the 102.50 level that may function as follow-through support.

Resistance is a bit clearer, however, as that trendline stalled bulls for more than two weeks and remains overhead. The 103.82 level is also of interest, and this can be seen as an initial spot of support ahead of the trendline, with the 105.00 level after as the next area of possible resistance.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

GBP/USD

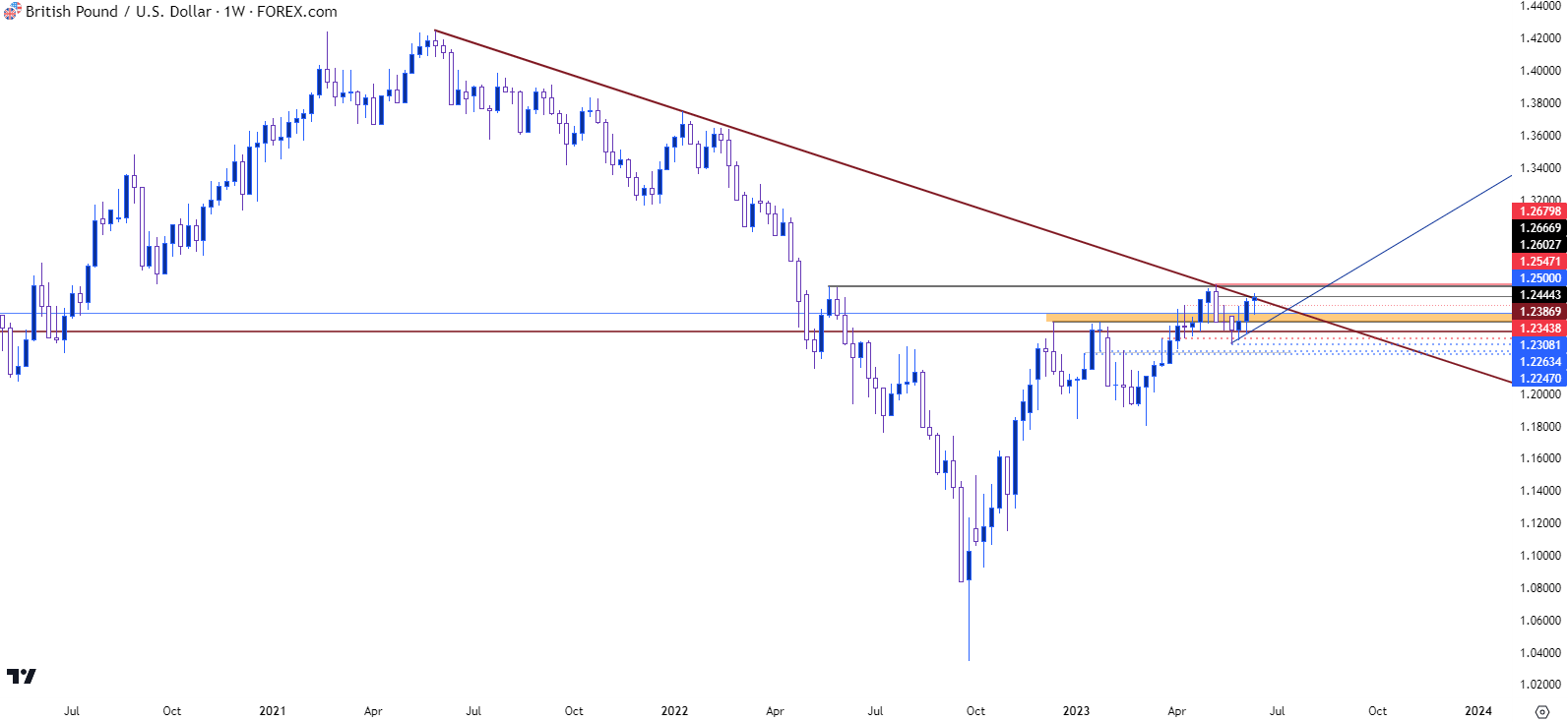

The Bank of England rate decision is next week and going into tomorrow’s FOMC rate decision, GBP/USD may be one of the more attractive markets for scenarios of USD-weakness. I highlighted this on the webinar as a longer-term trendline has been in-play of recent. The trendline connecting May 2021 and Jan 2022 swing highs on the weekly chart came into hold the highs in early-May. It was back in the picture yesterday, helping to hold the highs yet again.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

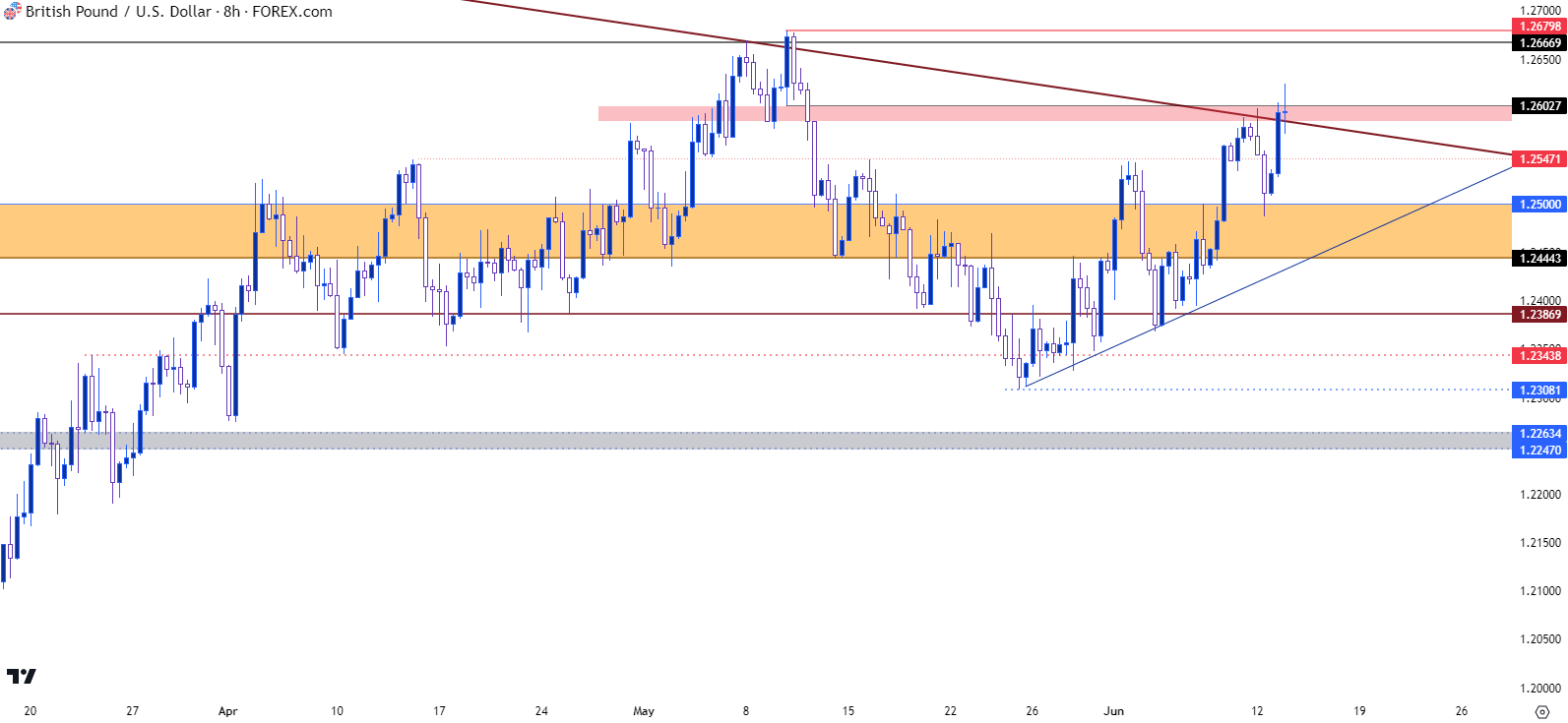

It’s the response to that resistance that’s of interest here, as a pullback found support at a longer-term zone running from 1.2444-1.2500, and that’s since led to a bounce back up to trendline resistance. This show of strength in the pair stands out compared to what’s shown in other majors, such as EUR/USD and if we do end up with a bearish USD scenario, GBP/USD could be an attractive venue to work with that theme.

The next spot of resistance in the pair is at a big spot with some longer-term relevance, shown above as the two swing highs in May of 2022 that plots at 1.2667. The yearly high sits at 1.2680 which can help to create a zone of confluent for near-term resistance in the pair.

GBP/USD Eight-Hour Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

EUR/USD

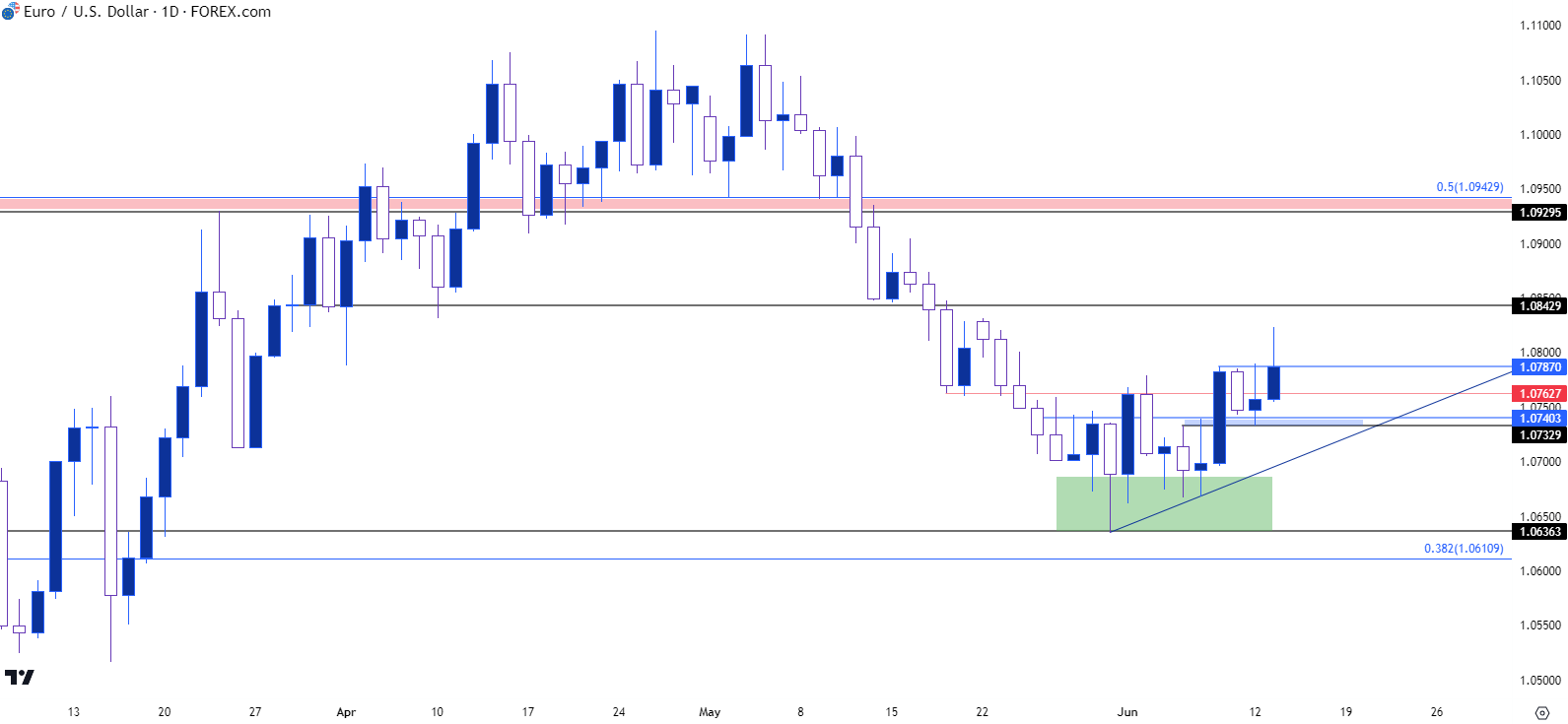

While GBP/USD is showing items of strength, the Euro is struggling to do the same. Bulls have had an open door to push for a pullback after price stalled at support two weeks ago but, to date, bullish advances have been moderated to a degree. There has been a progression of higher-highs and higher-lows, as shown on the below daily chart, but this would indicate little motivation from bulls as the highs haven’t been stretching very far beyond prior resistance.

EUR/USD Daily Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

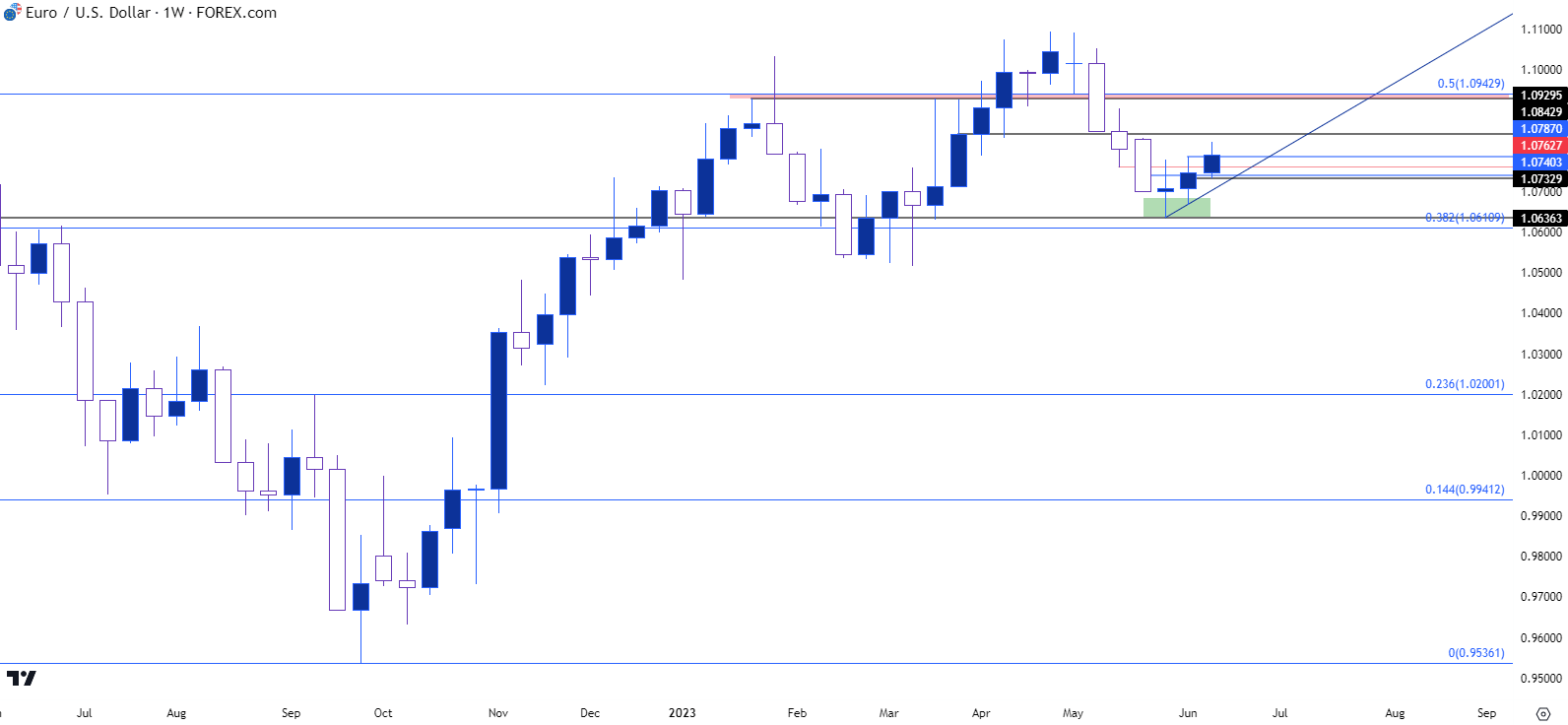

EUR/USD Longer-Term

There are going to be two days of massive drivers for this pair so much can change, but if bulls still fail to show a discernible drive the longer-term bearish scenario may remain as attractive. The big question there is how buyers treat resistance at levels of 1.0843 and then a zone of prior support that hasn’t really been tested for resistance yet, spanning from 1.0930-1.0943.

EUR/USD Weekly Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist