New Zealand Dollar Outlook: NZD/USD

The Reserve Bank of New Zealand (RBNZ) interest rate decision may sway NZD/USD as the central bank is set to deliver its quarterly Monetary Policy Statement (MPS).

NZD/USD Rate Outlook Hinges on RBNZ Interest Rate Decision

NZD/USD trades near the monthly high (0.6035) to retain the advance following the better-than-expected New Zealand Employment report, which showed a 0.4% rise in the second quarter of 2024 versus forecasts for a 0.2% decline.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It remains to be seen if the RBNZ will respond to the rise in employment as the central bank is expected to keep the official cash rate (OCR) at 5.50%, but the fresh forecasts from Governor Adrian Orr and Co. may influence the near-term outlook for NZD/USD should the central bank alter the forward guidance for monetary policy.

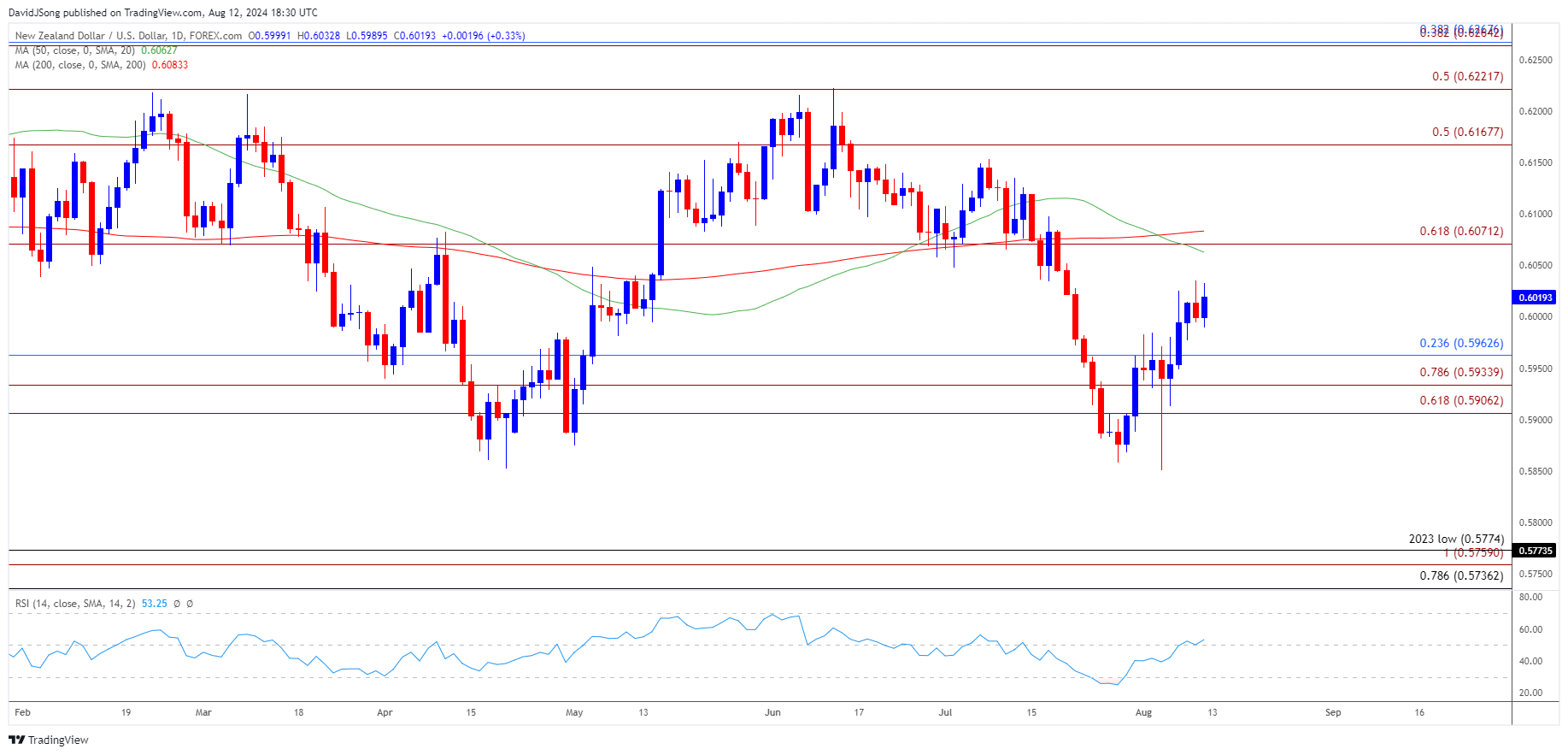

NZD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; NZD/USD on TradingView

- NZD/USD may further retrace the decline from the July high (0.6154) as the Relative Strength Index (RSI) continues to move away from oversold territory, with a break/close above 0.6070 (61.8% Fibonacci extension) raising the scope for a run at the July high (0.6154).

- Next area of interest comes in around 0.6220 (50% Fibonacci extension) to 0.6270 (38.2% Fibonacci retracement) but failure to hold above the 0.5910 (61.8% Fibonacci extension) to 0.5960 (23.6% Fibonacci retracement) region may push NZD/USD back towards the monthly low (0.5850).

- Next area of interest comes in around the November 2023 low (0.5789), with a breach below the 2023 low (0.5774) opening up the 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension) zone.

Additional Market Outlooks

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

Canadian Dollar Forecast: USD/CAD Flirts with 50-Day SMA

US Dollar Forecast: USD/JPY Continues to Defend January Low

Gold Price to Eye Monthly High on Failure to Close Below 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong