Japanese Yen Talking Points:

- USD/JPY is working on its sixth consecutive daily loss and has now erased all gains from June.

- The US Dollar has been similarly slammed down with a fresh yearly low in DXY, and the natural question now, in both markets but of particular importance for the matter on USD/JPY, is where support may eventually show.

- This article includes an archived webinar from today. You’re welcome to join these in the future as they’re hosted every Tuesday at 1PM ET. Click here to register.

The crowded traded has just become a bit less so.

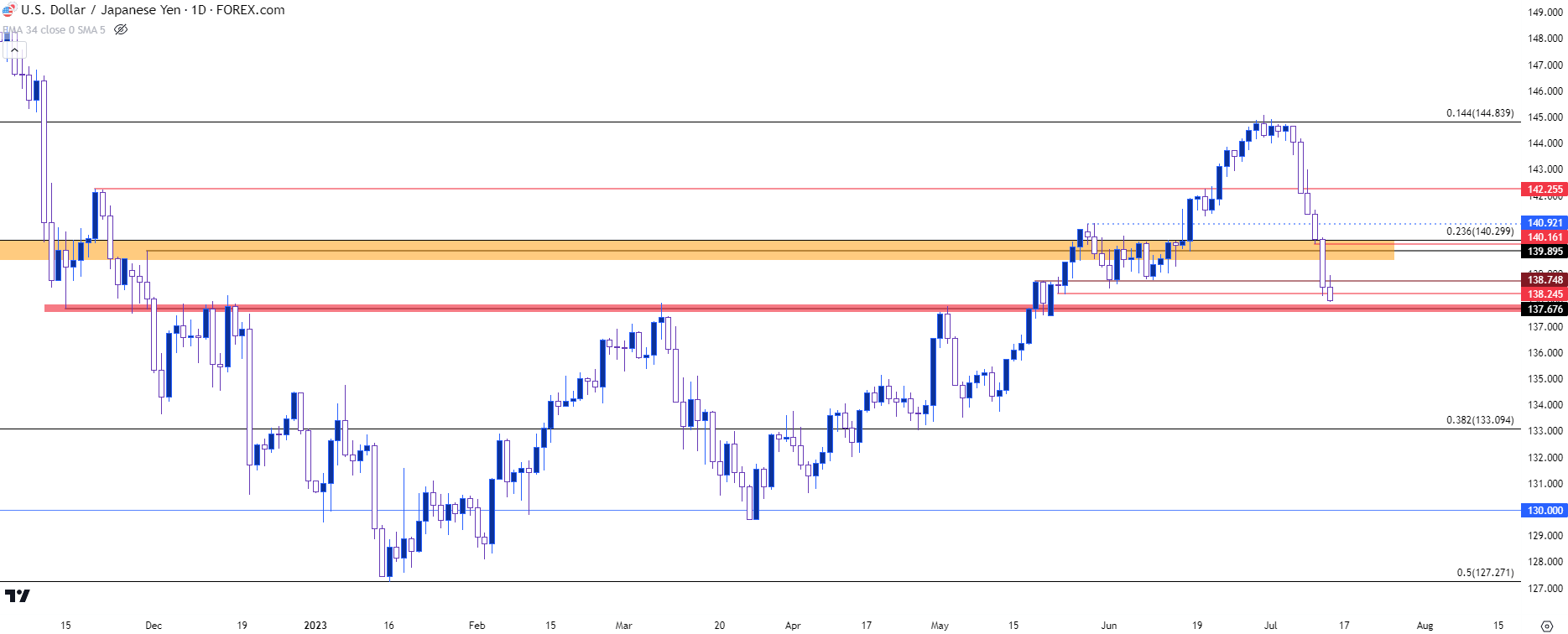

USD/JPY was testing the 145 level as we came into Q3 and that held for a few days, with bulls holding higher-low supports until a series of lower-highs started to show.

That led into a snap back move with USD/JPY pushing down to the 140 handle, and then yesterday’s CPI data out of the United States pushed the USD over the ledge of support, leading to further breakdown and pulling USD/JPY along with it. A day later and that bearish USD theme is continuing to push, and USD/JPY has continued to drive below a number of supports at 138.75 or 138.25.

There’s another major level nearing, and it has a bit of historical reference as this was a swing-low late last year that came in as resistance on three separate occasions after. Most recently, this level held the highs in early-May, as USD/JPY was pushing for a bullish breakout after the first rate decision at the BoJ with newly-installed Governor Kazuo Ueda.

This plots at 137.68, and it’s been pertinent a few times already this year; perhaps this can be the level that begins to stall this recent bearish breakdown.

If that doesn’t hold? There’s not much for nearby support until we get around the 135 handle. And the carry on the pair is still tilted to the long side, so if bulls can substantiate a bit of support, there could be motive for shorts to cover along with the possibility of bullish impetus on the basis of the rate disparity. But, for now this is dropping like a rock and it hasn’t yet shown a willingness to stop.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist