When will NatWest report H1 earnings?

NatWest is expected to report earnings on Friday 29th July before the market opens.

What to expect?

NatWest is expected to report a 7.3% rise in revenue and a 16.4% increase in pre-tax profits to £2.1 billion.

NatWest is set to report was the share price trades approximately flat on the year, after putting in a solid recovery from the one-year low struck when Russia invaded Ukraine.

The encouraging numbers from Lloyds have raised the bar and give some insight as to what we might expect from NatWest. Higher interest rates are expected to lift net interest income and an improved lending mix is likely to be supportive. Furthermore, it could be too early to see major difficulties in its loan portfolio.

Bad loan reserves are likely to increase, but that’s not difficult after last year’s release of £1.28 billion which went a long way to flatter full-year profits. Bad loans are still expected to remain at historically low levels. CEO Alison Rose told The Sunday Times last week that there hasn’t been a noticeable rise in the number of customers falling behind on repayment.

Given the backdrop of rising inflation and the ongoing cost of living crisis, costs will be an obvious focus. NatWest recently announced a £1000 pay increase for all its 22,000 staff to help them through the squeeze on incomes.

NatWest is widely expected to announce a further share buyback with its results which could be in the region of £1 billion and comes as the UK government continues to sell down its stake in the bank.

Where next for NatWest share price?

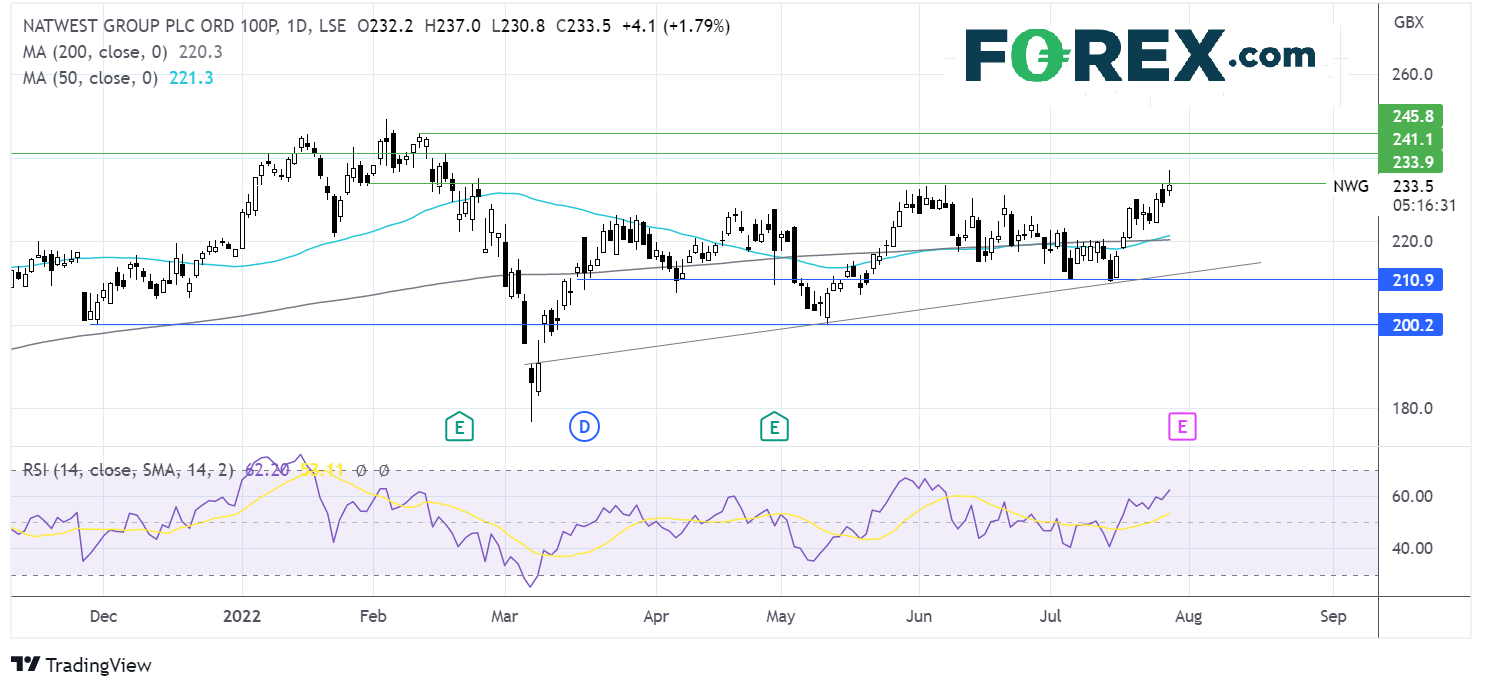

NatWest has been trading relatively range bound over the past few months, capped on the lower side by 210p and limited on the upside by 233p.

After two failed attemts to break below 210p the price has pushed higher, recapturing the 50 & 200 sma. The 50 sma has crossed over the 50 sma in a gold cross bullish signal and the RSI is supportive of further upside.

After briefly spiking over 233p, buyers will look for a close above this level to bring 241p the February 16 high into pay ahead of 245p the February high.

Failure to close above 233p could see the price fall back to test 220p the 50 & 200 sma ahead of 210p the lower band of the holding channel.