New Zealand Dollar Outlook: NZD/USD

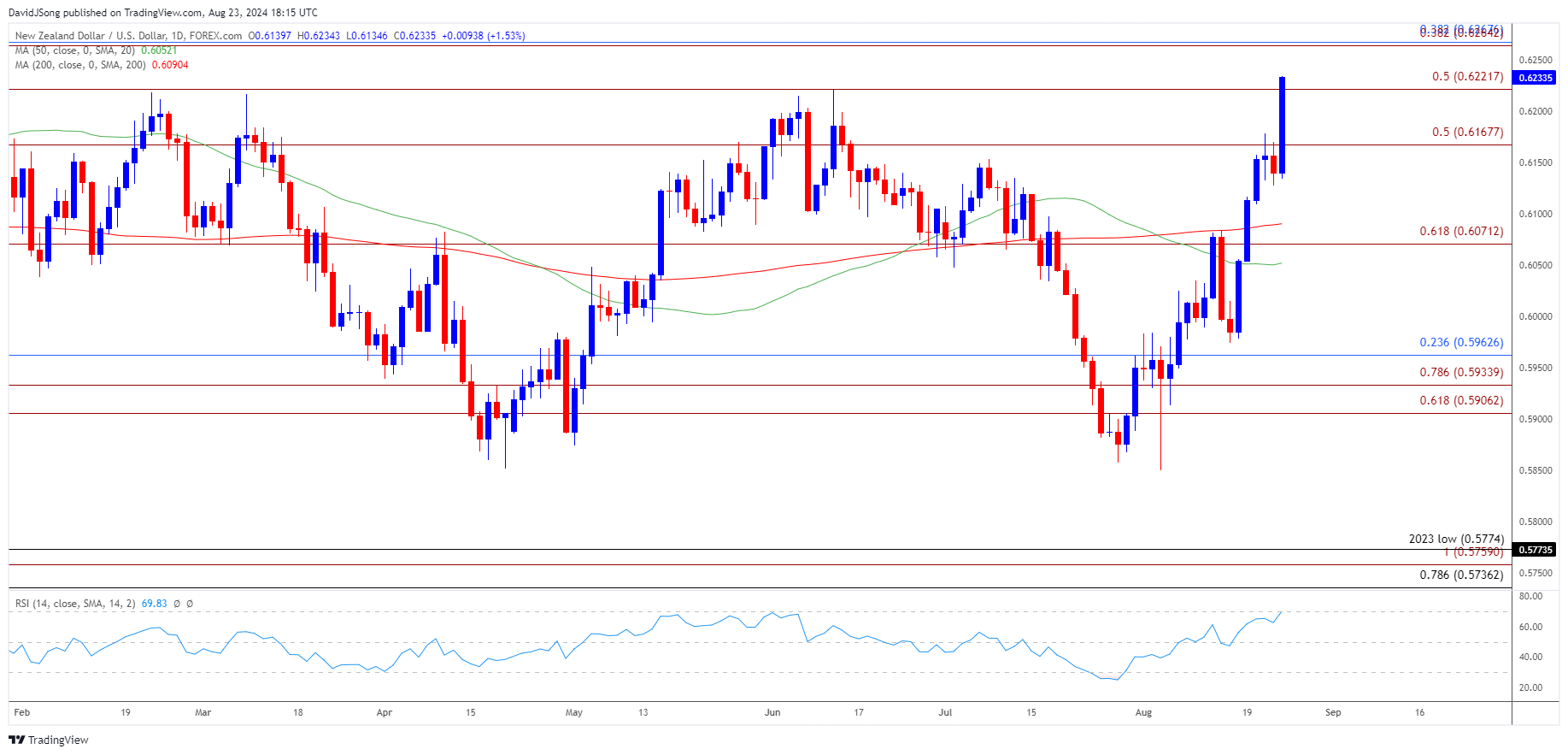

NZD/USD takes out the June high (0.6222) as Federal Reserve Chairman Jerome Powell signals an imminent change in monetary policy, with the recent rally in the exchange rate pushing the Relative Strength Index (RSI) toward overbought territory.

NZD/USD Rate Outlook: RSI Flirts with Overbought Territory

NZD/USD extends the rally from the start of the week to register a fresh monthly high (0.6234), and the exchange rate may attempt to further retrace the decline from the January high (0.6330) even as the Reserve Bank of New Zealand (RBNZ) adjusts monetary policy ahead of its US counterpart.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

A further advance in NZD/USD may push the RSI above 70 for the first time this year but the oscillator may show the bullish momentum abating if it struggles to push into overbought territory.

NZD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; NZD/USD on TradingView

- Keep in mind, NZD/USD mounts a 4-week rally after dipping to a fresh yearly low (0.5850) earlier this month, with a break/close above the 0.6220 (50% Fibonacci extension) to 0.6270 (38.2% Fibonacci retracement) region bringing the January high (0.6330) on the radar.

- Next area of interest comes in around the December high (0.6370) but NZD/USD may trade within a broad range amid the flattening slope in the 50-Day SMA (0.6052).

- Failure to hold above 0.6170 (50% Fibonacci extension) may push NZD/USD back towards 0.6070 (61.8% Fibonacci extension), with the next region of interest coming in around the 0.5910 (61.8% Fibonacci extension) to 0.5960 (23.6% Fibonacci retracement).

Additional Market Outlooks

British Pound Forecast: GBP/USD Rally Eyes 2023 High

Gold Price Forecast: XAU/USD Pullback Keeps RSI Below 70

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong