Japanese Yen Technical Analysis Talking Points:

- The big item from last week was another suspected intervention from the Bank of Japan.

- The move started about ten minutes after the Thursday release of US CPI, and Yen-pairs showed aggressive pullbacks in broader bullish trends.

- The prior intervention in late-April and early-May ended up as a pullback to support at prior resistance, at which point bulls jumped back on the bid and drove USD/JPY, EUR/JPY, GBP/JPY and AUD/JPY to fresh highs. The big question now is whether we’re sitting in-front of a repeat of that scenario.

It’s been the largest down week for USD/JPY since the late-April intervention, and the move from last week was highly suspected to be driven by another intervention. There is some difference however, as the prior instance in late-April took place after the USD/JPY pair had climbed above the 160.00 handle, and the corresponding move from the Bank of Japan and the Ministry of Finance was designed to defend the Yen from further losses.

It did lead to a fast snap back in the trend, with USD/JPY rushing back down to support at prior resistance of 152.00; and in the two months that followed, bulls simply re-loaded the boat and drove the pair right back up to the big figure.

USD/JPY broke-out above 160.00 in late-June trade and interestingly, this took place after an intervention warning from Masato Kanda. As he was making the threat, it seemed as though the Bank of Japan wasn’t yet ready to act as they often intervene without warning, and that helped the pair to propel up to a fresh 37-year high.

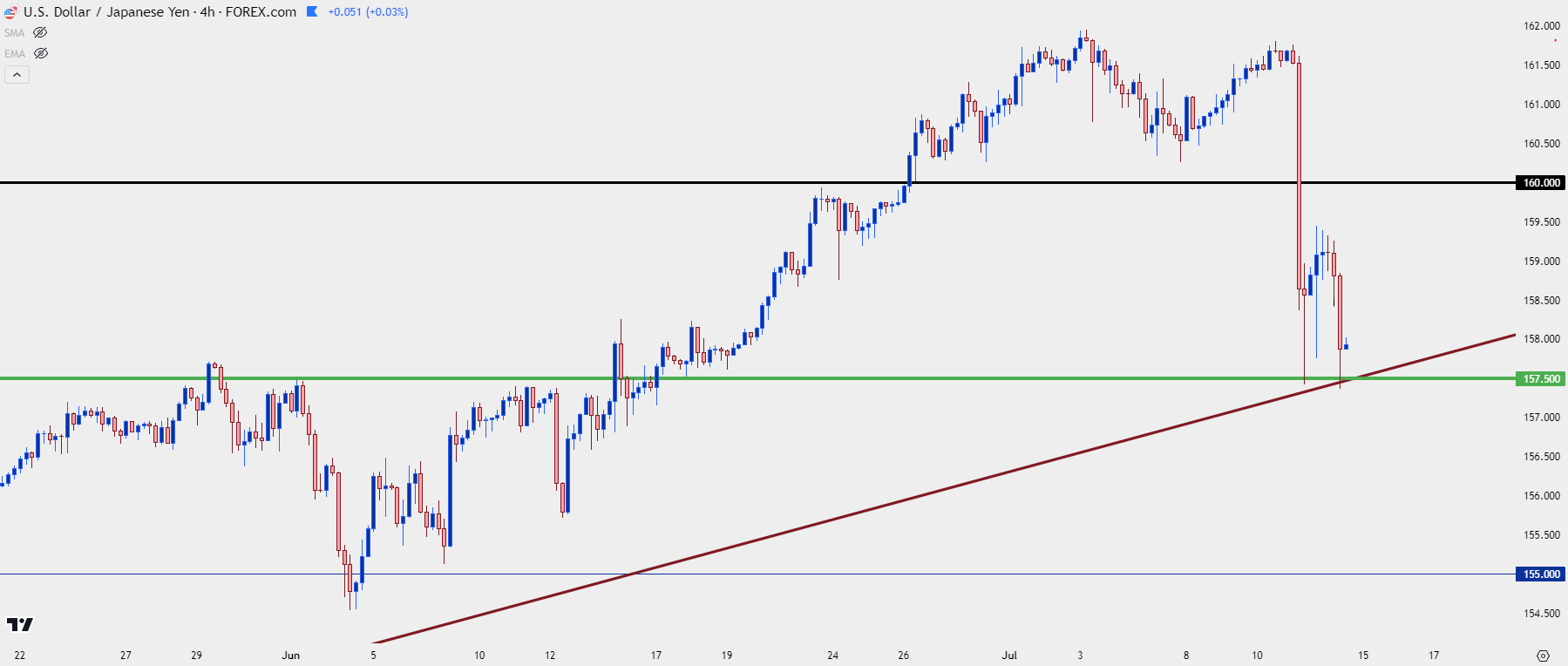

In this instance, the pullback in USD/JPY seemed to hit about ten minutes after the release of US CPI on Thursday, with a major move in USD/JPY pushing the pair back-below the 160.00 handle.

I personally thought this was related to carry unwind as opposed to intervention because unlike the late-April instance, this wasn’t a matter of defense, particularly after a bearish USD driver had been unveiled with lower-than-expected CPI data. But media reports after the event seem to point toward intervention which illustrates a more-aggressive Bank of Japan than what we had seen before. But there may also be a deductive message here as well that carries pertinence for price action as we move deeper into Q3 trade.

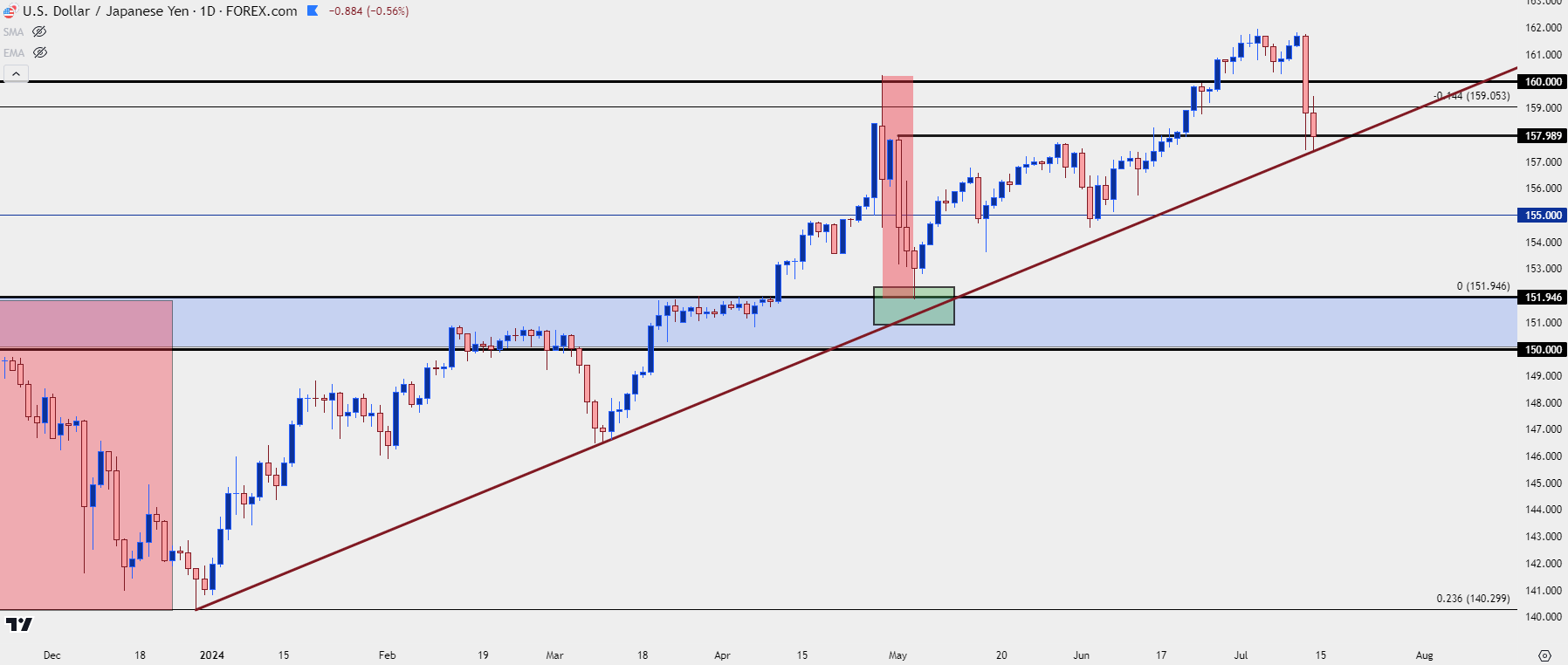

In USD/JPY, the pair has pulled back to and found support at a bullish trendline connecting December and March swing lows.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

BoJ: Is the More Aggressive Intervention Highlighting a BoJ Not Yet Ready to Shift Rates?

I had highlighted this multiple times over the past year but if the Bank of Japan wants to begin to turn the tables of the trend, they have tools to do so. There are consequences, to be sure, but evaluating their actions given the current set of circumstances could deductively highlight their forward-looking drive.

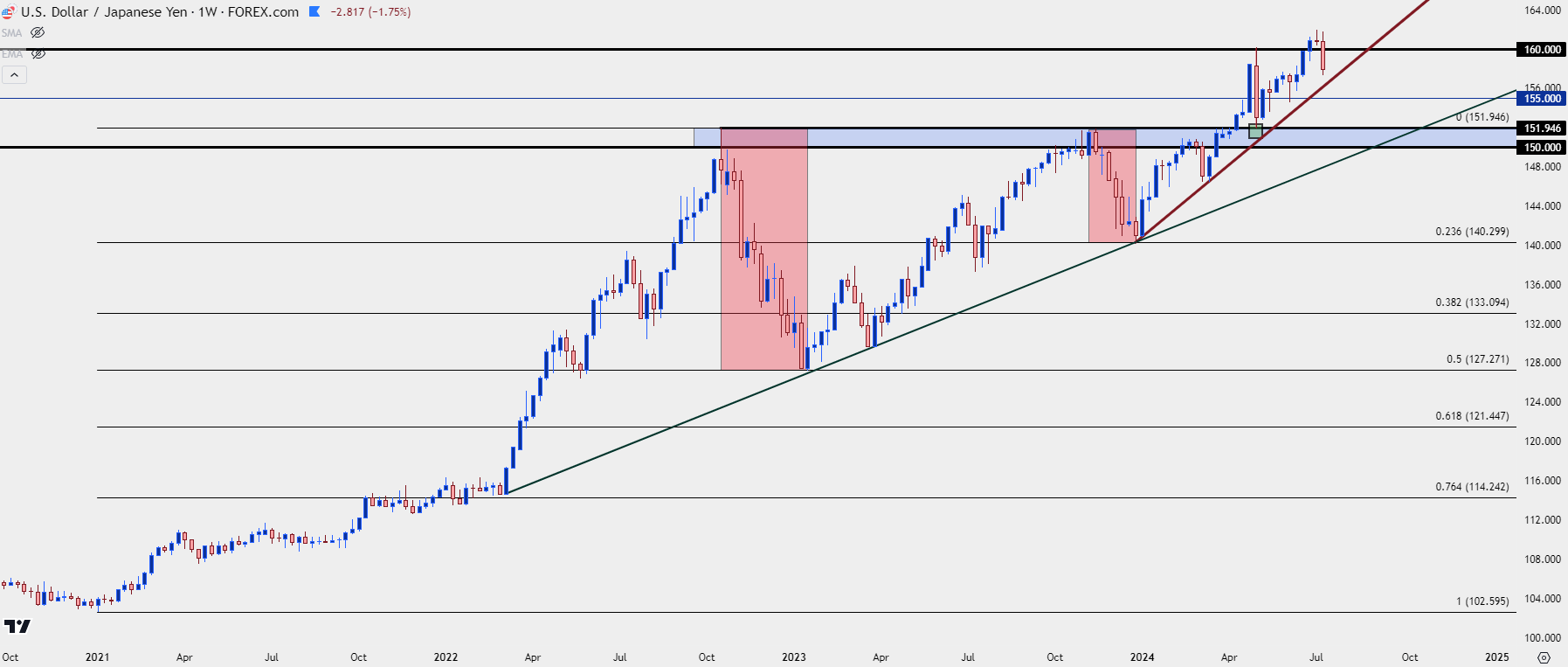

To date, the BoJ remains one of the more loose and passive central banks in the world, and this has fed into the carry trade as much of the rest of the world has already lifted rates multiple times in response to stronger inflation. That growing divergence in rates of economies has built larger rollover amounts, which serves as incentive on both sides of the pair. In USD/JPY, with the Fed going into a strong hiking cycle in 2022, the rollover on the long side of the pair had continued to grow while the rollover on the short side of the pair became more costly. This incentivized bulls to go long and bears to duck for cover; and as we can see on the below weekly chart, that drive has amounted to a significant trend that’s seen USD/JPY gain as much as 57.86% from the 2021 low up to last week’s high.

For a currency pair, particularly a major pair like USD/JPY, that type of movement is significant and there are a host of repercussions involved to both constituents of the pair.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Diminishing Impact of Pullbacks

With a trend that’s been going for two-and-a-half years, there’ve been a few different pullback scenarios. In November of 2022, a strong sell-off pushed the pair more than 2,400 pips from the prior high. This was followed by bullish continuation after support showed at the 50% retracement of that move.

And then in late-2023, another below-expected CPI report drove a pullback but this time, it was a mere 23.6% retracement of the prior trend.

In late-April, the BoJ intervened to defend the 160.00 level in USD/JPY but as you can see from the below, that merely pulled prices back to support at prior resistance, after which bulls returned and drove to another fresh high.

The constant throughout all of this was the positive carry on the long side of the pair. That can change, of course, but we would need to see either US rates go lower or JPY rates go higher, neither of which appear to be on the cards in the near-term.

But, perhaps more to the point – if the BoJ was willing to intervene this week even as market forces appeared to be in their favor after the CPI release – is this sending a message that they’re not ready to address rates in the near-term? That they’re feeling vulnerability behind JPY weakness without the ammunition to actually address the root of the problem, which is an interest rate divergence matter?

And more interesting for traders, does this spell any difference than what we’ve seen over the past two-plus years, where pullbacks have been mere short-term resets for bulls to re-load the boat at lower prices, and then ride the carry back up to resistance?

In that event – the big question is where the low might be and whether that’s already shown. At this point there’s support showing from a bullish trendline connecting December and March swing lows as noted above, and there’s additional structure just below that at the 155 and 152 levels.

But given the volatility and jaggedness in USD/JPY, perhaps a better question is whether USD/JPY is the most attractive venue for following themes of Yen-weakness, which I’ll delve into below.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

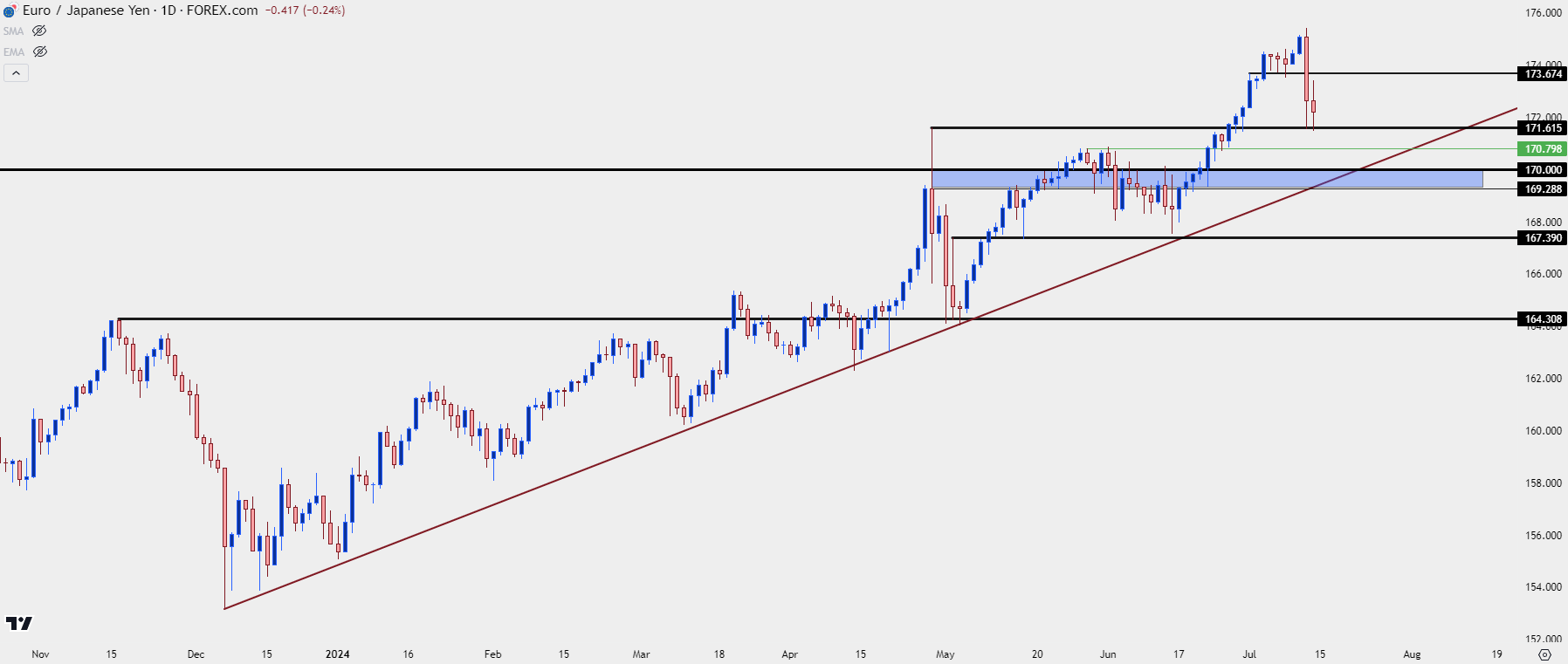

EUR/JPY

So far in Q3 trade the Euro has outpaced the US Dollar, and this comes despite the fact that the ECB just started a rate cutting cycle in June. And, correspondingly, EUR/JPY has shown greater strength than that of USD/JPY so far this quarter.

As of this writing, EUR/JPY is grasping on to support at prior resistance, taken from the late-April swing-high that came into play just before that BoJ intervention. This plots at 171.62 and there’s additional structure for support just below, around the 170 psychological level.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

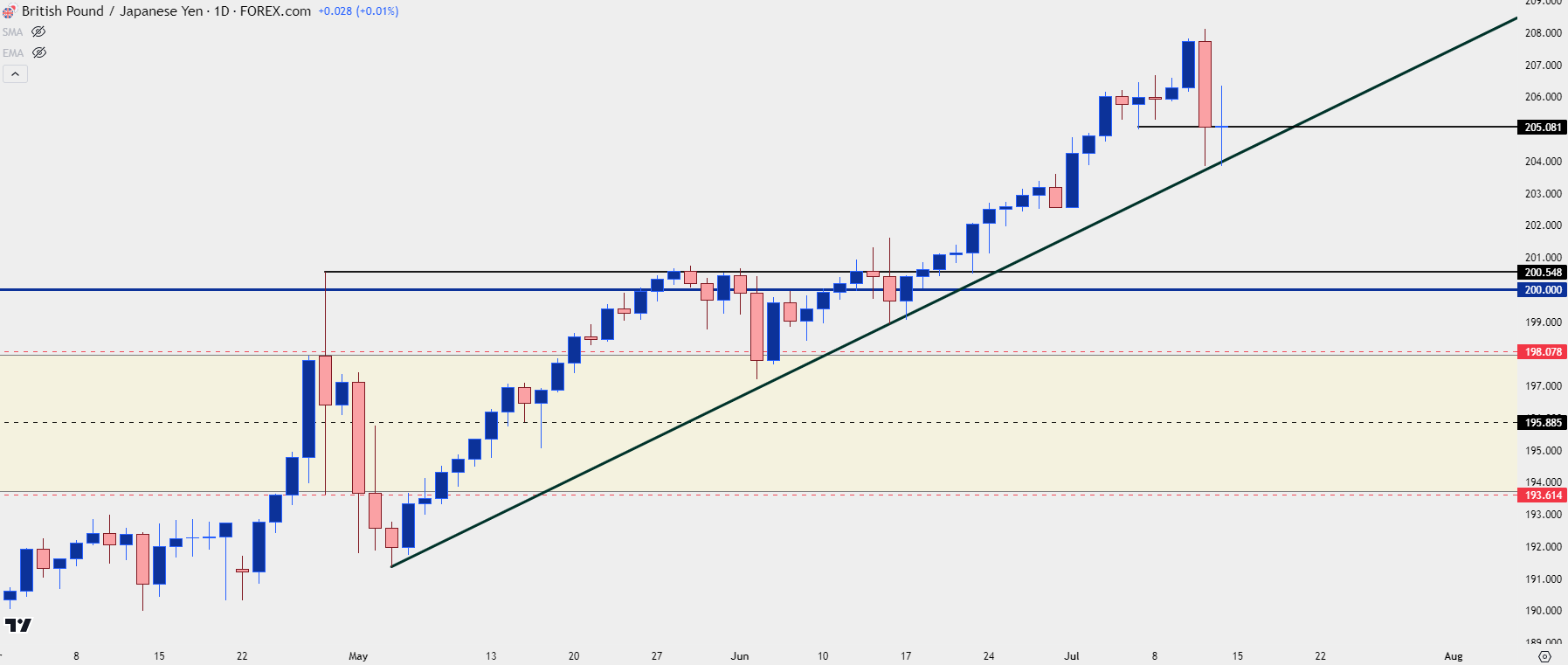

GBP/JPY

While EUR/USD has pushed up to fresh near-term highs, GBP/USD is in the midst of a strong breakout, making a run at the 1.3000 psychological level. There’s also been continued breakdown in EUR/GBP which further indicates greater Sterling strength versus what we’ve seen in the Euro.

GBP/JPY had built an ascending triangle formation when working on the 200.00 psychological level, but since the breakout in the second-half of June, it was all green candles on the weekly chart until this past week.

Given that prior resistance from 200 to 200.55, there’s a logical place to look for higher-low support if the pullback does extend further. At this point, the daily chart is showing an almost perfect doji right at prior support of 205.08, with the lows holding around a trendline projection taken from early-May and mid-June swing lows.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

Chart prepared by James Stanley, GBP/JPY on Tradingview

AUD/JPY

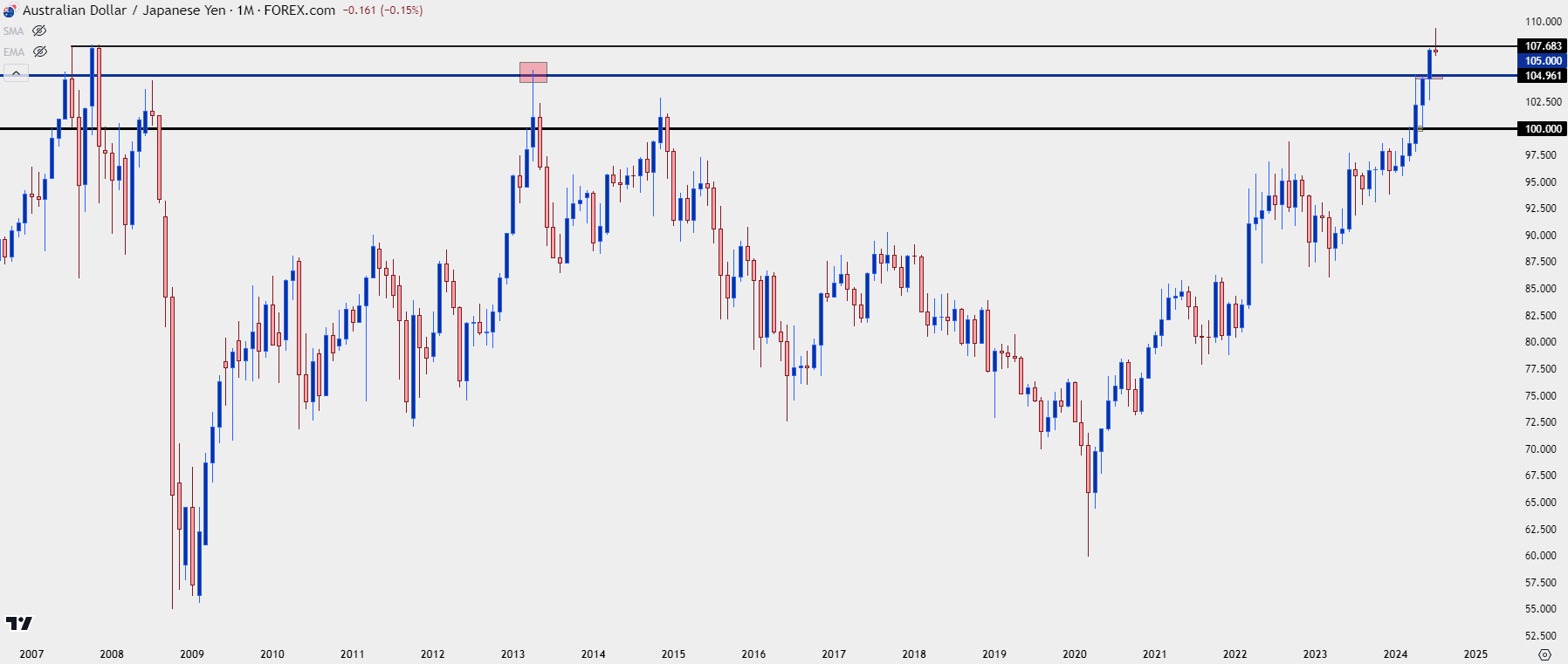

In terms of breakouts in Yen-pairs, I think AUD/JPY had one of the cleaner backdrops when Yen-bears were going to work. I had looked into this ahead of the June breakouts, highlighting an ascending triangle formation in AUD/JPY to go along with some historical price points that remained of interest.

The 105.00 level was a big deal in AUD/JPY as it had only traded briefly in the past 15 years; and when it did trade, it was a hardline of resistance that led to a strong sell-off.

Above that was another major level at 107.86, which was the swing high from back in 2007, and this is ultimately what finally helped to quell the trend after it came into play earlier last week.

AUD/JPY Monthly Price Chart

Chart prepared by James Stanley, AUD/JPY on Tradingview

Chart prepared by James Stanley, AUD/JPY on Tradingview

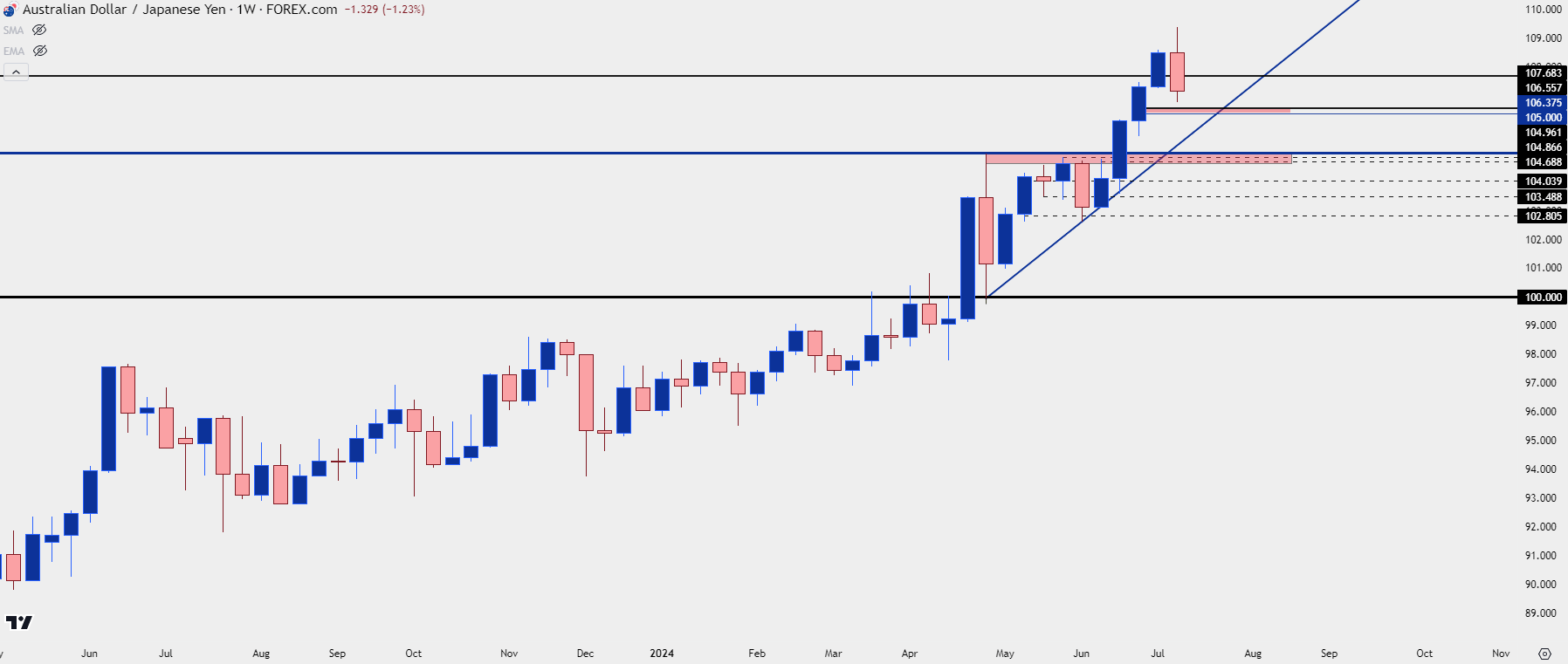

Shorter-term there’s been a minimum of pullback in that move since the breakout hit last month, and last week is showing as the first red weekly bar since the first full weekly candle from June. The weekly candle is currently showing as an outside bearish bar, which keeps the door open for deeper pullback potential.

AUD/JPY Weekly Price Chart

Chart prepared by James Stanley, AUD/JPY on Tradingview

Chart prepared by James Stanley, AUD/JPY on Tradingview

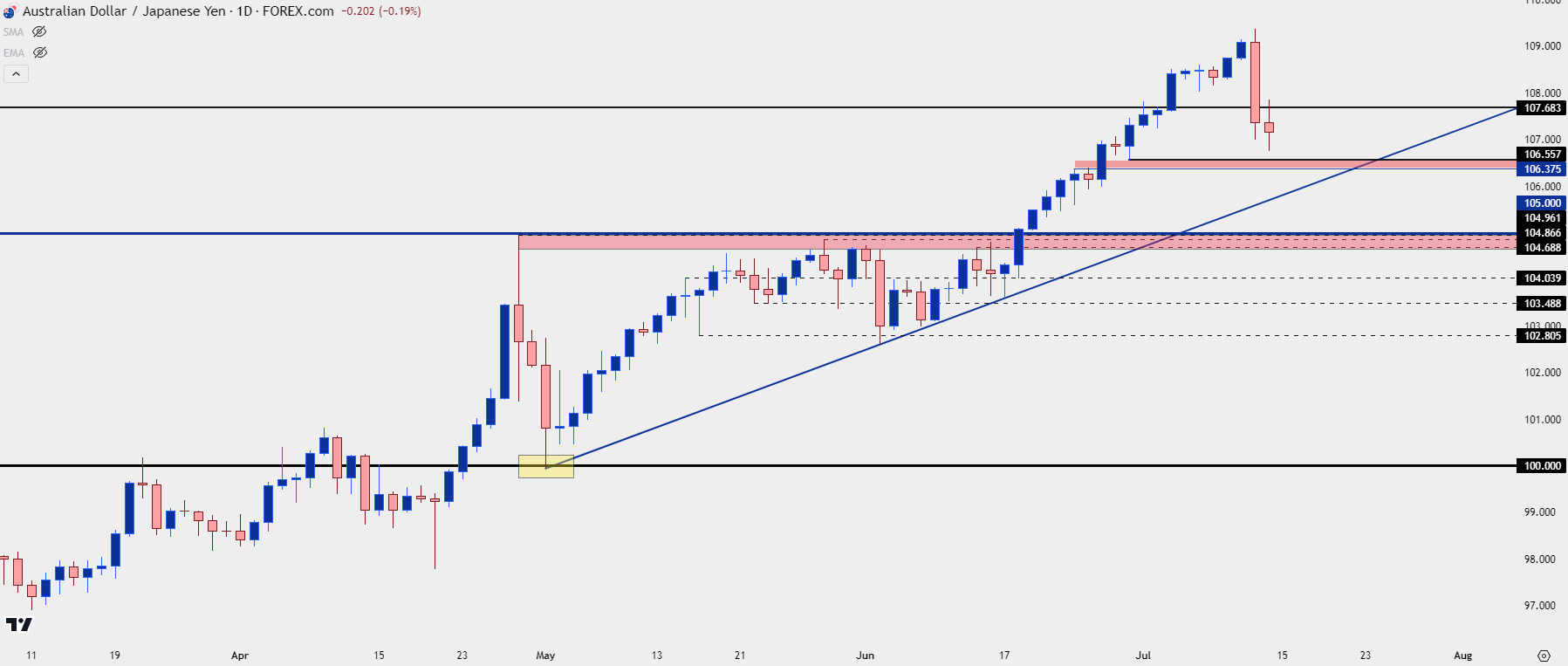

From the daily chart there’s a few different spots to look for support potential. Naturally, the 105.00 level sticks out as this was a key price in the longer-term backdrop of AUD/JPY, not to mention the resistance in the triangle before last month’s breakout. But there are other spots of interest, as well, such as the zone from 106.38-106.56, or the bullish trendline from the triangle that plots for next week around the 106.00 handle.

As for Yen-weakness strategies, given the breakout in AUD/USD this would have a similar attractiveness as the GBP/JPY setup above, whereas EUR/USD remains in a range and is nearing several resistance zones in the major pair.

AUD/JPY Daily Price Chart

Chart prepared by James Stanley, AUD/JPY on Tradingview

Chart prepared by James Stanley, AUD/JPY on Tradingview

--- written by James Stanley, Senior Strategist