US futures

Dow future 0.25% at 38,188

S&P futures 0.34% at 5250

Nasdaq futures 0.25% at 18593

In Europe

FTSE 0.56% at 8278

Dax 0.01% at 18500

- US core-PCE rose 0.2% MoM in April, down from 0.3%

- Treasury yields ease, stocks rise

- OPEC+ meet this weekend

US core-PCE rose 0.2% MoM in April, down from 0.3%

U.S. stocks are set to open higher after US inflation showed some signs of cooling.

The federal reserve's preferred measure for inflation - the core-PCE increased by 0.2% MoM on in April, down from 0.3% in March and below the 0.3% forecast. This marked the smallest monthly advance this year. On an annual basis inflation rose 2.8% in line with March meanwhile consumer spending fell by more than expected to 0.2% down from a 0.7% in March.

Service sector inflation which tends to be more sticky and is a metric which is closely watched by policy makers rose 0.3% after rising 0.4% in March.

The data could bring some comfort to the Federal Reserve that inflation is moving in the right direction, albeit slowing, particularly after consumer prices increased across the first quarter. The data comes after CPI data earlier in the month also cooled by more than forecast.

Following the data treasury yields are moving lower and the stocks on Wall Street point to a higher open. Markets expect the Federal Reserve to cut rates at least once this year, with a 50/50 odds of a September cut.

Corporate news

Dell is set to open over 15% lower after the tech stock posted a lower-than-expected current quarter earnings outlook and indicated that higher spending on building out servers to meet AI workloads would weigh on its full-year margin.

Gap is expected to rise 23% after the clothes retailer raised its full-year sales forecast and signs that its turnaround strategy is starting to bear fruits.

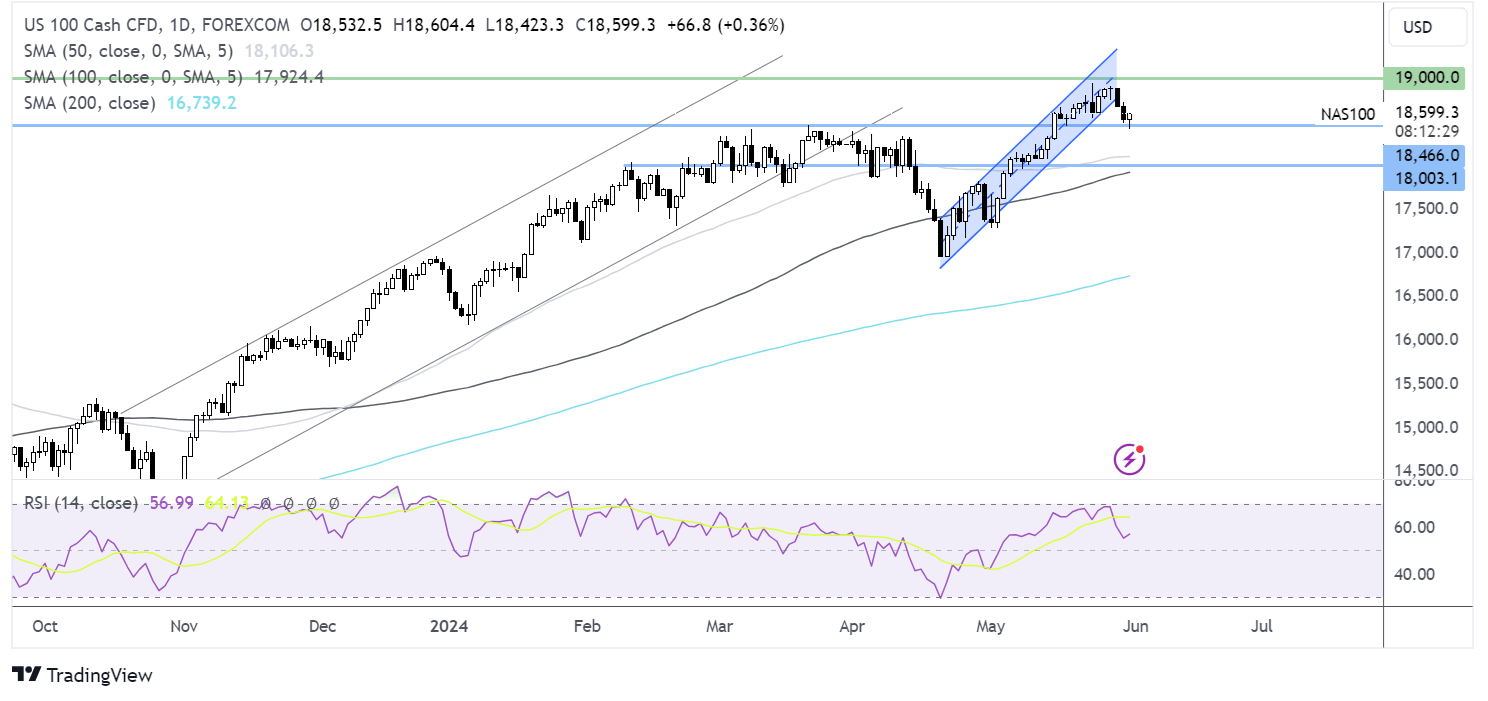

Nasdaq 100 forecast – technical analysis.

The selloff in the Nasdaq has halted at 18420, the March high, and is correcting higher. The longer lower wick on today’s candle suggests that there was little selling demand at the lower levels. Buyers will look to extend gains towards 18,883, the weekly high, ahead of 18947, the ATH. Meanwhile, sellers will look to break below the 18420 low to extend losses towards 18000.

FX markets – USD falls, EUR/USD rises

The USD is falling for a second straight day after US inflation data was slightly weaker than expected. This helped to lift Fed rate cut expectations, albeit modestly.

EUR/USD is rising after eurozone inflation rose by more than expected up 2.6% from 2.4% in April. This was ahead of forecasts of 2.5%. Despite the rise in inflation, the ECB is still on track to cut interest rates by 25 basis points in the meeting on June 6; however, with price pressures picking up again this month and the eurozone economy returning to growth in the first quarter, the ECB may adopt A more cautious approach to cutting interest rates for the rest of the year.

USD/JPY is rising after US inflation data and after mixed data from Japan. The leading inflation indicator Tokyo CPI was in line with estimates but still remained at weak levels however retail sales for April were higher unexpected but April industrial production was weaker than expected. The data doesn't clearly mark a path forward for the Bank of Japan to hike interest rates anytime soon.

Oil looks to OPEC+

Oil prices are holding steady as investors digest the latest US inflation data and look ahead to Sunday’s OPEC+ meeting to determine the state of supply into the rest of the year.

Oil prices fell almost 5% in May amid concerns over a weak demand outlook despite a weaker U.S. dollar.

The OPEC+ group is expected to extend its oil production cuts of 2.2 million barrels per day into 2025, which could offer some support to oil prices.