- Nasdaq futures bounce off 21340 after sharp Fed-driven drop; fresh setups in focus

- Mixed momentum signals put emphasis on price action, especially in Europe and US

Nasdaq respectful through the rout

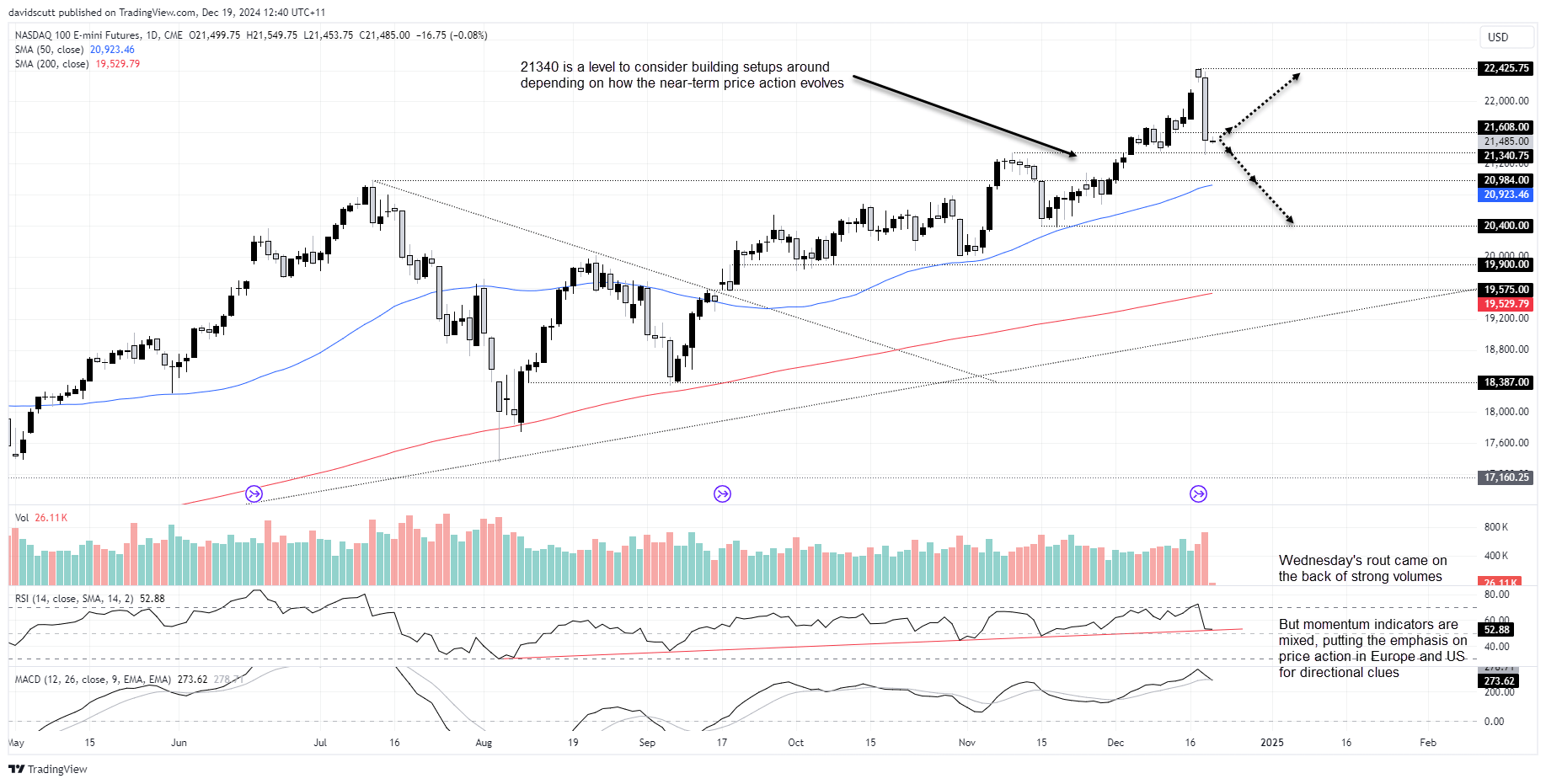

Nasdaq futures may have had an ugly decline following the Fed’s rate decision but it’s noteworthy the price remained respectful of technical levels, bouncing off 21340.75 at the height of the carnage.

It’s far too early to call a bottom, especially with momentum indicators mixed: MACD has crossed over from above, generating a bearish signal, but the long-running uptrend in RSI (14) remains intact. Therefore, rather than trying to anticipate directional risks based on thin volumes going through in Asian trade, I’d much rather see how the price action evolves into Europe and US.

Source: TradingView

If the price tests and holds 21340 again, longs could be established above the level with a stop beneath for protection. Apart from a minor level at 21608, there’s little visual resistance until the record highs.

Another potential bullish setup would be if the price pushes above and holds 21608, allowing for longs to be established above with a stop beneath for protection.

Alternatively, if the price breaks 21340 without being able to reverse back higher, you could flip the setup around, selling beneath the level with a stop above for protection. 20984 and important 50-day moving average are nearby levels of note, with a break of the latter opening the possibility of a deeper flush towards 20400.

Monumental hawkish shift? Really?

Source: TradingView

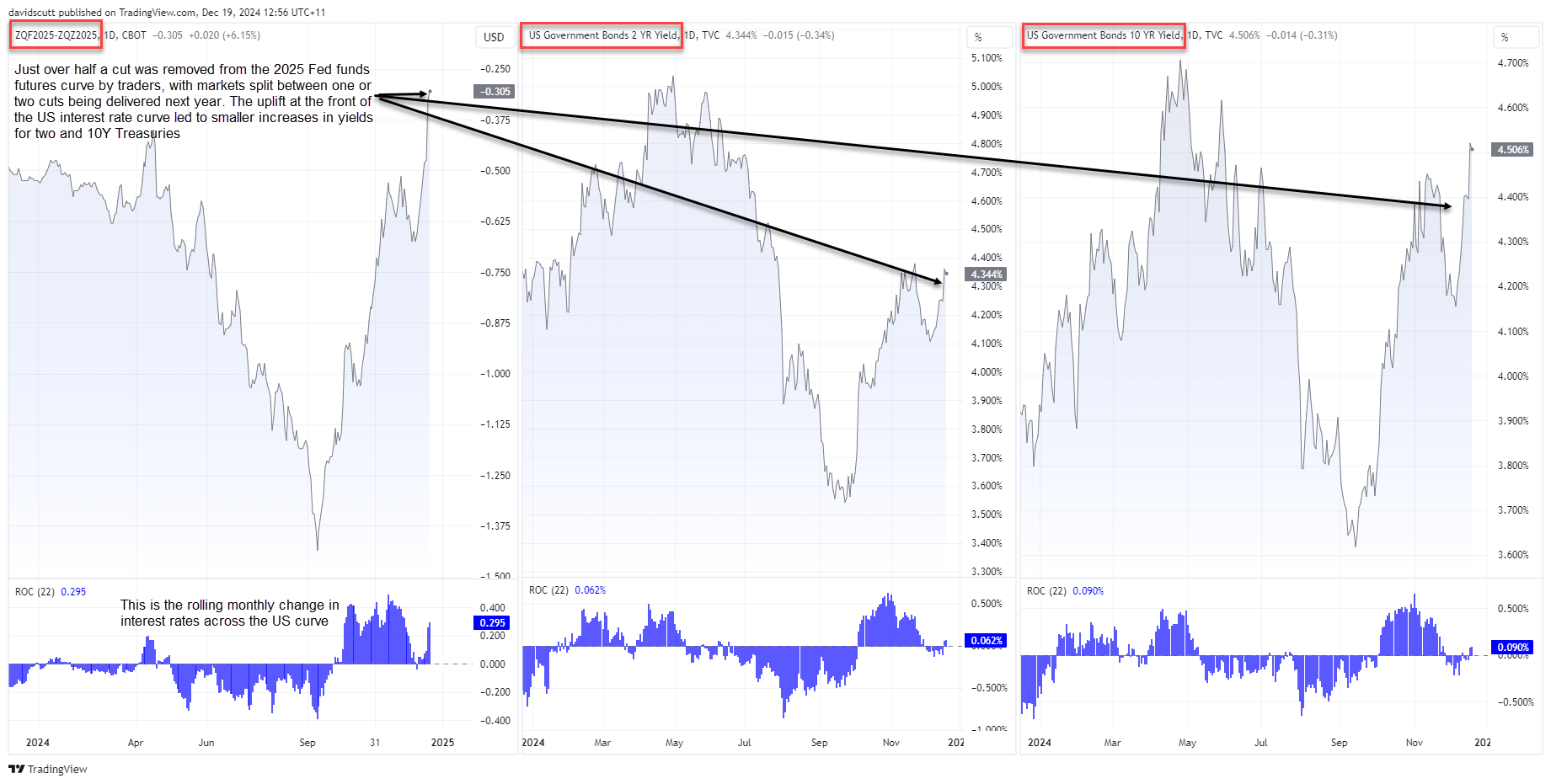

More broadly, for the carnage witnessed following the Fed, its updated rate projections were not significantly different to what traders were anticipating before the event. And when you step back and look at where markets see the funds rate bottoming, it’s around 70bps higher than the Fed’s dot plot. The Fed remains far more dovish.

What the Fed signalled was a slower pace of cuts, not a large reduction in cuts. One 25bps move was removed from the funds rate forecast track by the end of 2027. That’s it. Based on the market reaction, you’d think multiple cuts were removed!

That makes me think the move was more about market positioning rather than a monumental hawkish shift from the FOMC, making me question how long the rout can be sustained when that reality sets in.

-- Written by David Scutt

Follow David on Twitter @scutty