US futures

Dow future 0.17% at 39784

S&P futures 0.24% at 5645

Nasdaq futures 0.30% at 20730

In Europe

FTSE 0.25% at 8209

Dax 0.77% at 18498

- Stocks at record highs

- CPI & core-CPI cooled by more than expected

- AI-related stocks & big tech continue to rise

- Oil holds steady amid mixed demand signals

Stocks at record highs, again

U.S. stocks are pointing to a higher open after US inflation data showed consumer prices cooled further in June, fueling rate cut expectations.

CPI cooled to 3% YoY in June, down from 3.3% in May and lower than the 3.1% forecast. Core inflation eased to 3.3%, down from 3.4%, coming in below expectations of 3.4%.

Meanwhile, jobless claims were stronger than expected, falling to 222K, down from 239K the previous week. The data point to the labor market is still holding up well even as inflation is cooling in what appears to be a Goldilocks scenario for the Federal Reserve.

The data comes after US Federal Reserve Chairman Jerome Powell said he wanted to see more good data to feel confident about cutting interest rates. Today’s data certainly supports the case that inflation is cooling, bolstering the case that the Fed could be cutting rates as soon as September.

Following today's data, the market is now pricing in an 87% probability that the Fed will cut rates. This is up from around 45% just a month ago and 68% a week ago.

Following the data, bond yields have fallen, and U.S. stocks have pushed higher. The Nasdaq and the S&P500 have reached record levels, while the US dollar has tumbled.

Corporate news

PepsiCo is set to open over 2% lower after beating earnings and missing on revenue. The snacks and soft drink giant posted EPS of $2.28 versus $2.16 expected, on revenue of $2.5 billion versus $22.57 billion expected. The revenue miss comes as its three North American business units reported declining volumes. The company also gave a more cautious outlook for its full-year sales.

Delta Airlines is set to open over 9% lower after forecasting weaker profits in the current quarter. The company cited discounting pressures in the low end of the market as the reason.

Pfizer is set to open 2.4% higher after the drugs giant announced it was advancing the development of its key anti-obesity drug, a likely profitable market.

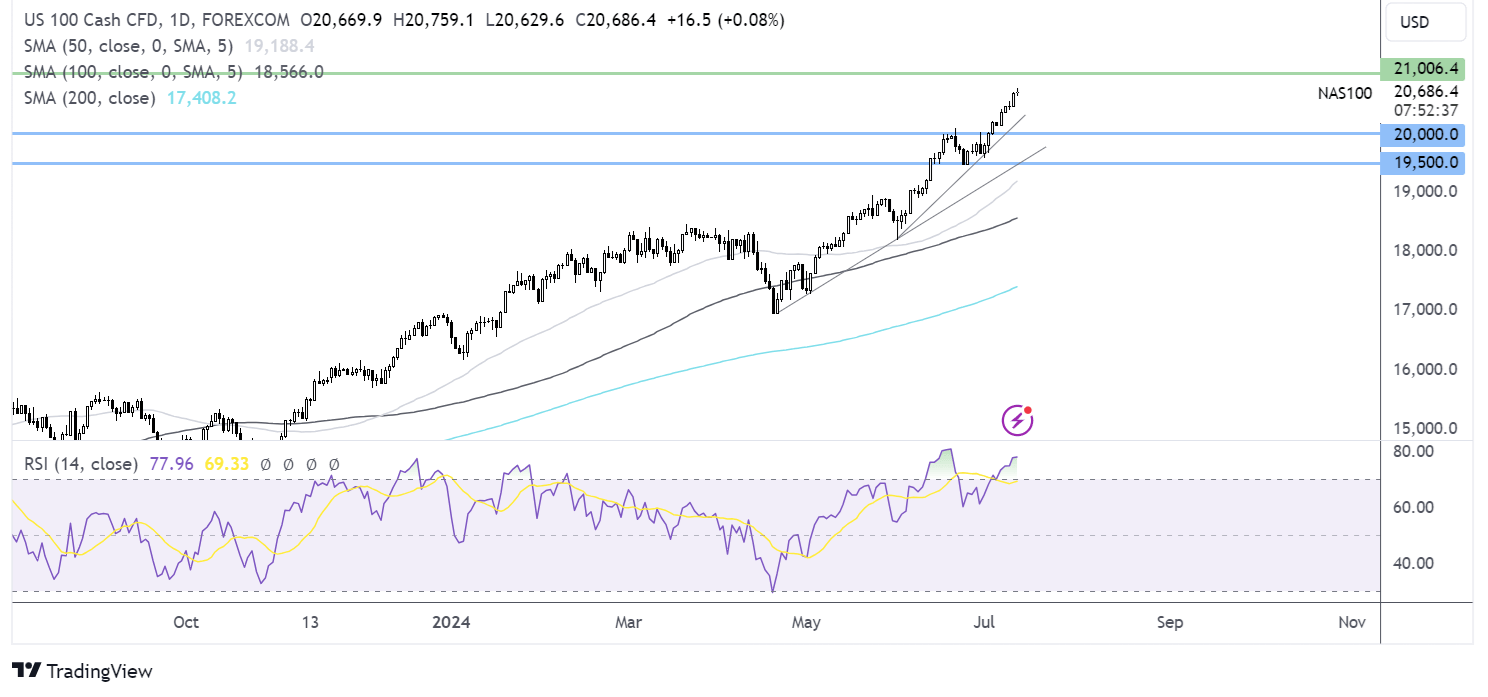

Nasdaq 100 forecast – technical analysis.

The Nasdaq trades at fresh ATHs as bulls press ahead towards 21000. The RSI is overbought, so buyers should be cautious. Support can be seen at 20,000, the psychological level, the June high, and the rising trendline support.

FX markets – USD falls, GBP/USD rises

The USD is falling after US inflation data showed that inflation cooled, fueling expectations that the Federal Reserve will cut rates soon.

EUR/USD is rising to a monthly high on USD weakness and after German inflation cooled to 2.2% in line with forecasts. Attention also remains on France, where the parties are struggling to form a coalition government.

GBP/USD is rising after UK data shows the economy grew twice as fast as expected in May. GDP rose 0.4%, up from 0% in April, thanks to a strong rebound in the construction sector. The upbeat data, combined with hawkish comments from Bank of England speakers this week, have seen the market push back on rate cut expectations. The market is pricing in a 5050 probability of a cut next month, down from 60% at the start of the week.

Oil holds steady on mixed demand signal

Oil prices are holding steady after gains yesterday and as investors weigh up mixed demand signals.

Oil prices rose yesterday, snapping a 3-day losing streak, after the IEA oil inventory report showed that US crude and gasoline stockpiles fell by 3.4 million barrels and 1.3 million barrels, respectively. The data points to solid demand as the US driving season ramps up.

Meanwhile, the International Energy Agency gave a bleaker demand outlook earlier in the week; however, this was offset by signs of growing US consumption.

In its latest oil market report, the IEA said global demand growth was at its lowest in over a year in the second quarter, at 710,000 barrels per day, mainly owing to a contraction in Chinese consumption. The IEA’s oil demand growth forecast for 2024 remained unchanged at 970,000 barrels a day.

OPEC , in its monthly report on Wednesday left the forecast for world oil demand growth unchanged for both this year and next.