US futures

Dow futures +0.23% at 36117

S&P futures +0.35% at 4587

Nasdaq futures +0.48% at 15696

In Europe

FTSE +0.45% at 7522

Dax +0.64% at 16635

- ADP payrolls miss forecasts at 103k down from 113k

- Data comes after weaker JOLTS job openings yesterday

- Oil falls to a 5-month low

Weak jobs data could see the Fed cutting rates sooner

U.S. stocks are heading higher after weaker-than-expected ADP payrolls adds to evidence of a cooling labour market.

ADP private payrolls rose 103k in November, down from 113k in October and well below the 130k forecast.

The data comes after US jolts job openings slid to 8.7 million in October, well below estimates and the lowest level since March 2021. The data has brought the ratio of job openings to available workers down to 1.3 to 1.

Signs of weakness seeping into the jobs market are growing after the Fed’s aggressive rate hikes slow demand and hiring requirements. A cooler jobs market supports the narrative that the Federal Reserve could be looking to cut rates earlier next year. The market has priced in the 55% probability of the Fed cutting rates as soon as March next year.

High hopes of Fed pivot boosted stocks across the month of November and are keeping equities supported at the start of December, as treasury yields slip.

The Federal Reserve interest rate decision is next week, and the market is fully pricing in the Fed leaving rates unchanged. Investors will also be hoping for some clears over when policymakers could consider cutting rates. However, the Fed will want to be sure that inflation is truly down before it starts to loosen policy. Right now, the market is trying to second guess the Fed and is focusing on the data to provide those clues.

Corporate news

Elon Musk’s xAI is looking to raise up to $1 billion in equity offering according to a filing with the US SEC. The group has already raised around $135 million and is asking investors to chip in a million minimum of $2 million. The move comes as the AI startup looks to reinforce its position in the increasingly competitive AI field.

MongoDB is set to fall despite posting better than forecast Q3 results. EPS was $0.96 ahead of $0.51 estimated and revenue came in at $432.9 million, ahead of $406.3 million forecast.

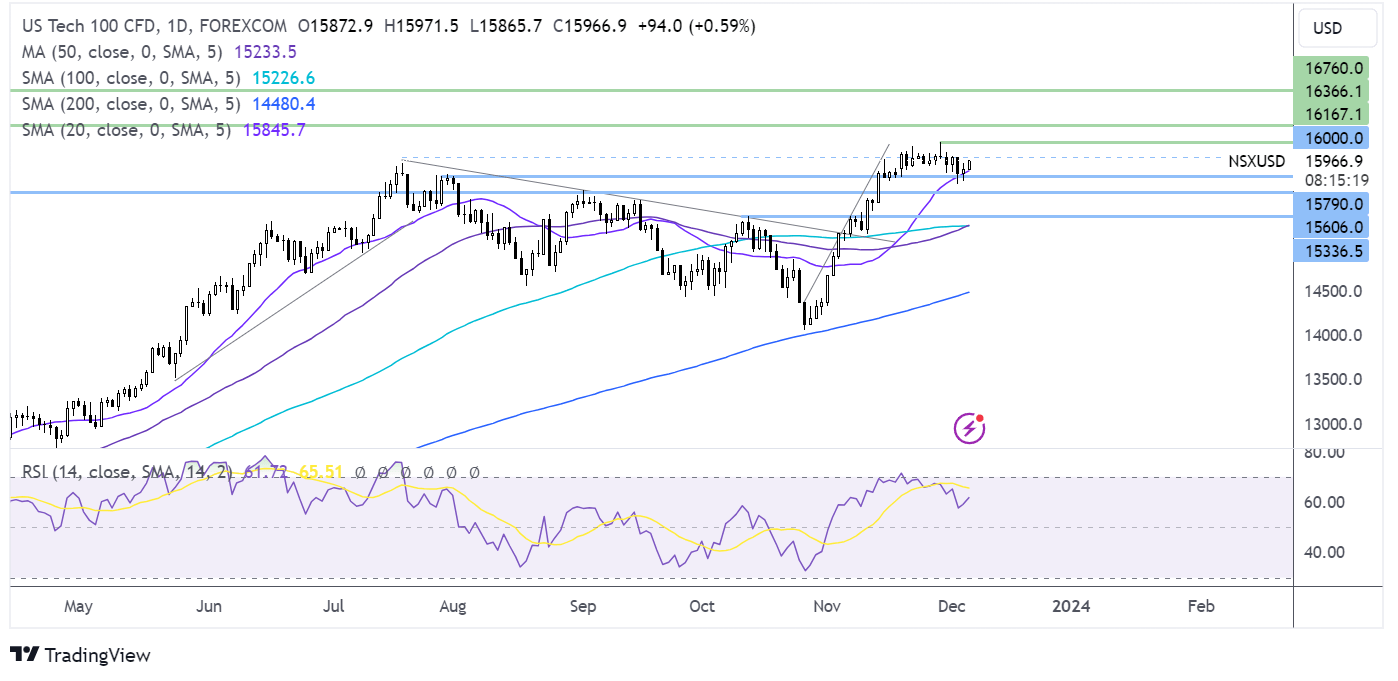

Nasdaq 100 forecast – technical analysis

The Nasdaq 100 has found support on the 20 sma and is pushing back towards 16000, the December high. A rise above here opens the door to 16168 the November high ahead of 16450 the early November ’21 high. On the flip side, should sellers break below the 20 sma at 15845, also the mid-November low, sellers could look to test 15630 the September high.

FX markets – USD rises, EUR/USD falls

The USD is holding steady after the ADP payroll data, which supports the view that a rate cut could be sooner rather than later.

EUR/USD is falling after eurozone retail sales came in weaker than expected at 0.1% in October, after falling 0.1% MoM in September. This was below expectations of a 0.2% rise. The data comes after PMI figures yesterday showed that the business activity in the region remains in contraction. A contracting economy combined with inflation almost back at the central bank's 2% target has even ECB hawks thinking the next move will be a rate cut.

GBP/USD is rising after the Bank of England. Governor Andrew Bailey once again pushed back on expectations of a rate cut by the central bank. The pound is being supported by bets the BoE will keep rates higher for longer after Bailey reiterated that rates could stay at their current level for some time. This is in contrast to market bets for the Fed.

EUR/USD -0.04% at 1.0794

GBP/USD +0.05% at 1.2600

Oil falls to a fresh 5-month low

Oil prices are falling for a fifth straight day and have dropped to a fresh five-month low as the market weighs up demand concerns from China whilst continuing to mull over OPEC+’s voluntary supply cuts.

Last week, the OPEC+ group agreed to voluntary output cuts of 2.2 million barrels per day, which could be extended or deepened beyond Q1 next year. However, the move has so far failed to support oil prices despite assurances from Saudi Arabia and Russia. While the agreement looks good on paper, the voluntary element of the deal has the market questioning whether production will see a decline.

Meanwhile, concerns over Chinese economic health aren't going away after Moody’s lowered the outlook on China's credit rating. China the world’s largest oil importer is set to release trade data on Thursday and could show that Chinese refinery runs have declined further in November.

WTI crude trades -0.8% at $71.35

Brent trades -0.8% at $76.14