JPY, VIX, SPX, Nasdaq Talking Points:

- Carry trades have continued to unwind with another gust of selling after the weekly open. I had warned of this last week as Nikkei futures showed a sizable move ahead of the US close for the week and given that some of that selling happened after Japanese markets had already closed for the day, there was likely to be a gap on the weekly open in the Nikkei.

- With the USD/JPY carry trade being a funding vehicle for other risk markets over the past few years, carry unwind is driving sell-offs in a wide range of assets, ranging from tech stocks to DXY, or the US Dollar.

- I’ll be discussing this in the weekly webinar tomorrow: Click here to register.

It’s been a busy start to the week and I’m going to try to parse through these items once at a time, starting with the market that I think has started the move: USD/JPY.

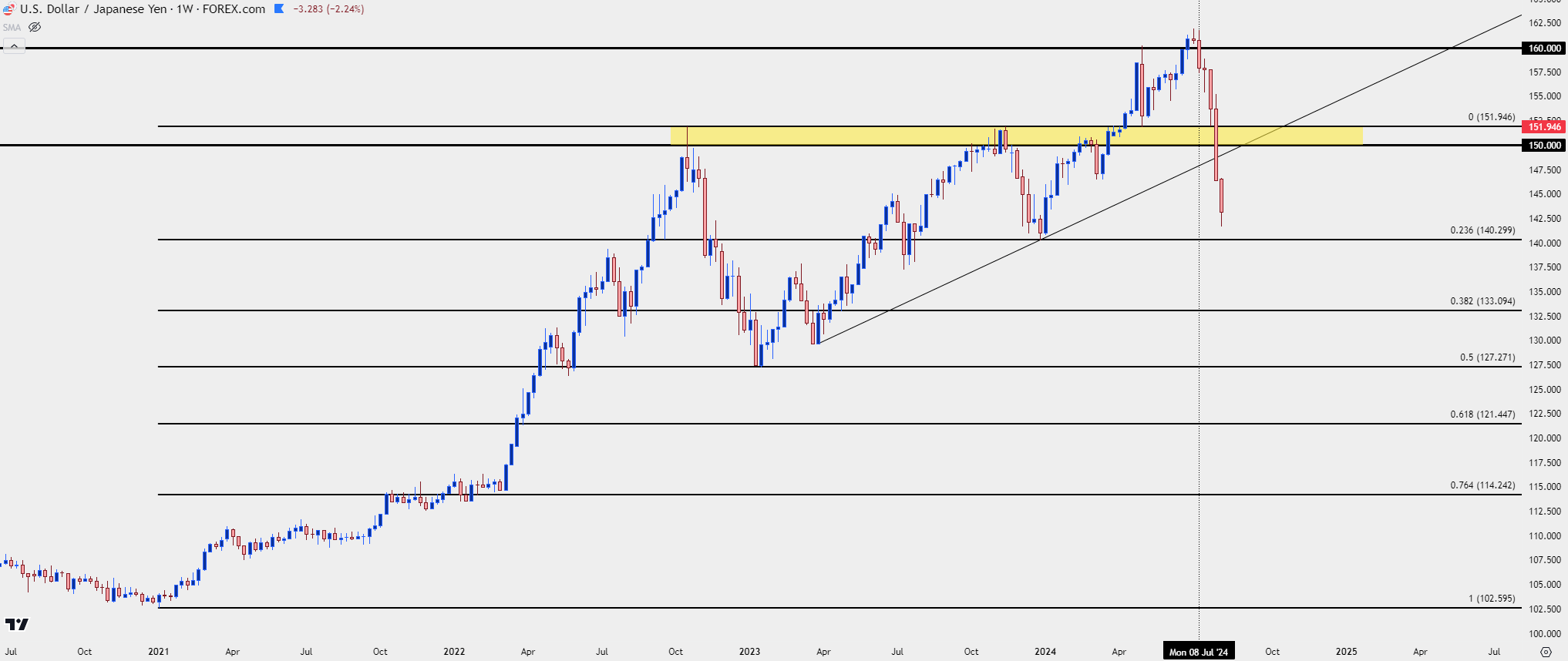

USD/JPY Continues Fall as Carry Unwind Picks Up

Carry trades can be pretty fantastic backdrops when they appear. Rate differentials between economies can allow for daily interest payments if long the higher-yielding currency and short the lower-yielding; but perhaps even more attractive is that as more and more traders line up on one side of the market, a trend can grow significantly.

As the US hiked rates in 2022 and 2023, USD/JPY drove-higher as the Bank of Japan didn’t touch monetary policy at all. The higher that the US hiked rates, the more attractive that carry trade became, and more and more traders lined up on the long side of the move.

The trend in USD/JPY started even before the Fed had hiked rates, as US inflation was showing more prominently and as market participants began to price-in eventual rate hikes. From trough-to-peak, USD/JPY climbed by 57.86% from the 2021 low up to the high set less than a month ago.

When that carry trade is in order; it can be a fantastic market backdrop. But it can also build a very one-sided trade as longs are encouraged and shorts are discouraged from holding exposure. At that point, even the slightest hint or whiff of change can compel a fast reversal scenario. We saw similar setups in Q4 of 2022 and 2023 as US inflation was softening, but that didn’t lead to rate cuts.

Bulls soon loaded back up on the long side of the pair, at 50% and then 23.6% Fibonacci retracements – and the trend resumed.

What’s changed here is the likelihood of a rate cut from the Fed with another surge-higher in rate cut odds after the Friday NFP report.

Now – it’s a rush for the exits as carry traders abandon the long side of USD/JPY. These can be fast and violent episodes as longs looking to avoid further principal losses aren’t usually precious about their exits. And along the way, stops get triggered, adding more supply into the market which leads to even lower prices, and more incentive for bulls to abandon ship.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

It’s a Yield Trade

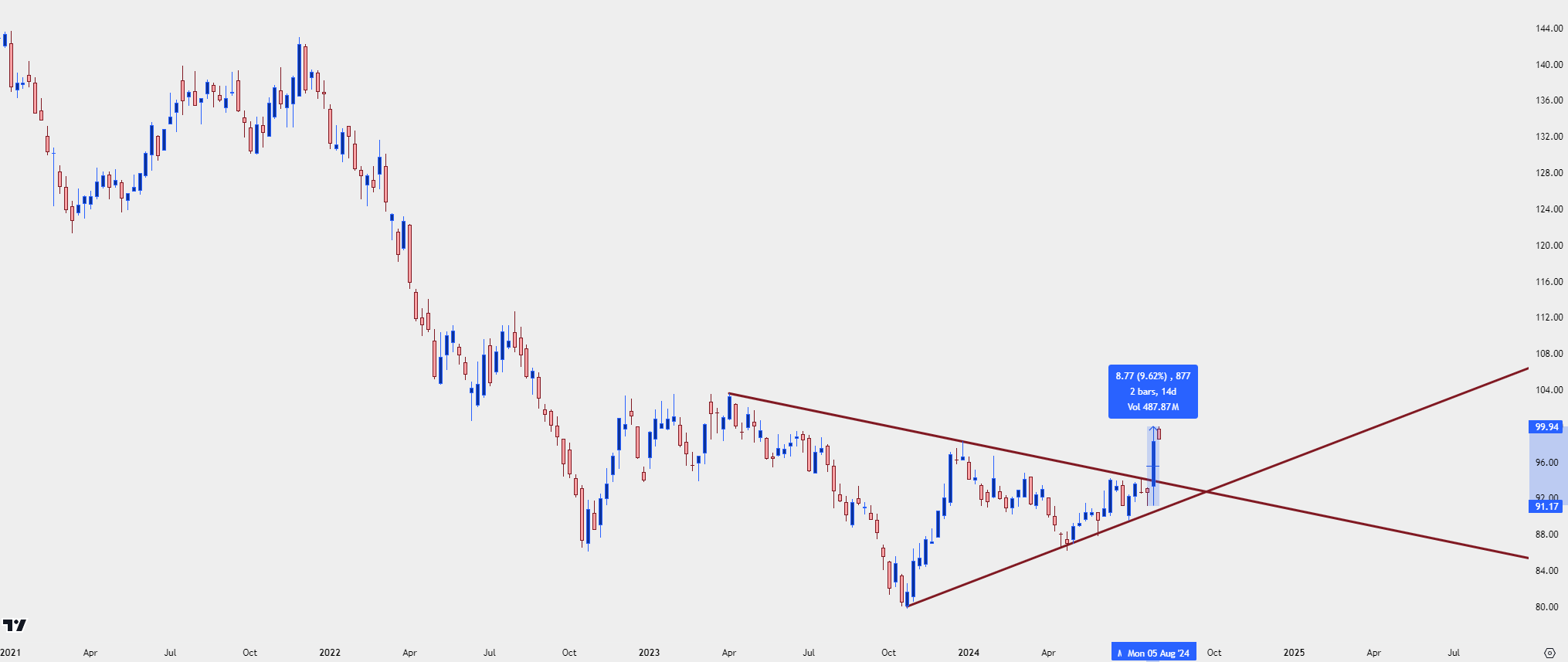

Not every market is ugly right now: As Treasury yields dive on the idea that the Fed will soon be cutting rates, bond prices shoot-higher. I had looked at this on Friday as the ETF ‘TLT’ was working on its strongest weekly gain since March of 2020, just as Covid was getting priced-in.

Now – that move has stretched even further as capital flows out of riskier assets like stocks and into Treasuries – as traders are trying to get in-front of what feels like an inevitable spate of rate cuts from the FOMC.

TLT has moved up by as much as 9.62% from the low just two weeks ago.

TLT Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

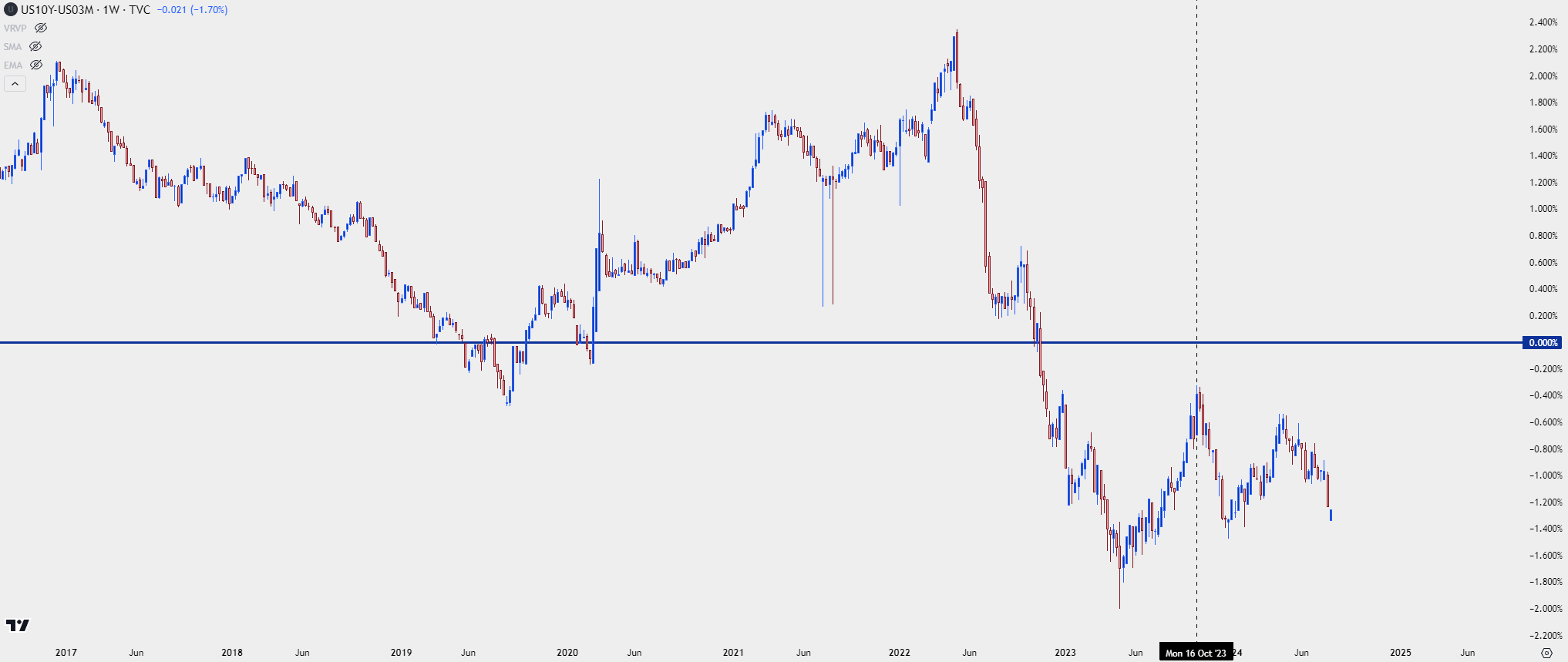

Yield Curve Normalizes

As a manifestation of Treasury rates, the 10 year and 2 year Treasury spread has normalized. I’ve written quite a bit about yield curve inversion and it rarely seems to excite others, but that’s probably because it’s an easy-to-dismiss factor until it actually starts to bring impact, such as right now.

For an investment of 10 years to yield less than an investment of 2 years or even 3 months, something is amiss in the backdrop. Like if you goto your bank to get a loan – and they offer a lower rate for a 10 year loan than a 3 month loan, you’d think there was something wrong.

When this happens in the world’s most important debt market it’s often sign of distortion. From the Fed’s own research, there’s a link between Treasury Spread Inversion and recessions, as that level of distortion has often been found to lead to a recession. But, you don’t have to take my word for it, the Federal Reserve issues a plethora of research on the topic and you can read more about that here: The Yield Curve as a Leading Indicator.

At this point, the 10 year-2 year Treasury spread has moved to a level of ‘0,’ indicating no inversion. But, the Fed’s preferred spread of the 10 year and 3 month Treasury remains deeply inverted, and as the FOMC has said in the past, this is the variable that they watch for recession probabilities.

US Treasuries: 10 Year/3 Month Spread – Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

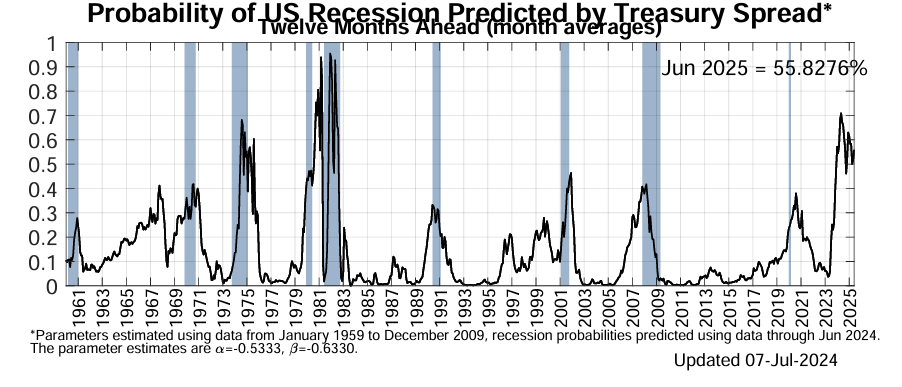

Recession Odds

Since the Fed started hiking rates the big question was ‘soft landing’ or ‘hard landing.’ Eventually, it seemed the widespread expectation was for ‘no landing.’

But – from the Fed’s own research as drawn from the 10-year/3-month Treasury spread, there’s been a greater than 50% probability of recession within the next 12 months for the over a year now. Below is a table taken directly from the Fed’s website, which can be found at the above link.

This has impact on what I’m going to talk about next as global equities have been hammered over the past few weeks.

FOMC: Probability of Recession Within the Next 12 Months

Chart prepared by James Stanley; data derived from Federal Reserve, Yield Curve as a Leading Indicator

VIX Spikes

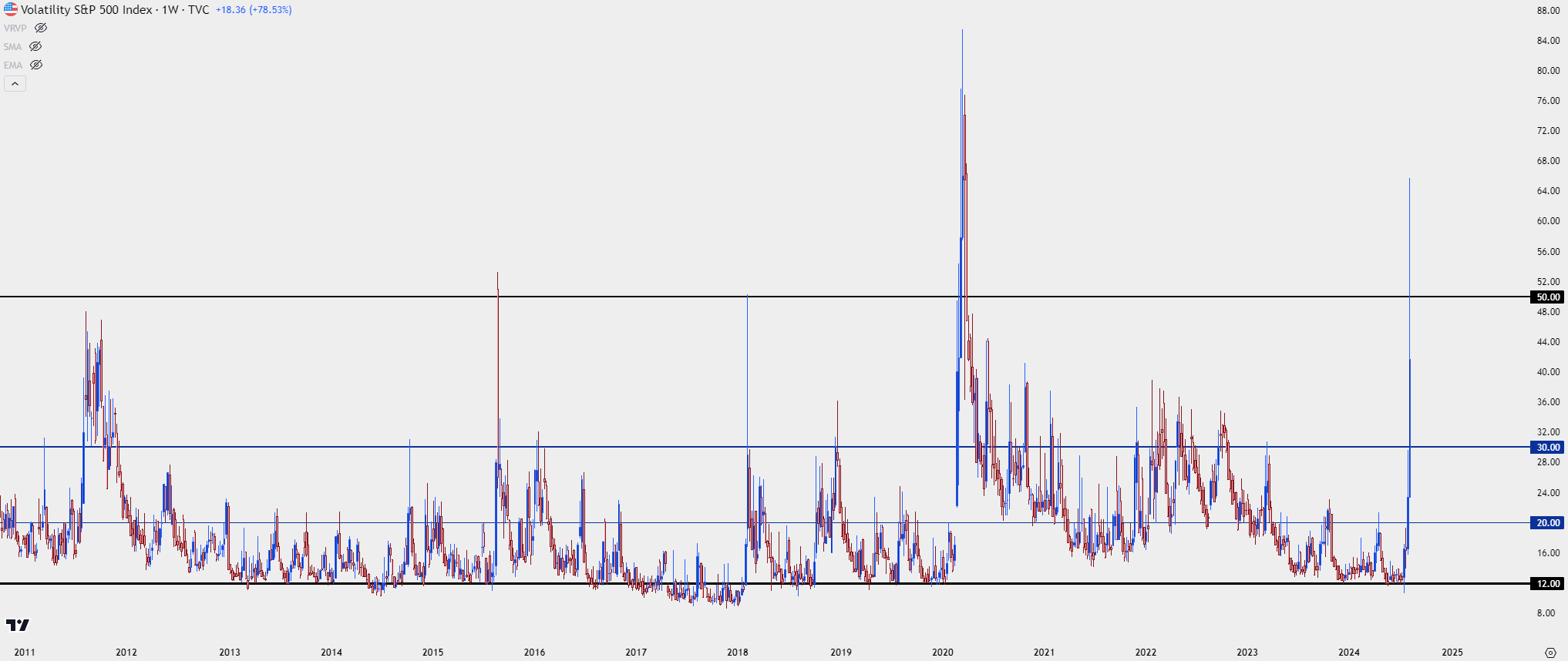

As uncertainty has shot-higher over the past few weeks, so has the market’s favorite ‘fear gauge.’ But – it’s notable just how stretched the VIX is right now as there’s only been a handful of other instances in the past 20 years where VIX has tested above the 50-level, and only one other time when it pushed above 60, which was when Covid was getting priced-in in March of 2023.

With VIX, many will often look at spikes as pullback opportunities in equities. But, it’s important to remember this is a lagging indicator like most others, so I think a more proactive way of looking at it is as VIX spikes, so does the possible range of scenarios and outcomes. It does, however, highlight that chasing a move after an already-aggressive sell-off can be dangerous from a timing perspective.

VIX Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Stocks

As the Yen carry trade remained in full-force, there was a funding vehicle that large players and institutions could easily use: The could borrow capital in Japan at near-zero rates, and then deploy that capital in other, riskier markets. As long as the Yen remained week this trade remained attractive, even as US yields were pushing higher. This helped to elevate valuations on US equities, particularly tech stocks and AI-heavy companies.

But now that this funding vehicle has given way to unwind, there’s capital flowing out of many of those markets and, oh, there’s also a more attractive area to be invested in as Treasury prices rise and yields fall.

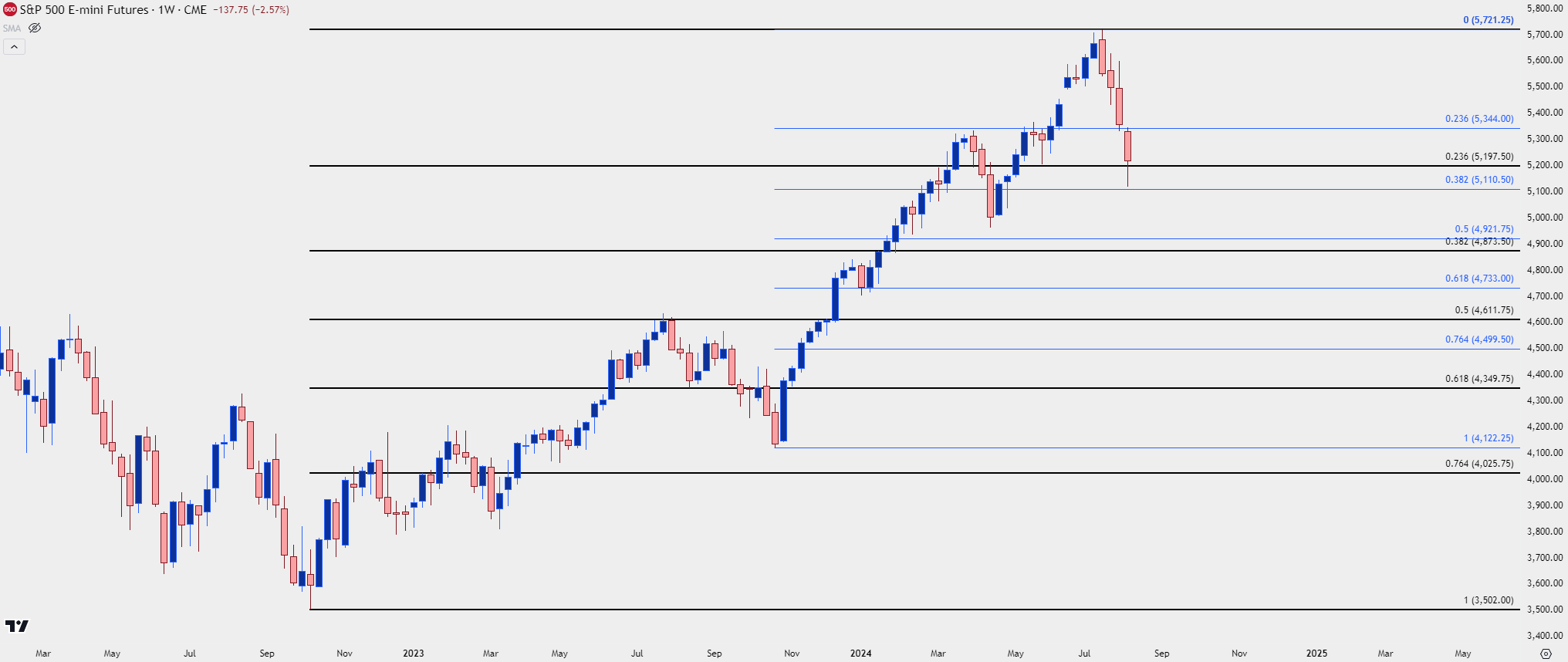

This has led to fast sell-offs in US equities and S&P 500 Futures are continuing the breakdown from the rising wedge formation. As of this writing, it’s down by more than 10% from the July highs – which were set on the morning that the Bank of Japan had intervened following the US CPI report.

At this point, S&P 500 Futures have pushed down for a support test at the 23.6% retracement of the 2022-2024 major move. As price wiggles higher, the big question is whether more sellers will respond to tests of lower-high resistance.

S&P 500 Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

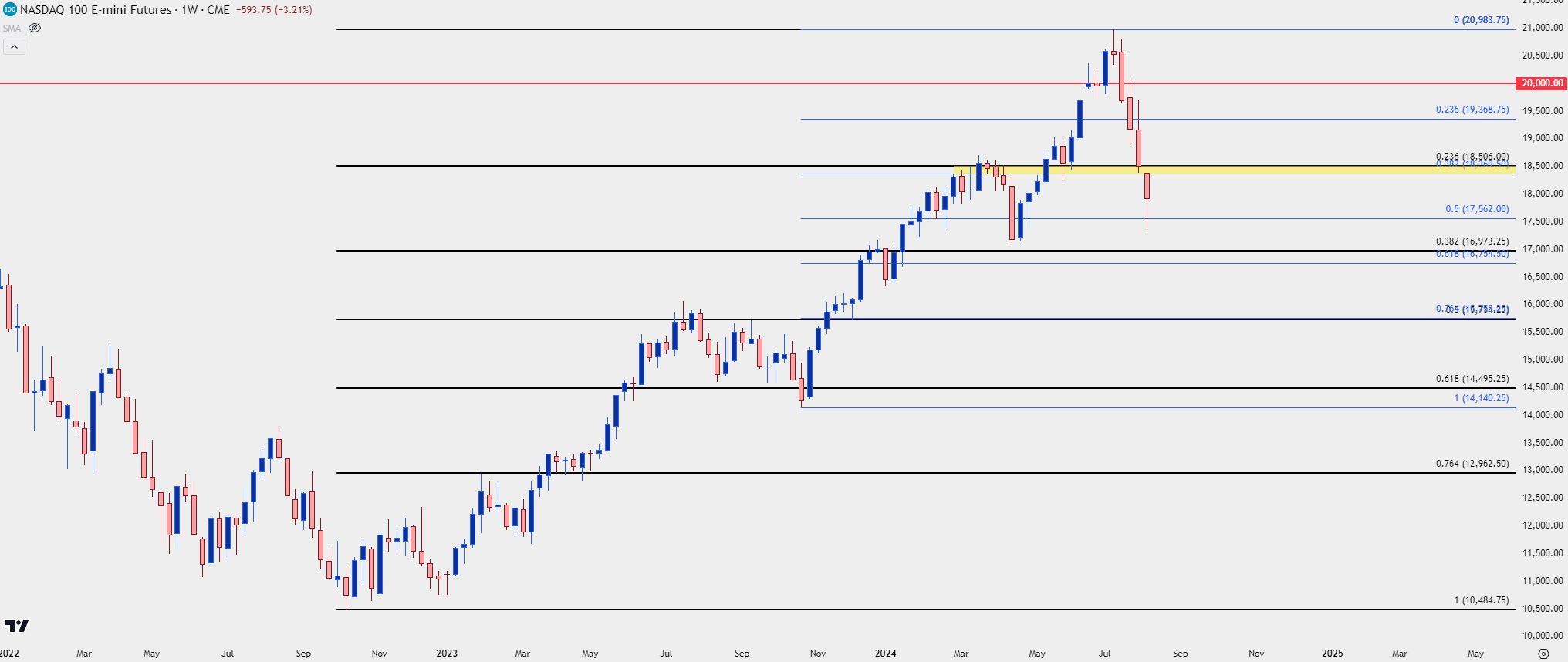

Nasdaq

Given the AI-heavy allocation in the Nasdaq, the sell-off has been more aggressive. While S&P 500 Futures test the 23.6% Fibonacci retracement of the 2022-2024 move, the Nasdaq has already made a push towards the 38.2% retracement of the same measured move from the 2022 lows. The 23.6% retracement did help to hold the lows into the end of last week though, so this becomes an important level of possible resistance at prior support.

There’s also a 38.2% retracement at 18,369 and this helps to create a zone of interest for lower-high resistance potential.

Nasdaq 100 Futures – Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist