Japanese Yen Talking Points:

- The Japanese Yen continues to fall with USD/JPY now trading at a fresh 37-year high. EUR/JPY is at a fresh 31-year high, GBP/JPY a fresh 15-year high and AUD/JPY on the verge of a fresh 32-year high.

- I looked into the Yen last week as Masato Kanda was threatening intervention. But, as mentioned there, the fact that they were threatening intervention was being read that they weren’t ready to intervene, and this has simply led to more Yen-weakness.

- I’ll be discussing these themes in-depth in the weekly webinar. It’s free for all to register: Click here to register.

Japanese Yen weakness remains as one of the more dominant themes across global markets and this week has brought fresh lows for the JPY in a number of currency pairs.

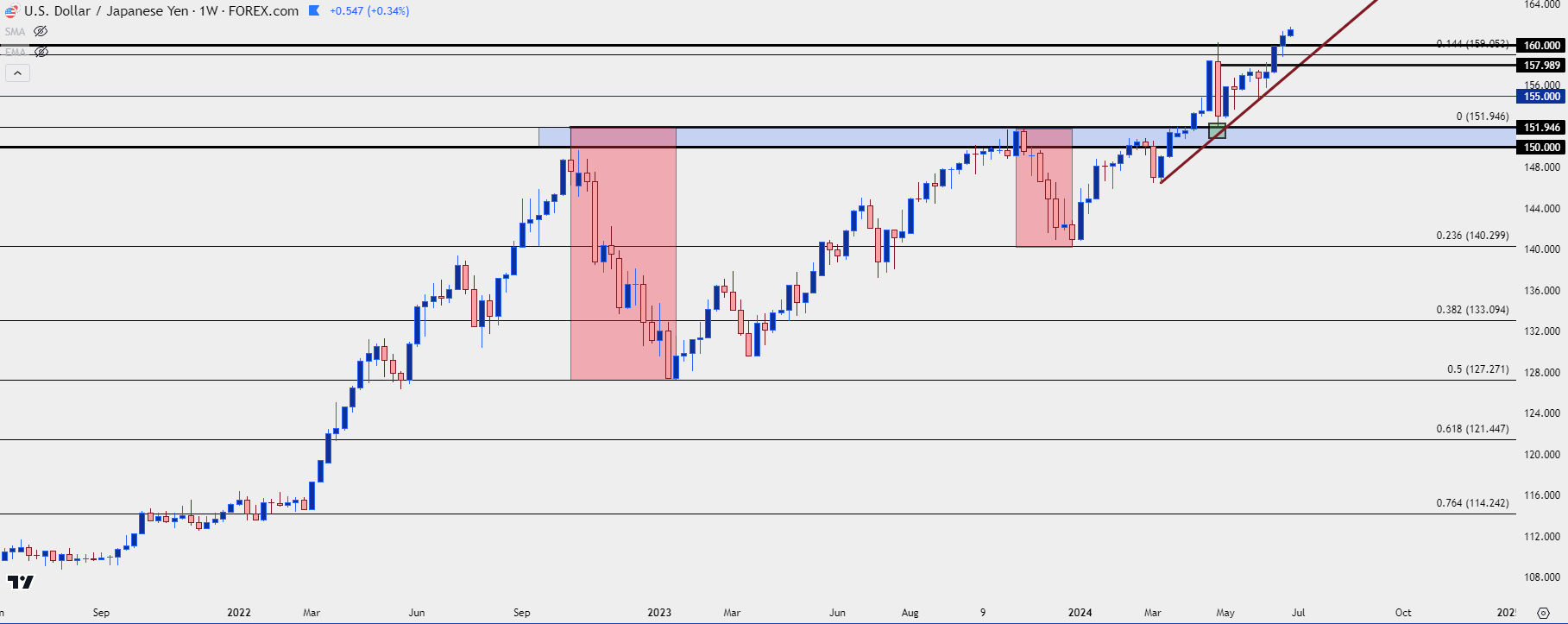

I looked into this last week as USD/JPY putting in another test of the 160.00 big figure. As I wrote then, Masato Kanda of the Japanese Finance Ministry had already opined that intervention was a possibility, which delivered a quick pullback to the pair. But the fact that he was making threats also made it seem as though the MoF and BoJ weren’t yet ready to intervene, and that quick pullback was followed by strength as the pair valued above the psychological level and has continued to drive-higher ever since.

At this point, USD/JPY is trading at a fresh 37-year high and since last Wednesday’s breakout, the pair hasn’t even pulled back for a 160.00 support test yet.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY: Options v/s Strategies

I’ve talked about this quite a bit over the past couple of years and for the BoJ, this remains a conundrum. One of the major reasons for the continued trends in the Japanese Yen is the BoJ’s policy rates. With rates so low in Japan and higher elsewhere, there remains an attractive carry trade in Yen-pairs.

And just like we saw after the late-April intervention: The BoJ intervening at the request of the Finance Ministry can prod a pullback, but with the carry still-positive on the long side of those pairings, this merely lowers the boat so that more bulls can load on. This is why the entirety of that intervention-fueled pullback was clawed back in the two months after.

And at this point, price sits at a fresh 38-year high while the Bank of Japan burned $62 billion with practically nothing to show for it, save for a pullback in the major pair.

So, given that we’re at a point of necessity the question is worth asking: How badly does the Finance Ministry and Bank of Japan want to quell Yen-weakness? Because it seems as though rate hikes would be the path forward if that was the case as higher rates in Japan could begin to make that carry trade as less attractive.

And if that wins out, and Yen-strength comes roaring back, the Bank of Japan might find themselves in a familiar place, eventually worried about a lack of inflation and slowing growth; the same problems that plagued the economy during the ‘lost decades’ of Japan. Given the demographic dilemma for the country, that may be the less desirable option.

As I’ve been saying in webinars, if Yen-weakness was a major problem that the BoJ and Ministry of Finance wanted to address, they have tools to do so (rate hikes, tighter policy). The fact that they haven’t used those tools could deductively highlight where their priorities are and that can keep themes of Yen-weakness as attractive until something shifts or changes.

In USD/JPY, the primary bearish factor would appear to be USD-weakness, if it shows. That’s what was behind the 50% retracement that started in Q4 of 2022 and the 23.6% retracement in Q4 of 2023.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

EUR/JPY

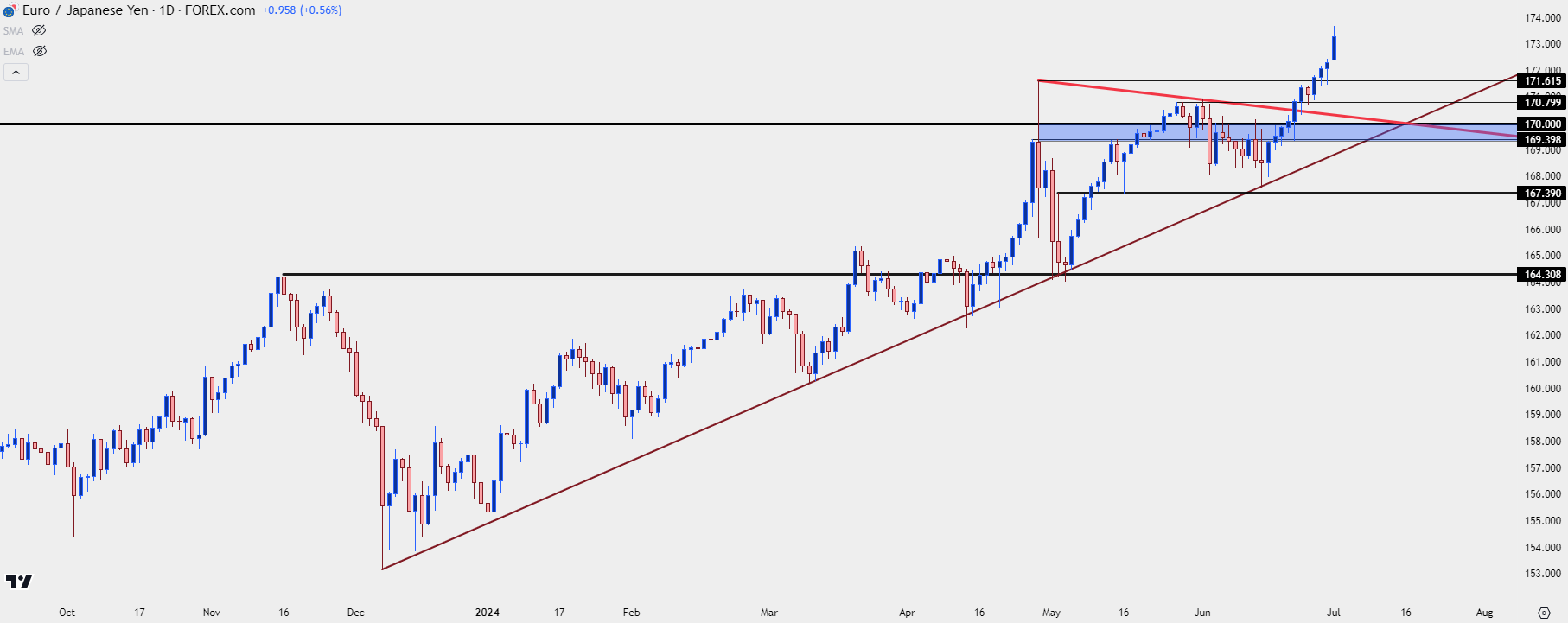

Amongst major currencies the Euro has had some headwinds to deal with of late. The ECB started cutting rates last month and there’s been a fresh bout of political drama that will continue into the next week.

Going into the Bank of Japan rate decision last month there was even potential for a reversal, as price had pushed down to a support trendline just after the meeting. But, in the two weeks since the pair has had only one red day and buyers have driven price well-above the 170.00 psychological level that was previously holding resistance.

As I wrote ahead of that BoJ rate decision, if there is a shift in Japanese policy EUR/JPY could be a vulnerable candidate, as the potential for Euro weakness could mesh well for scenarios of Yen-strength. The fact that this didn’t happen and, instead, the pair has pretty much went parabolic, highlights that markets are harboring little expectation of any shifts at the BoJ anytime soon. At this point, prior highs are now support potential and those plot at 171.62 and 170.80. Below that is a key support zone that spans from 169.40 up to the 170.00 handle.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

GBP/JPY

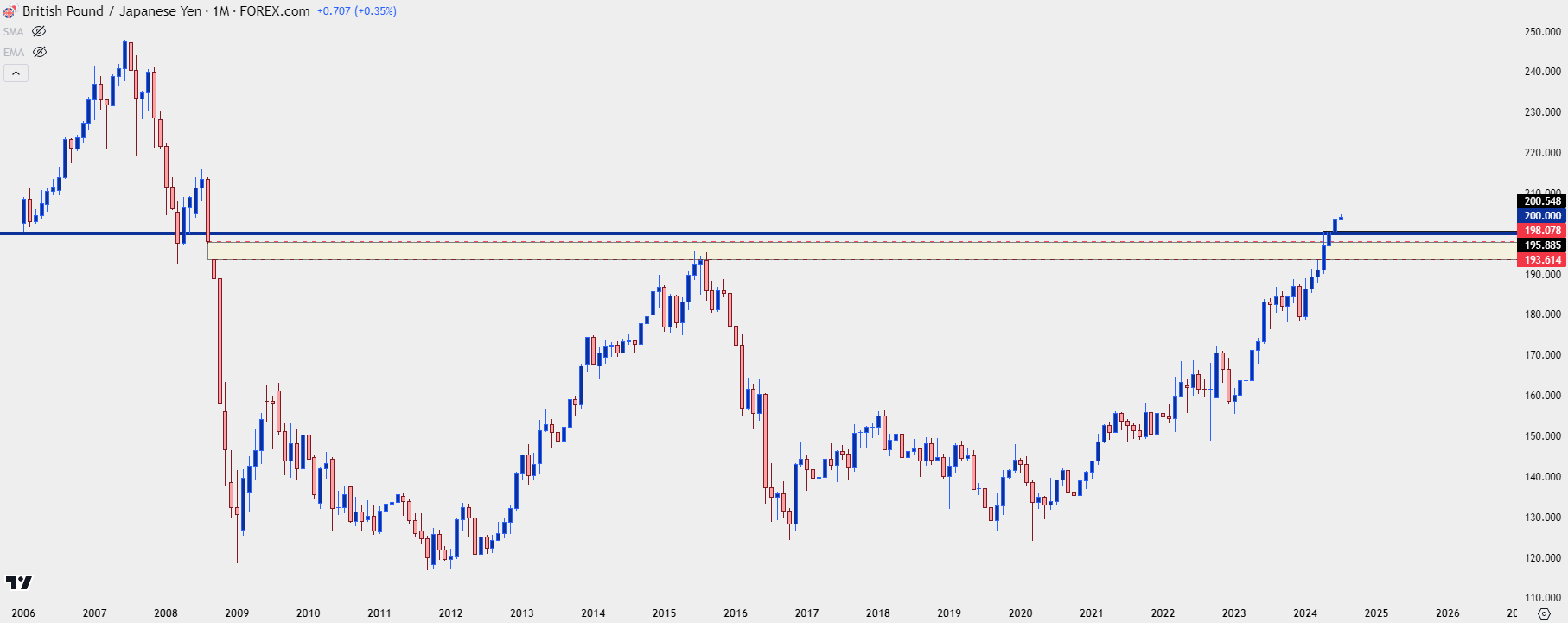

This is the pair that I’ve been tracking for Yen-weakness away from the USD for the better part of the past year.

There was some unfilled gap from the Financial Collapse that ran from 193.61 up to 198.08. It was a large gap, to be sure, but it posted from the monthly bar back in August and September of 2008. This was the spot that held resistance in 2015, holding the highs over a three-month period at the bottom of that zone until prices retreated back-below 125.00.

GBP/JPY Monthly Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

Chart prepared by James Stanley, GBP/JPY on Tradingview

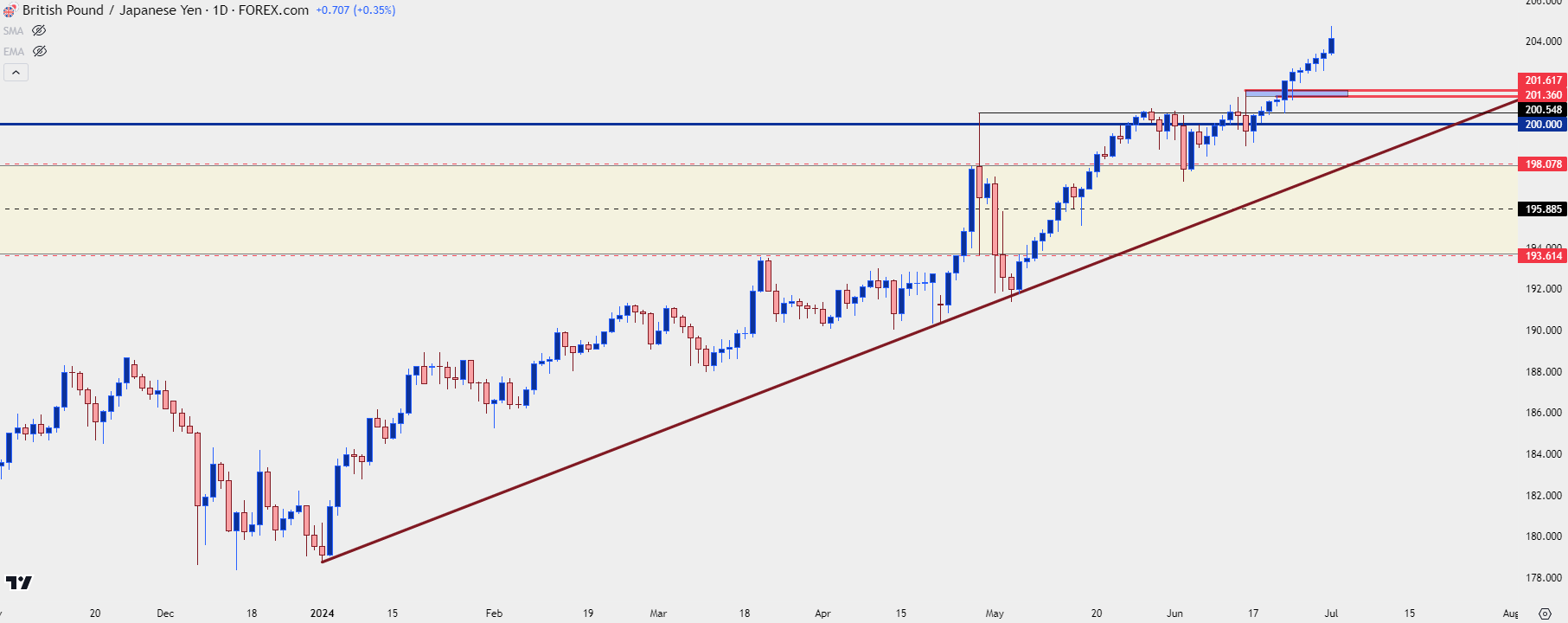

It started to come back into play in March of this year, initially, holding bulls at bay. The pullback from that resistance noted in the article held at the 190.00 psychological level, allowing for support to build before buyers could come back into the picture. Then the month of April saw a strong push from buyers with the gap completely filling. As USD/JPY traded above 160.00, GBP/JPY tested above the 200.00 handle before pulling back.

That 200.00 level required some work as bulls put in two more tests before finally finding the ability to build a trend above it; and for the past two weeks, price has been up every day on GBP/JPY.

This does create complications for chasing, but there are now a couple of key levels of support for pullback scenarios, such as the 201.36-201.62 zone or the 200.55 level. If neither of those hold, 200.00 becomes the spot to follow for higher-low support potential.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

Chart prepared by James Stanley, GBP/JPY on Tradingview

AUD/JPY

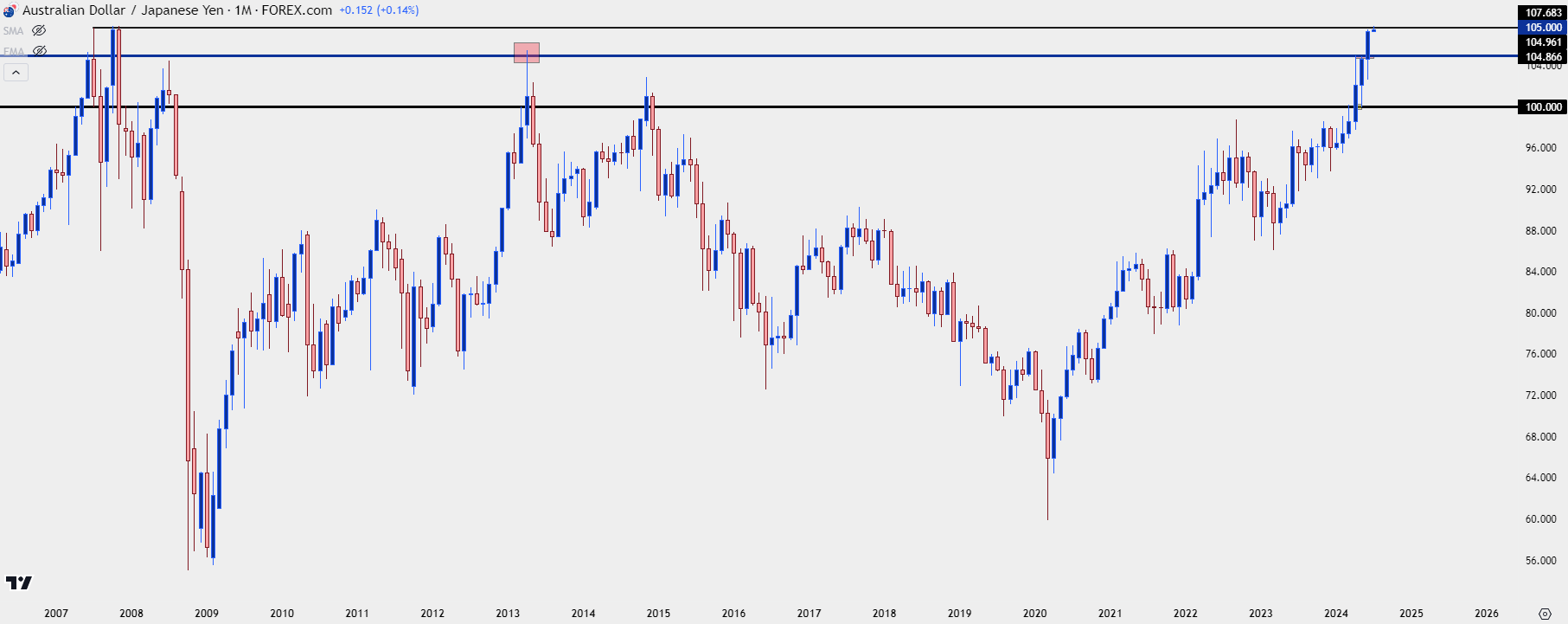

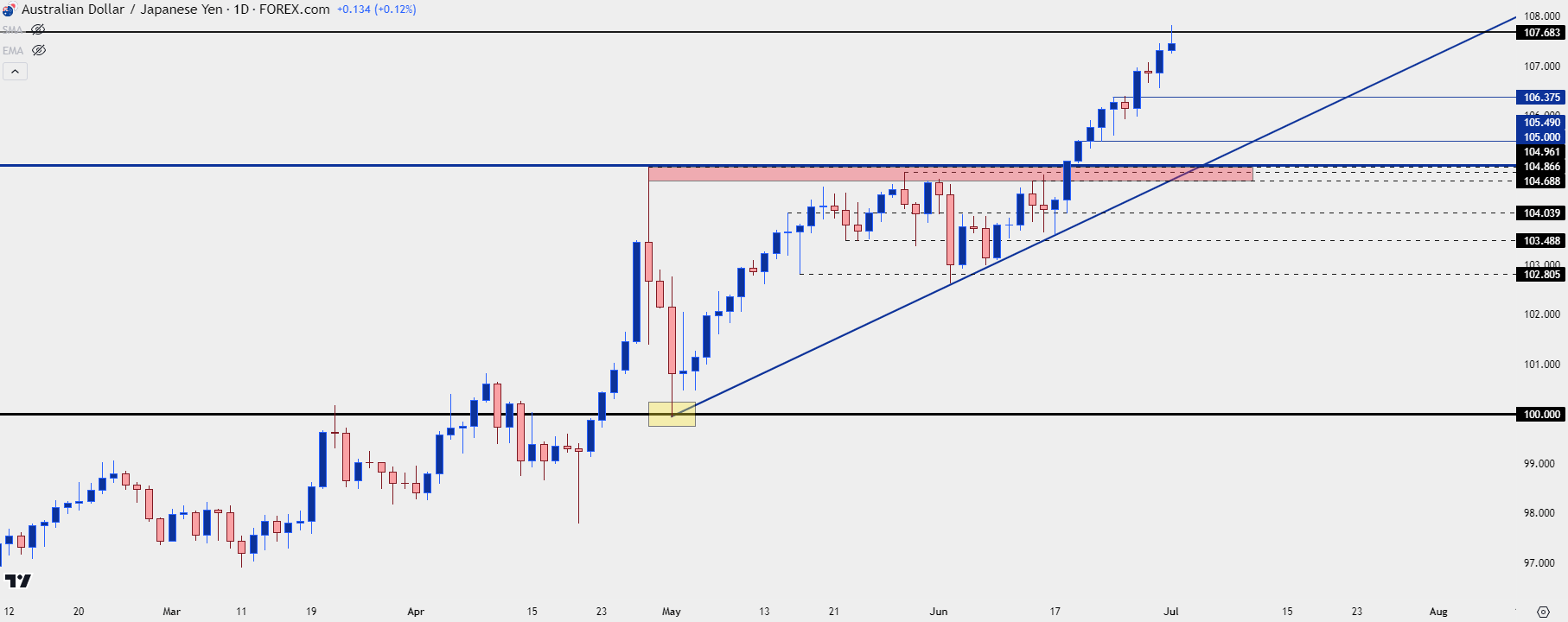

Amongst the Yen-pairs, I’m counting AUD/JPY as one of the cleaner breakouts over the past couple of months. I looked into this ahead of the BoJ rate decision last month and at the time, AUD/JPY had set up an ascending triangle formation, often approached with aim of bullish breakout.

Those formations are noted with horizontal resistance and higher-lows accented with a bullish trendline, and the horizontal resistance showed at a key spot on longer-term charts, taken from the 105.00 psychological level that had only traded briefly in the prior decade-plus.

Now that 105 is out, AUD/JPY has jumped up to the next long-term level of resistance at 107.68, which was the high back in 2007 over a few different tests.

AUD/JPY Monthly Price Chart

Chart prepared by James Stanley, AUD/JPY on Tradingview

Chart prepared by James Stanley, AUD/JPY on Tradingview

That resistance in AUD/JPY came back into the picture this morning and, so far, it’s held the highs in the pair. Similar to the above in GBP/JPY, this could be a difficult spot to chase from given how far price has moved off of any recent supports; but given the continued gains there are a couple of spots of prior resistance that could be of interest for higher-low support potential. There was a swing-high early last week plotted at 106.38. Below that is a possible spot around 105.50 and then the 105.00 psychological level that was previously resistance for the ascending triangle formation.

AUD/JPY Daily Price Chart

Chart prepared by James Stanley, AUD/JPY on Tradingview

Chart prepared by James Stanley, AUD/JPY on Tradingview

--- written by James Stanley, Senior Strategist