- The RBNZ kept its cash rate unchanged at 5.5% in April, as expected

- It delivered one of the shortest statements on record. Growth is weak but inflation is still too high

- NZD/USD and NZD/JPY are pushing higher given the RBNZ remains committed to lowering inflation despite growth risks

RBNZ keeps it short and sweet

After talking it up as the little central bank that packs a mighty market punch, the Reserve Bank of New Zealand (RBNZ) has delivered a nothingburger at its April monetary policy decision, keeping its cash rate unchanged at 5.5% and making no meaningful changes to its policy statement.

With limited new information at its disposal since it met in February, it should come as no surprise the entire document was over and done with in 140 words.

“The New Zealand economy continues to evolve as anticipated by the Monetary Policy Committee,” it said. “Current consumer price inflation remains above the Committee’s 1 to 3 percent target range. A restrictive monetary policy stance remains necessary to further reduce capacity pressures and inflation.”

Mirroring its own sentiment, the RBNZ noted most major central banks are “cautious about easing monetary policy given the ongoing risk of persistent inflation.”

Regarding the outlook, it acknowledged domestic economic growth remained “weak”. It said maintaining rates at a restrictive level for a sustained period will return consumer price inflation to within its target range by the end of 2024.

Total nothingburger, right?

New Zealand CPI arrives next week

Thankfully for traders, New Zealand’s March quarter consumer price inflation report arrives next Wednesday, providing an event that usually shakes things up. And, of course, the US inflation update for March arrives later in today's session. That’s always a volatility generator.

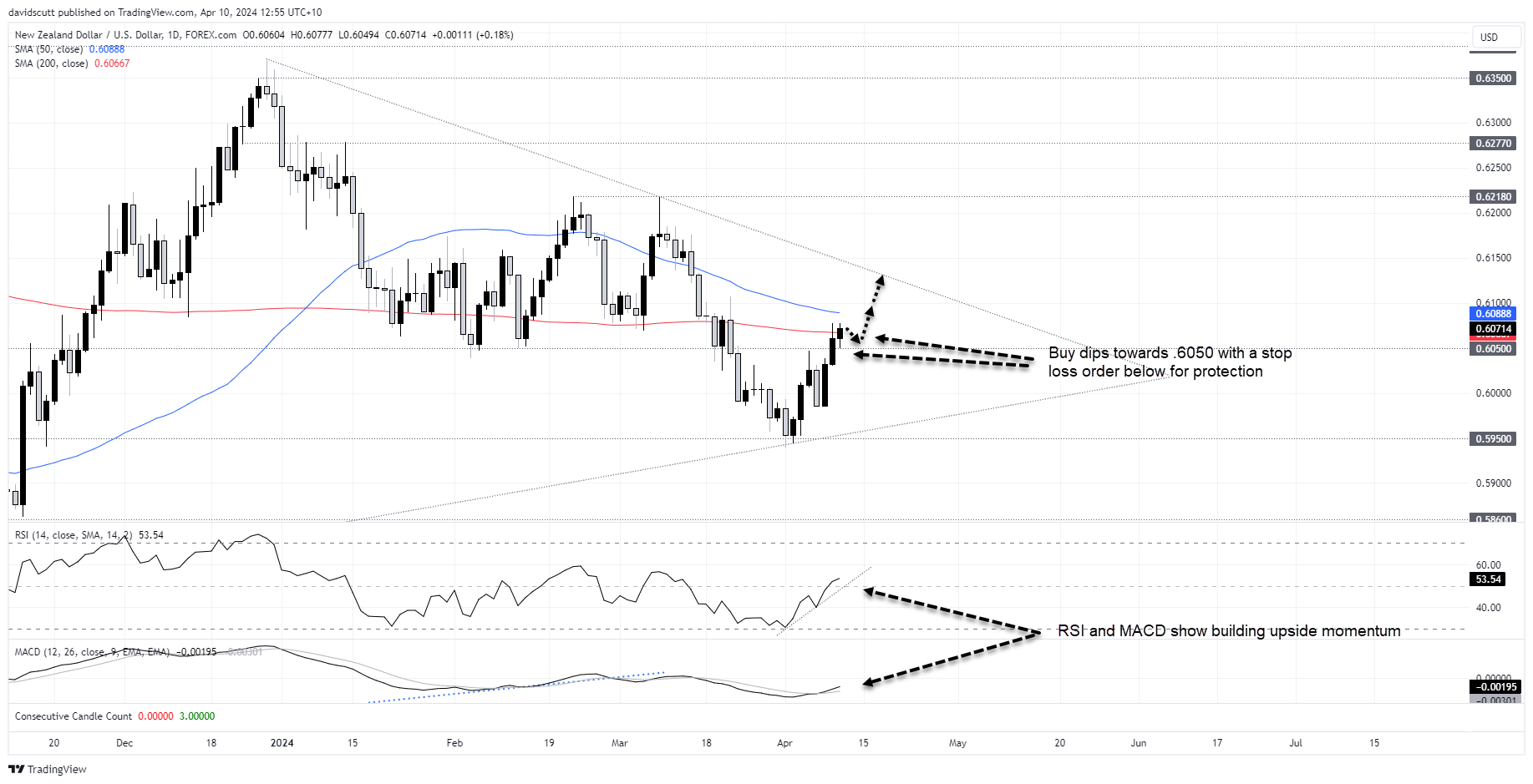

NZD/USD grinding higher

The Kiwi dollar has pushed higher following the statement, potentially reflecting no escalation in dovish rhetoric from the RBNZ despite New Zealand sitting in a double-dip recession. It has an inflation mandate and inflation remains too high to justify lowering rates yet.

With Monday’s bullish engulfing candle pointing to near-term upside, NZD/USD broke resistance at .6050 today, retesting the level before the RBNZ before resuming its path higher. It’s now grappling with the 50-day moving average, a level it has respected since the start of March.

Given the recent price action, and with RSI and MACD pointing to building upside momentum, dips between the 50DMA and .6050 can be used to enter longs, allowing for a stop to be set below the latter for protection. The initial target would be .6100, a minor resistance level the price tagged in March. Beyond, the downtrend running from late December around .6140 is another to consider.

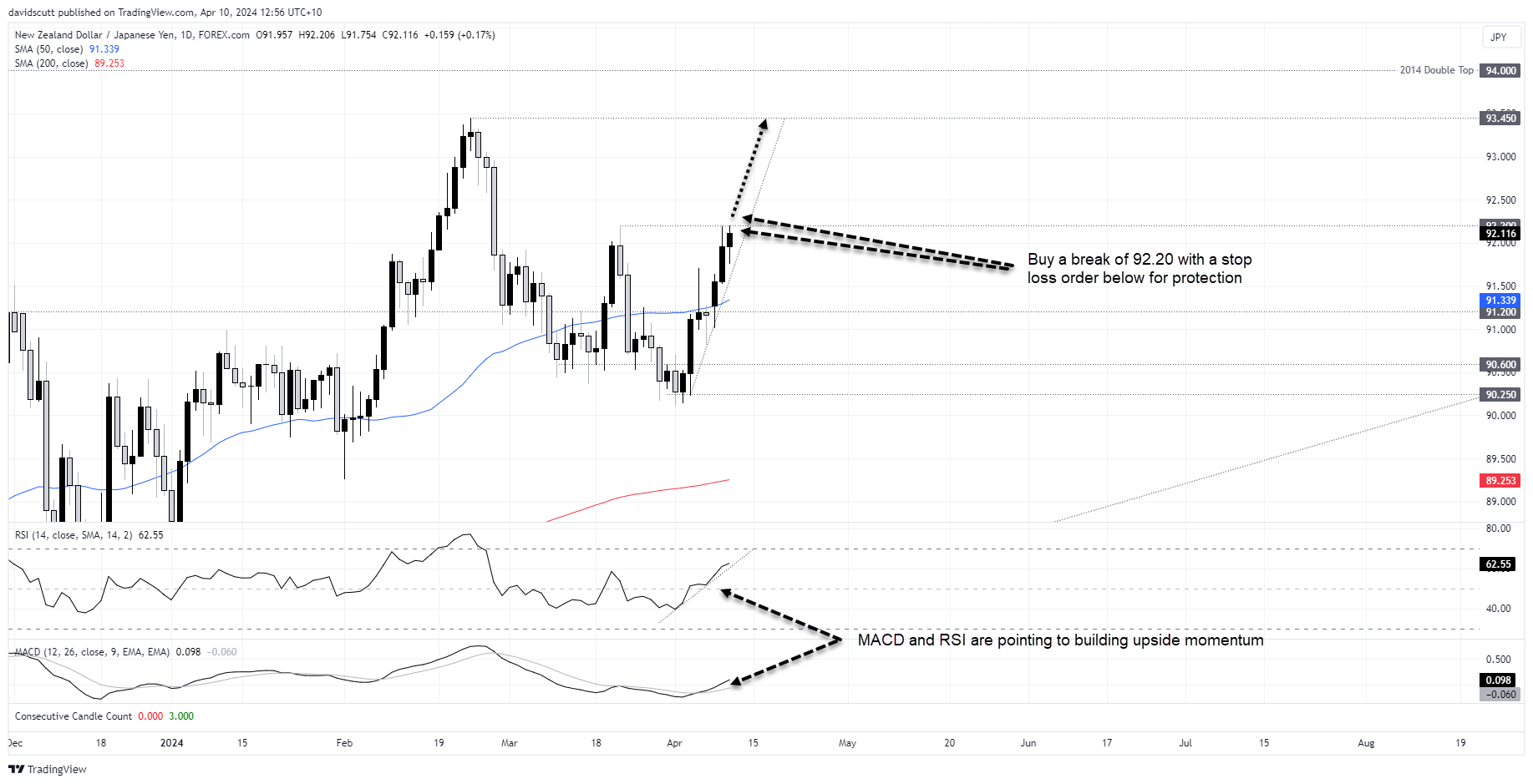

NZD/JPY threatening bullish break

NZD/JPY is also trending higher, continually bouncing off uptrend support before running into resistance located at 92.20. With RSI and MACD pointing to building upside momentum, a possible break of 92.20 opens the door to a push towards the February high of 93.45. If we see 92.20 give way, traders can enter long positions with a stop below the level for protection.

-- Written by David Scutt

Follow David on Twitter @scutty