- Nasdaq 100 analysis: No changes in macro backdrop to justify a market rally

- Downtrend likely to resume amid weak market sentiment

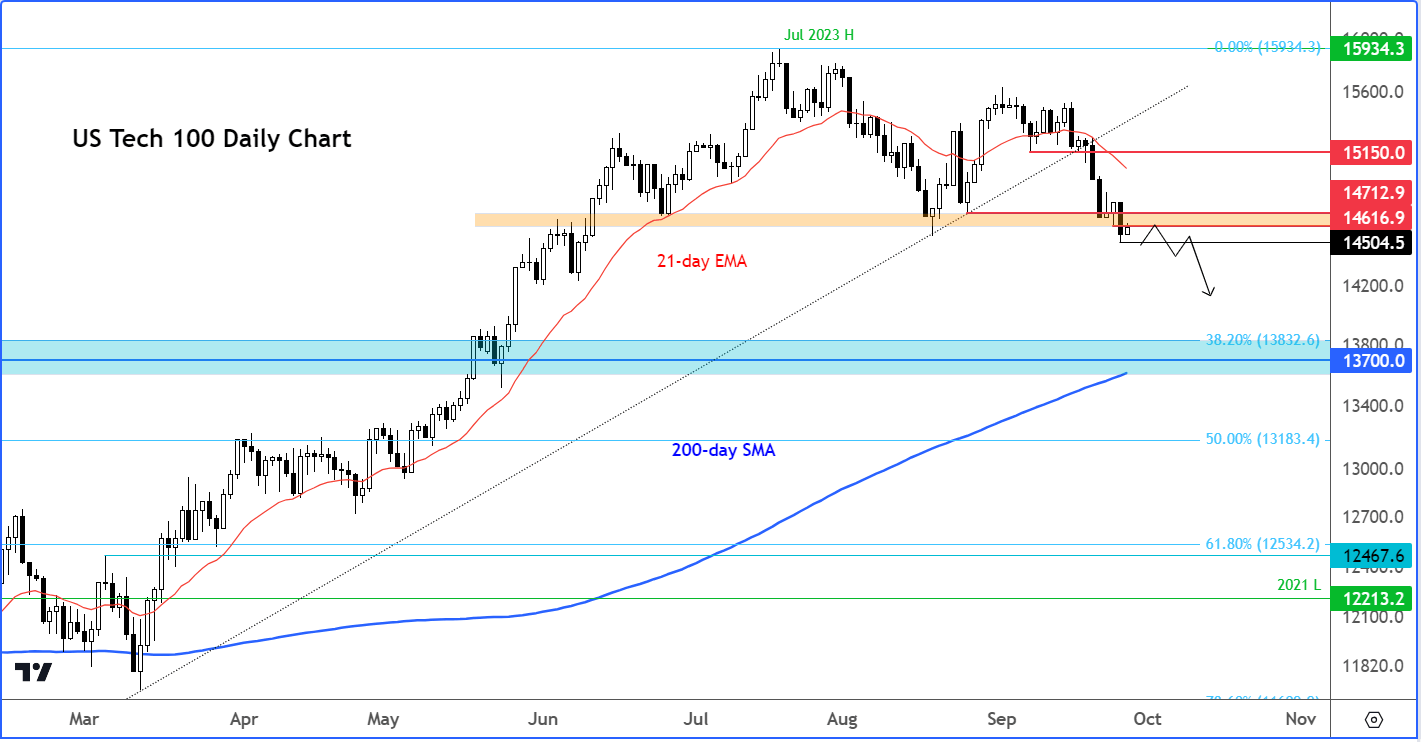

- Nasdaq 100 technical analysis: Index testing broken support

There was a bit of relief rally for global markets in the first half of Wednesday’s session after a bruising sell-off on Tuesday. Given that the recovery has not been supported by any fundamental news or development, I suspect the sellers will come back and drive stock prices lower again. There’s been too much technical damage already to scare away the stock market bears just yet. Dip buyers are thus unlikely to hang around for long. If anything, stock market investors have been slow to react to the macro risks compared to FX and bond markets. This means that there is more room to the downside as more and more investors realise that they are significantly underpricing macro risks.

Nasdaq 100 analysis: No changes in macro backdrop to justify a market rally

Unless something changes fundamentally to arrest the bond market sell-off, or the rally in US dollar and oil prices, I am expecting to see more losses for the Nasdaq and other global indices. In fact, the US dollar further extended its gains today, largely thanks to the Fed remaining hawkish, elevated bond yields and oil prices, and poor risk appetite across financial markets. The USD/CHF, for example, broke to a new 5-month high, while the GBP/USD slipped below 1.2150 and the EUR/USD closed in on the 1.20 handle. Gold fell below $1900, unable to find much love even though we are in a risk-off environment right now.

Markets have struggled in recent weeks amid concerns over rising oil prices and bond yields, subdued economic activity across the global manufacturing sector and still-high inflation in major developed economies. As a result, investors have lost appetite for taking on too much risk. They have been selling stocks and buying dollars. Traders have been happy to sit on the offer and slam asset prices back down each time we see a bit of relief rally. Even gold has fallen this week amid rising bond yields and the dollar.

Nasdaq 100 technical analysis

Source: TradingView.com

Following Tuesday’s sharp sell-off, the Nasdaq closed below key support around 14615 to 14715 area (see the shaded area on the chart). This was another clear bearish signal to appease the bears and displease the bulls. The Nasdaq and other US indices have been creating lower higher for weeks. Now, we have another lower low and a bearish engulfing candle to take note of. Today’s slight recovery could come to a halt, as the index tests this former support range (14615 to 14715 area). Unless we reclaim this resistance area on a closing basis now, watch out for a continuation of the sell-off today. The risks remain skewed to the downside.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R