- New Zealand CPI grew 0.5% in Q4, in line with expectations and the weakest increase since late 2020

- Non-tradable inflation remained sticky, printing a quarterly increase of 1.1%.

- NZD/USD has rallied following the inflation report. Direction later in the session is likely to be influenced by the performance of Chinese equity markets

New Zealand has a homegrown inflation problem like Australia, limiting the likelihood of a near-term interest rate cut from the Reserve Bank of Australia (RBNZ) in the absence of a n abrupt global economic downturn. The NZD/USD is bid as rate cut bets are trimmed.

Domestic price pressures remain elevated

Consumer price inflation (CPI) rose a modest 0.5% in the December quarter, seeing the annual increase decelerate to 4.7%. Both matched market expectations, and while still above the midpoint of the RBNZ’s 1-3% annual inflation target, it mirrors the disinflationary picture seen in other advanced economies around the world before it.

However, upon closer inspection, the subdued quarterly increase revealed the slowdown was driven by weakness in volatile trade prices with non-tradable prices – which reflect domestic factors -- rollicking along at a quarterly pace of 1.1%, three-tenths higher than expectations. Over the year, domestic-driven inflation remained sticky at 5.9%.

<NZD/USD has eyes on Chinese equities

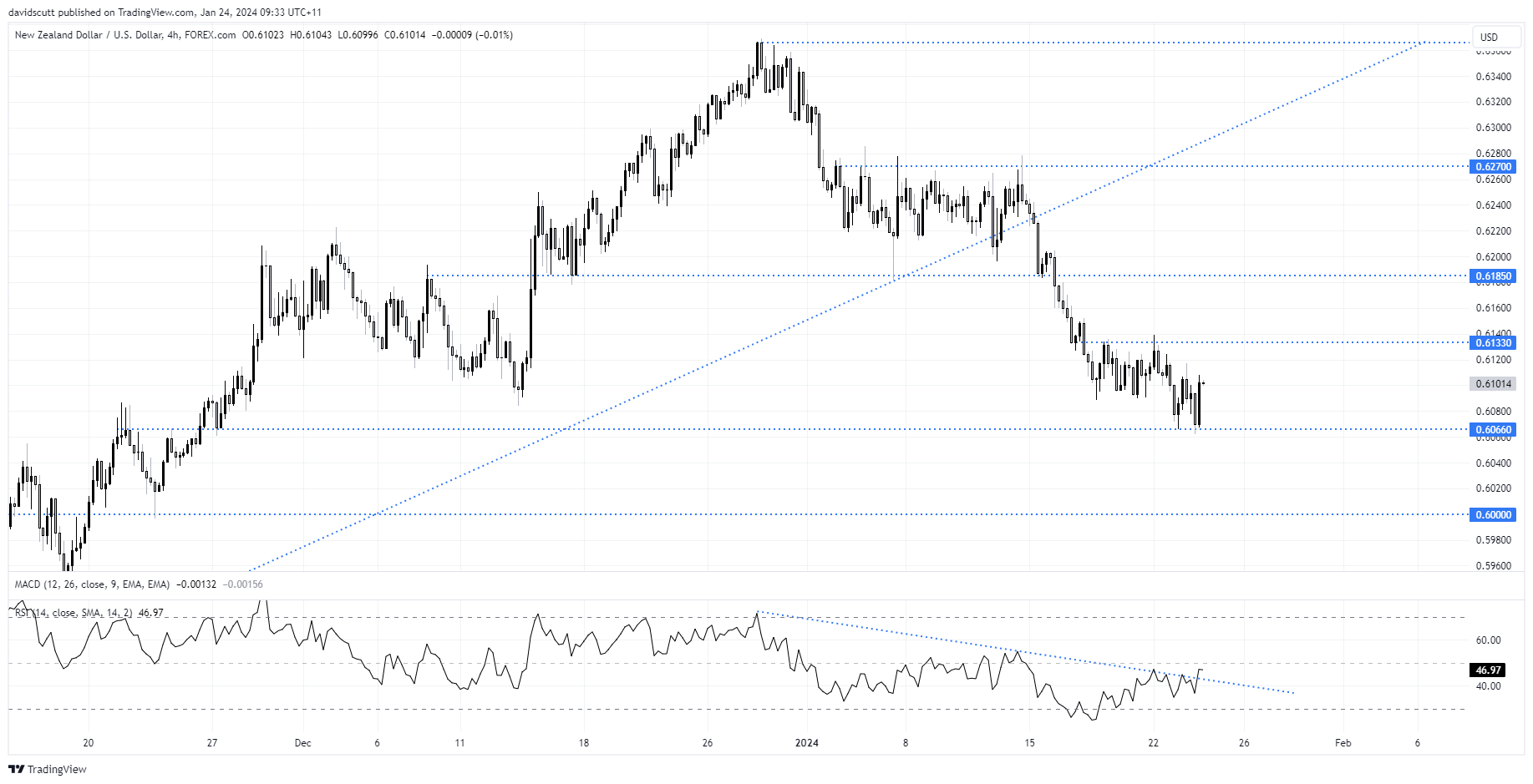

The reaction in NZD/USD to the inflation report details was immediate with the pair surging more than 0.4%, printing a bullish engulfing candle on the four-hourly chart in the process. But whether the Kiwi can maintain these domestic-driven gains beyond the short-term is questionable, especially with so many major macro risk events to contend with in the coming days.

Even with the constructive price action, it’s clear FX traders are highly attune to developments in Chinese equities right now, meaning the performance of mainland markets today could play an outsized role in dictating how the NZD/USD fares. The RBNZ will also release its preferred underlying inflation reading – the sectoral factor model – at 3pm Wellington time, providing another risk event to navigate.

On the charts, NZD/USD is attracting bids on dips towards .6066, bouncing off the level on several occasions this week. Below, further support is located at .6000. On the topside, resistance is found at .6133 and again at .6185. While NZD/USD has produced a series of lower highs in recent days, of note, RSI has broken its downtrend dating back to late 2023, suggesting downside momentum is waning.

Over a longer timeframe, it looks like a head-and-shoulders pattern may also be forming, but that’s something to consider for another day.

-- Written by David Scutt

Follow David on Twitter @scutty