As my colleague Fawad Razaqzada astutely highlighted in yesterday’s NFP Preview report, “wage growth has taken on increased importance than the actual jobs number given concerns about rising levels of inflation and in turn interest rates.” That dynamic is playing out in spades as traders digest today’s jobs report.

On a headline basis, the US economy created 134k new jobs in September, well below the median expectation of +185k jobs. While the headline figure looks disappointing, it was more than made up for by positive revisions to the previous two months’ reports, which totaled +87k jobs. In addition, a subcategory of the accompanying household survey showed that employees “not at work due to bad weather” (read: Hurricane Florence, primarily) came in at nearly 300k, well above the historical average for September, though below last year’s anomalous result .

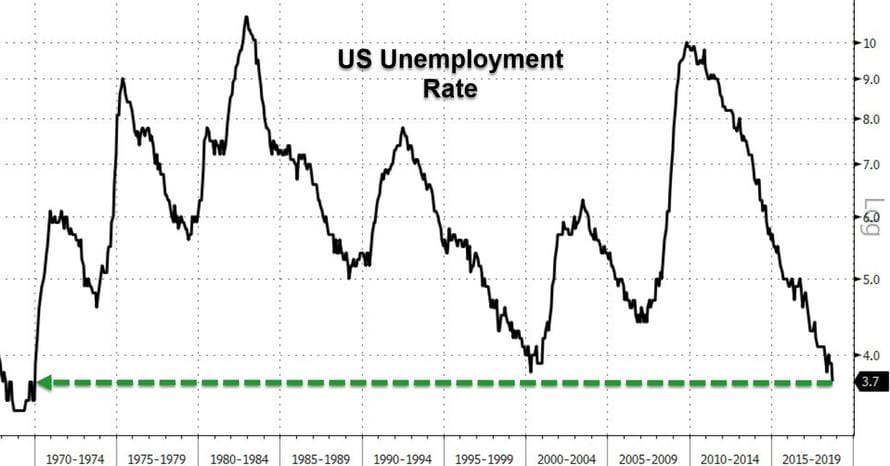

In an event that few observers thought they’d see in their lifetime (yours truly included), the unemployment rate dropped to just 3.7%, its lowest level in 49 years! Of note, this drop was not driven by a decline in the labor force participation rate, which held steady at 62.7%. Taken together, these data points suggest that the overall quantity of jobs created remains strong, despite the slightly disappointing headline figure.

Source: Zerohedge

When it comes to the quality of those jobs, there’s not much to write home about. Average hourly earnings rose 0.3% m/m, as expected, causing the year-over-year growth rate in wages to tick down to 2.8%. This isn’t the 3.0%+ rate that bulls were hoping for, but wage growth is nonetheless holding steady near the top of the post-GFC range. Meanwhile, average hours worked held steady at 34.5 per week.

For the market, and the Federal Reserve, the big takeaway from today’s jobs figures is that the labor market still appears to have plenty of “slack.” In other words, job growth continues apace, without a corresponding increase in wages, a full nine-plus years into the recovery from the Great Financial Crisis. As the Federal Reserve continues to normalize interest rates toward their long-term “neutral” level, today’s jobs report may, at the margin, consider raising interest rates slightly more slowly in 2019 than if we had seen job growth slow and wage growth rise further.

Market Reaction

As we go to press, US stocks are poised for a flat-to-slightly-positive open while the US dollar is falling by 15-20 pips against most of its major rivals in the wake of the jobs data. The yield on the benchmark 10-year Treasury bond is rising by 3-4 bps to 3.22%, building on its gains from earlier this week. Both gold and oil (WTI) are trading slightly higher on the day.