Japanese Yen Talking Points:

- USD/JPY continued a strong bounce through last week’s open but found resistance at a confluent spot on Thursday.

- The sell-off from that resistance was intense and spanned through this week’s open but has since pared back. This sets up possible tests at 150 and 152, both of which could serve as major decision points for the pair.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

Carry unwind was all the rage across the media as sell-offs engulfed US equities in the back-half of July. There were a plethora of explainers and background reporting on the theme that just a month earlier seemed to get little attention. The accusation being that unwind of the USD/JPY carry trade had driven massive sell-offs in U.S. equities, to the point where there were even growing calls for emergency rate cuts from the Fed.

As I had shared then, matters likely weren’t so simple. Sure, there was probably some pull in U.S. equity markets from the initial stages of carry unwind in USD/JPY, but there was also a likely force from rising probabilities of recession. That drove a rally in Treasuries and as investors tried to get in-front of FOMC rate cuts, capital left riskier markets with heavier valuations for the perceived safer harbors of Treasury notes. The 6% rally in TLT two weeks ago speaks to that, which was the largest weekly gain in the ETF since the first week of March 2020, when markets were bracing for the onset of the covid pandemic.

But last week’s U.S. data was fairly positive, helping to pull recession and rate cut odds back. This gave stocks a boost but, notably, USD/JPY continues to struggle.

Deductively – the fact that USD/JPY has pulled back while stocks have remained elevated illustrates that the sell-off wasn’t entirely Yen-driven. But this also doesn’t mean that the USD/JPY pair is yet out of the woods. While we may not be seeing emergency rate cuts from the Fed and perhaps, we may only see a 25 bp cut in September, the fundamental tides for USD/JPY have shifted.

The Fed is unlikely to hike – and the BoJ is unlikely to cut anytime soon. This removes the fundamental impetus on the long side of the pair that had held for more than three years as the carry trade built a very one-sided position in the pair.

I had discussed this in last week’s webinar and the case remains the same today, as pullback to key levels will bring a major decision point for the pair: The 148 level was breached last week but the 38.2% retracement of the sell-off held the highs at 149.43, which was confluent with the underside of the bullish trendline connecting swing lows over the past two years.

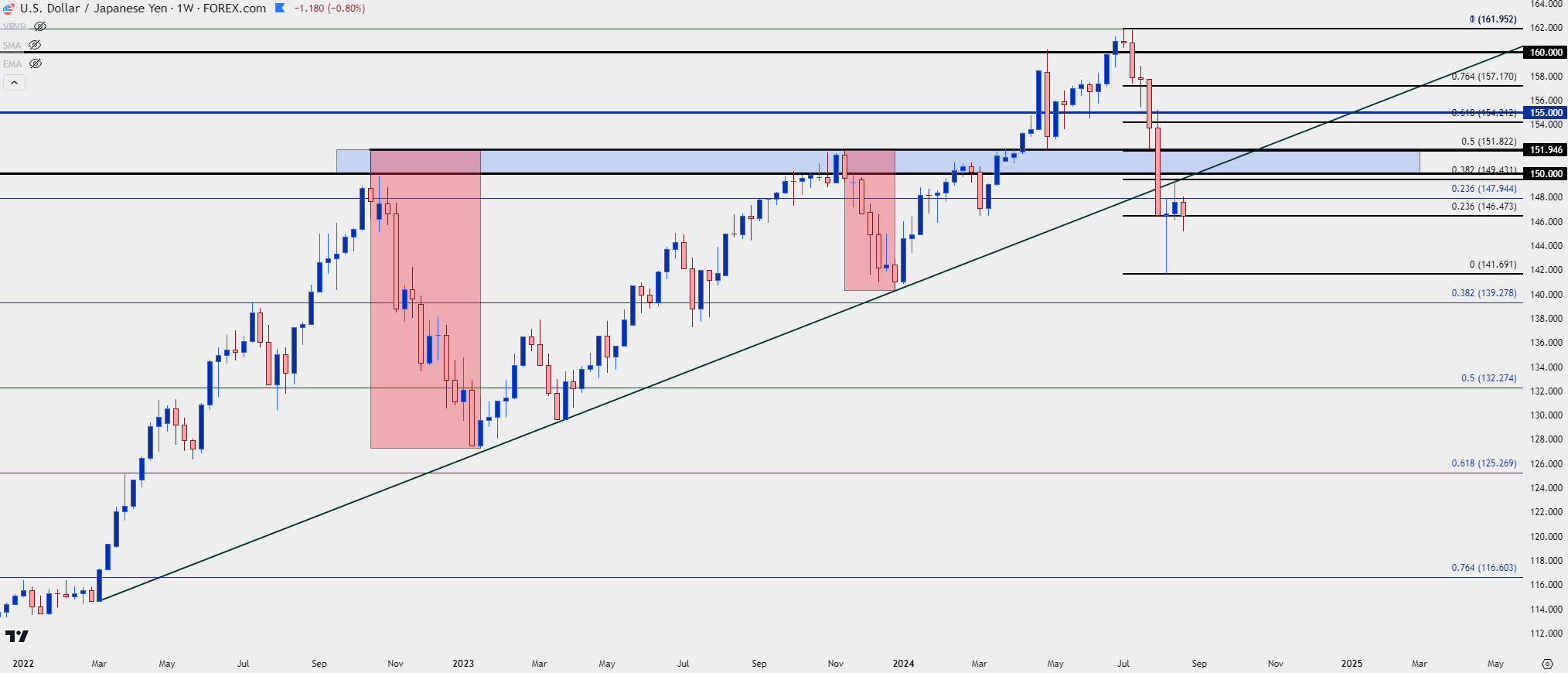

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

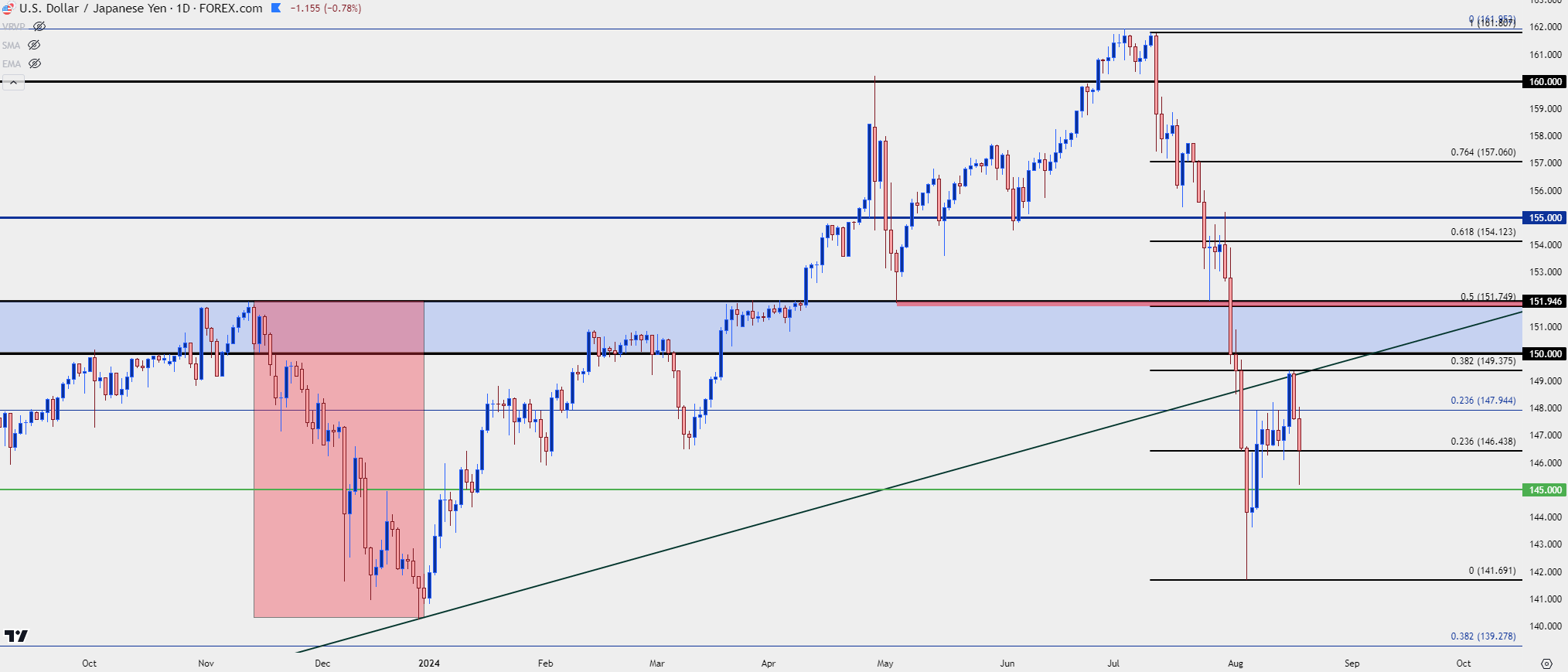

USD/JPY Daily

From the daily chart below, we can see how impactful that resistance inflection was. I’ve also adjusted the shorter-term Fibonacci retracement, using the lower-high as a starting point as it now fits a bit better given last week’s inflection.

Bears took a shot at this week’s open but that selling pressure dried up ahead of a test of the 145 big figure, which now becomes a major point of reference. As of this writing, the pullback has pushed back-above the 23.6% Fibonacci retracement of that same major move.

This sets the stage for lower-high resistance potential at 147.94 and if that doesn’t hold, then 149.38 comes back into the picture followed by the big figure at 150.00.

Above that, 151.95 looms large. This was the price that was defended by the Bank of Japan in Q4 of 2022 before holding resistance in 2023 and in March of 2024. The level was broken-through in April on the back of a strong U.S. CPI print but it then came back as support on two separate occasions, including after the late-April intervention from the Bank of Japan.

This is a major level and if it does come back into play, it represents a key decision point for directional biases in the pair.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

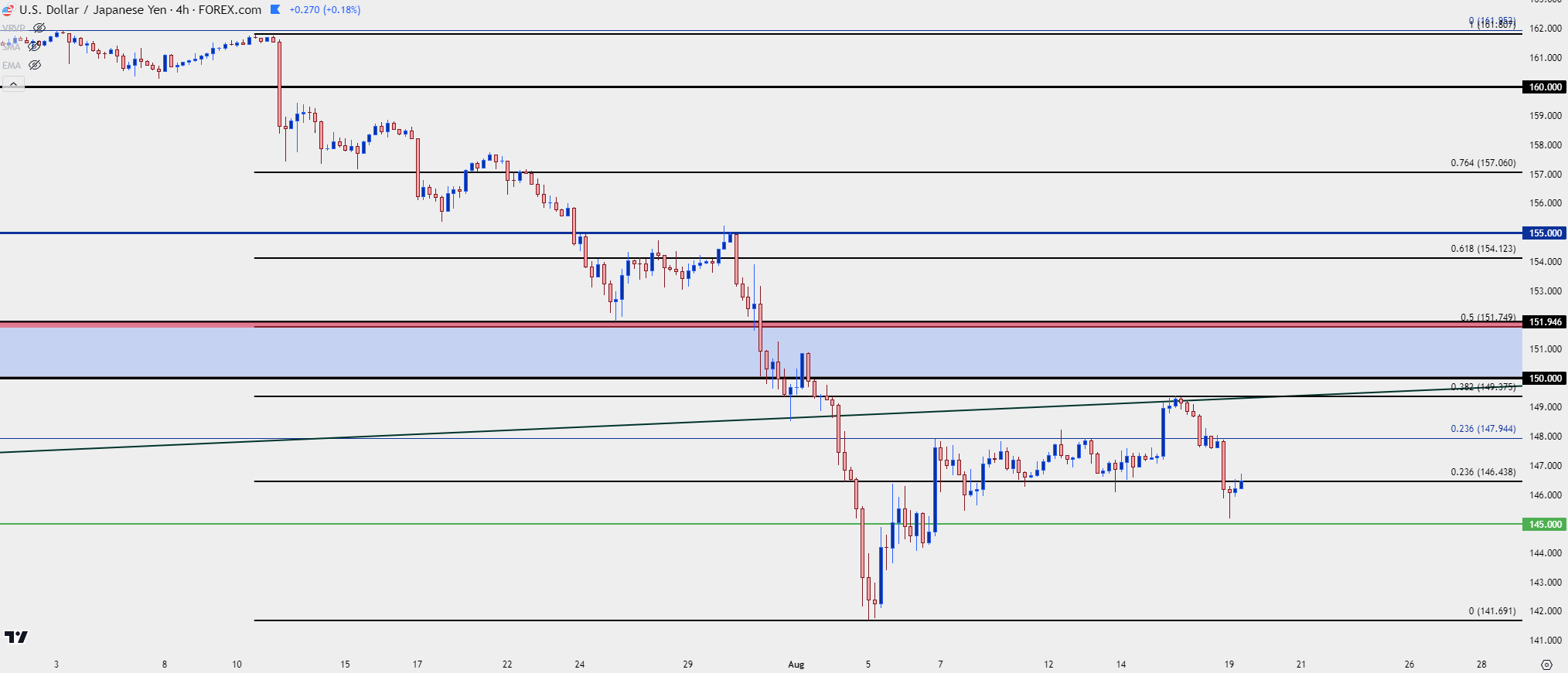

USD/JPY Structure

From the shorter-term chart we can see that bears have opened the door a bit with a push down to a near-term lower-low. And with last week’s swing-high at 149.38, a lower-high inside of that would keep the door open for bearish continuation scenarios. The same resistance that was previously in-play around the 148-handle would be a novel area for a lower-high to show up.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist