Oil falls ahead of Trump’s inauguration.

- Nerves are showing after a 10% rally in recent weeks

- The executive orders Trump signs will be watched closely

- Trade tariffs on China could pull oil lower

- Oil breaks below 75.00

Oil prices are falling after a solid run-up over the past few weeks, as attention turns to Trump’s inauguration and expectations surrounding his policies. Oil has rallied 10% in recent weeks reaching a peak of 80.77, a multi-month high last week on supply worries after Russian oil sanctions and following solid Chinese GDP data.

Trump’s inauguration is on Monday at 5:00 PM GMT, where he is expected to make policy announcements that will set the tone for his second term.

There is significant uncertainty across the market regarding what policies and executive orders Trump could sign immediately. Given the oil markets' 10% run-up in recent weeks, some profit taking is to be expected. Reports that Trump could relax curbs on Russia's energy sector in exchange for a deal to end the Ukraine war or that he will end a moratorium on US liquified natural gas export license have also weighed on oil prices.

Across his term, Trump is also expected to boost drilling permissions within the US. However, he could also implement stricter bans on Iranian oil, which would increase oil prices.

Meanwhile, the oil market will also closely monitor Trump's actions regarding tariffs on China, given that China is the world's largest oil importer. China is already implementing measures to boost economic activity, helping its GDP reach Beijing’s 5% growth target last year.

Should aggressive trade tariffs be applied, the oil market could fall on a weaker demand outlook.

Separately, oil is also seeing its risk premium fade amid easing tensions in the Middle East after Israel and Hamas exchanged hostages and prisoners amid a ceasefire.

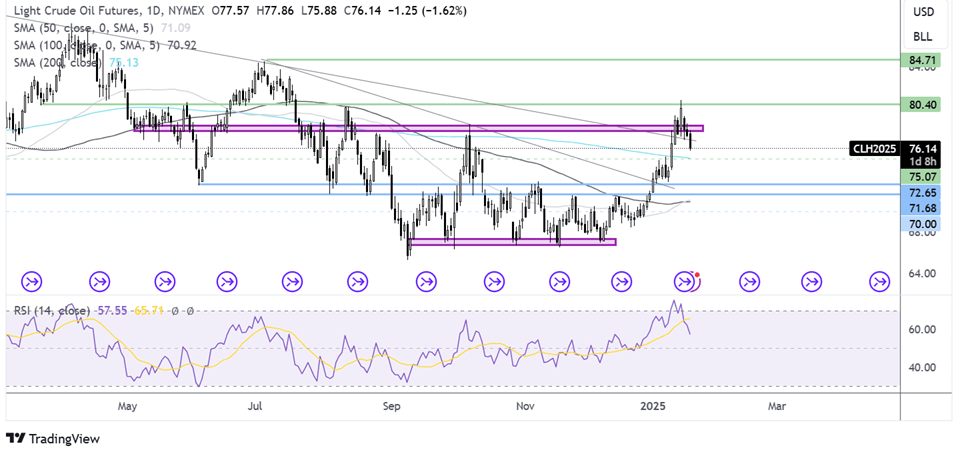

Oil forecast – technical analysis

Oil rebounded lower from the 80.75 high reached last week, falling below the 75 support zone and the falling trendline towards the 200 SMA.

The bearish engulfing candle combined with the break below the support zone and bearish cross over on the MACD keep sellers hopeful of further declines towards 75.00 the 200 SMA and the round number. Below here sellers could gain traction.

On the upside, buyers would need to rise back above the 75.00 resistance zone to test 80.00 and clear the way to a higher high.