US futures

Dow futures 0.23% at 37825

S&P futures 0.20% at 5071

Nasdaq futures 0.22% at 17532

In Europe

FTSE 0.04% at 7859

Dax 0.8% at 17750

- Stocks inch higher after recent losses

- Chip stocks recover after TSMC earnings impress

- Netflix reports Q1 earnings later

- Oil falls further on demand worries

Stocks inch higher after recent losses

US stocks are pointing to a modestly higher start after losses earlier in the week, as chip stocks rebounded and despite stronger than forecast jobless claims data.

Stocks fell from their record highs last month as investors became increasingly convinced that the Federal Reserve could keep rates high for longer. Recent data has highlighted the robustness of the US economy, while inflation has also ticked higher, raising doubts over when the Fed may start cutting interest rates.

Earlier in the week, Federal Reserve chair Jerome Powell adopted a more hawkish tone, highlighting that the lack of progress towards cooling inflation could delay cutting rates.

Today, US jobless claims highlighted the ongoing resilience of the labor market after jobless claims held steady at 212k, stronger than the 215k forecast.

Attention will be on Federal Reserve speakers later today, and further hawkish commentary could pull the USD lower. Yesterday Fed Governor Bowman said that progress on lowering inflation may have stalled. She added that it remains to be seen whether rates were high enough to get inflation back to 2%.

Amid a quiet economic calendar, attention is on corporate earnings, with chip stocks rebounding after recent losses.

Corporate news

TSMC is also in focus. The world's largest contract chip posted impressive Q1 results, posting a 9% rise in net profits, beating forecasts thanks to a surge in AI demand, which has helped Q1 revenue rise 16.5%. TSMC's earnings are primarily seen as a bellwether for global chip demand.

Netflix is due to report earnings after the close and is expected to confirm that it is the undisputed leader in TV streaming. Expectations are for an additional 5 million subscribers in Q1, almost three times the 1.8 million it saw in the same period last year, but a marked slowdown from the previous quarter. EPS is expected to be $4.16, up from $2.88, and revenue is expected to rise to $8.54 billion from $8.16 billion.

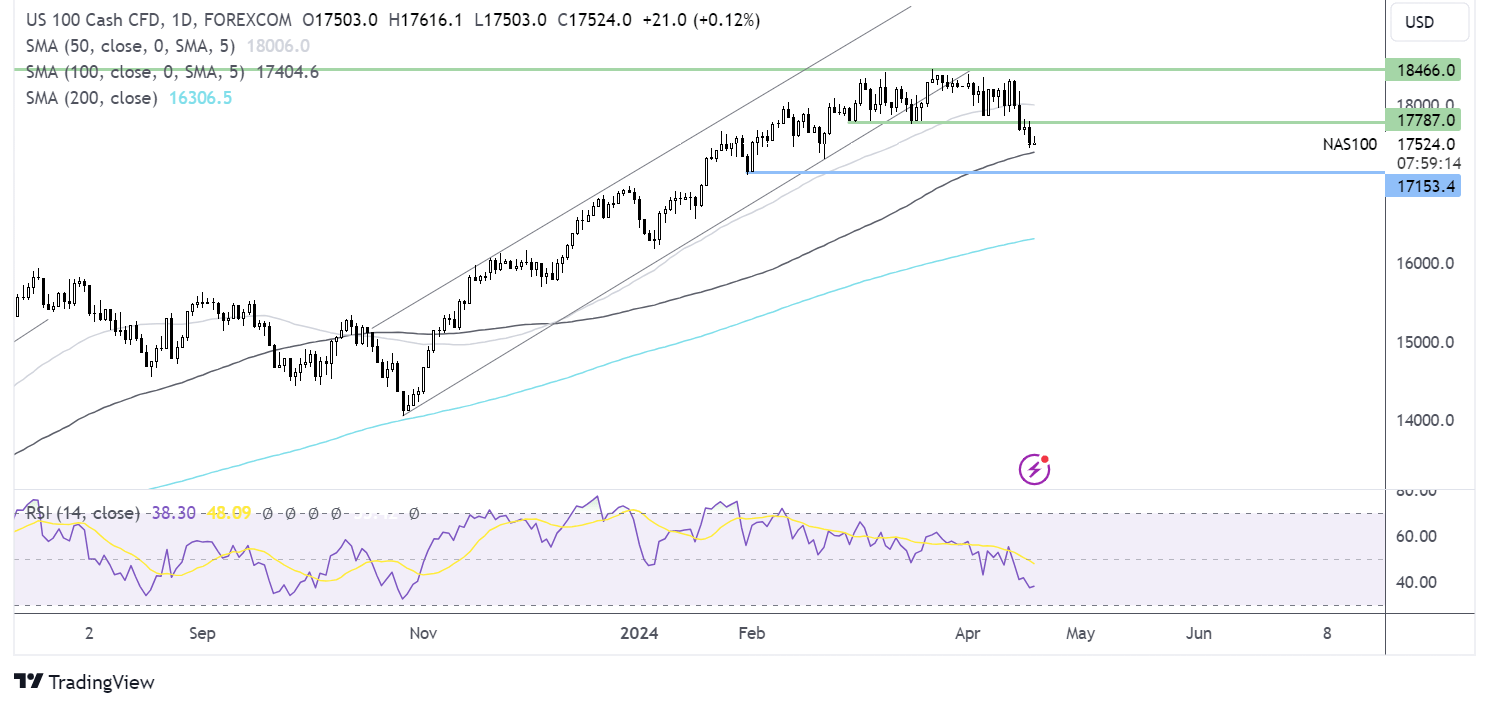

Nasdaq 100 forecast – technical analysis.

Nasdaq 100 broke out of its holding pattern, taking out support at 17800 and falling to a low of 17500. Sellers, supported by the RSI below 50, could look to break below the 100 SMA to test 17160, the February low. Should buyers defend 17500, any recovery would need to rise above 17800 resistance and 18000, the 50 SMA, to extend gains towards 18466 and fresh all-time highs.

FX markets – USD steadied, GBP/USD rises

The USD is steady, rising from session lows after the jobless claims data. Despite yesterday’s weakness, the near-term outlook is still supportive of the USD, given the sticky inflation and the prospect of higher rates for a longer.

EUR/USD is falling amid expectations that the ECB will cut rates in June. Vide President Luis De Guindos said today that it would be appropriate to cut rates if inflation continues to cool.

GBP/USD is rising, but gains could be limited after comments from Bank of England governor Andrew Bailey yesterday. He said he saw inflation on the right trajectory for a rate cut this year. The market is currently pricing in two rate cuts from the central bank starting either in August or September.

Oil slips on demand worries

Oil prices fell over 3% yesterday and are extending the sell-off today amid rising concerns over the oil demand outlook and as Middle East tensions ease slightly.

US crude oil stockpiles rose more than expected to 2.7 million barrels, almost double the 1.4 million forecast. The data comes amid increasing worries about the demand outlook in the US, the largest consumer of oil, amid the prospect of higher interest rates for longer, which could slow economic growth.

Meanwhile, the risk premium on oil has fallen as the market is more convinced that Israel will not launch a retaliation attack on Iran following last weekend's attack.