Crude Oil Technical Forecast: WTI Weekly Trade Levels

- Oil prices mark outside weekly reversal - WTI rallies through March opening-range high

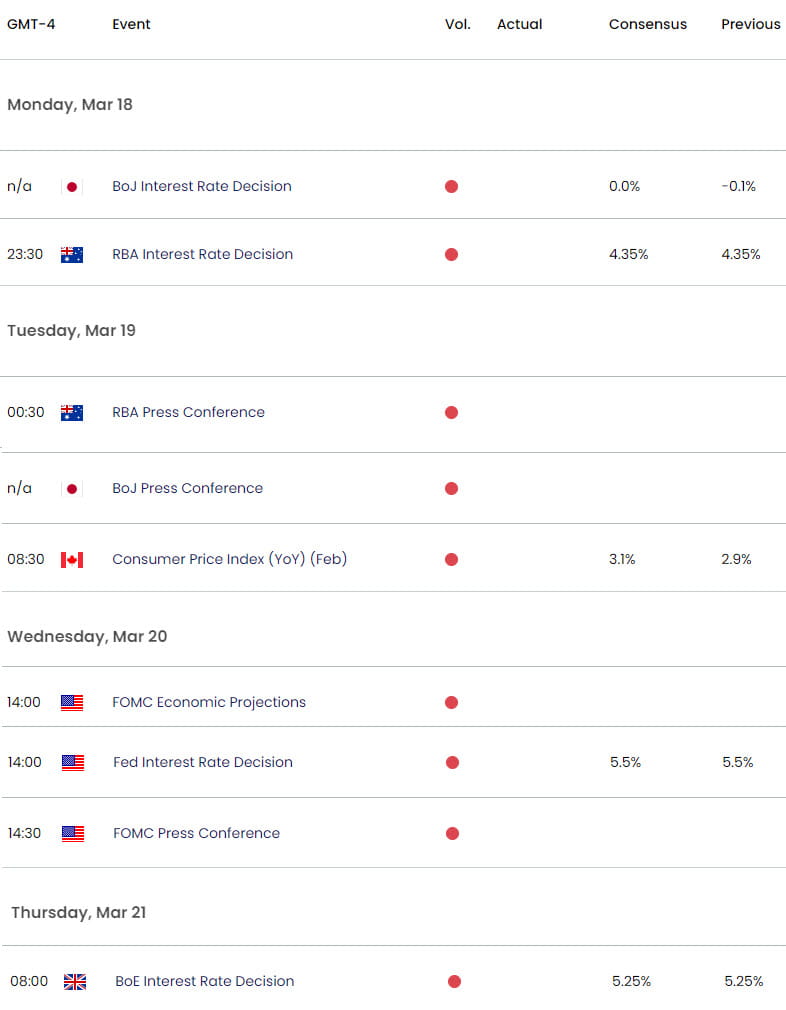

- Crude breakout eyeing technical resistance at multi-month highs- BoJ, RBA, Fed, BoE on tap

- WTI Resistance 82.78-83.28, 84.57 (key), 89.16- Support 79.75, ~78.27/30, 76.96

Oil prices surged more than 6.2% off the March lows this week with WTI now up more than 20% from the December low. A breach of resistance at the February / March range highs keeps the focus on more significant technical hurdle just higher. These are the updated targets and invalidation levels that matter on the WTI daily technical chart heading into next week’s flurry of central bank rate decisions.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this crude oil setup and more. Join live on Monday’s at 8:30am EST.

Oil Price Chart – WTI Daily

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Technical Outlook: Oil price ripped through technical resistance around the monthly opening-range highs this week at 79.75-80.31- a region defined by the mid-November swing highs, the February highs, and the objective 2023 yearly open. The move is set to close an outside-weekly reversal into fresh yearly highs ahead of the close on Friday and keeps the broader outlook weighted to the topside in the weeks ahead.

The next confluent resistance hurdle is eyed at the October low-day close (LDC), the 100% extension of the December rally, and the 2021 high-week close (HWC) around 82.78-83.28. Key resistance remains with the 61.8% retracement of the September decline at 84.57- a breach / weekly close above this threshold is ultimately needed to suggest a larger breakout / trend reversal is underway towards the 89-handle and beyond.

Initial weekly support now rests at 79.75 backed by a more significant technical confluence at objective monthly open / 200-day moving average at ~78.27/30. Broader bullish invalidation now raised to the 2022 yearly open at 75.35.

Bottom line: The breakout to multi-month highs keeps the uptrend viable heading into next week. From at trading standpoint, look to reduce portions of long-exposure / raise protective stops on a rally towards 83 - losses should be limited to 78.27 IF price is heading higher on this stretch. Keep in mind there are numerous central bank rate decisions on tap next week with the releases of the highly anticipated quarterly economic projections from the Fed likely to take center stage Wednesday.

Key Economic Data Releases

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- S&P 500, Nasdaq, Dow

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- US Dollar Index (DXY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex