USD/JPY, Japanese Yen Talking Points:

- I had looked at the 145 level in yesterday’s webinar, sharing my opinion that the Yen carry unwind theme was still in-force.

- Bigger picture, the motivation for the carry has shifted and as the U.S. gets closer to rate cuts expected to start in September, there’s less and less reason for bulls to hold on to long positions in the pair.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

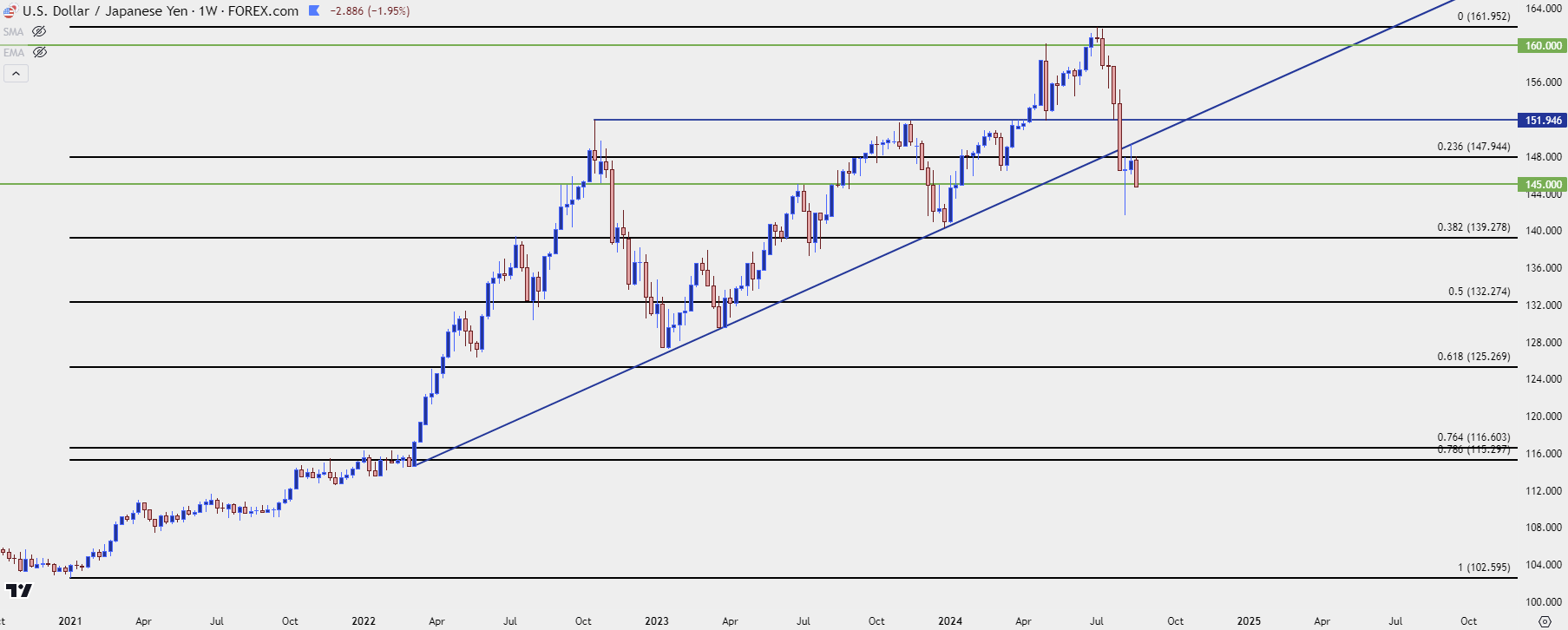

USD/JPY bears have pushed down through the 145.00 level and this is a price that has some historical significance with the recent theme of USD/JPY carry. This was initially a stall point back in 2022 as the Ministry of Finance had started to threaten intervention. It didn’t hold, as bulls eventually went for the breakout and pushed up to the 150.00 handle, with the BoJ ultimately stepping-in to set a high of 151.95.

But, from that high prices pulled back and held 145 until a below-expected CPI report out of the US compelled a case of unwind, driven by the thought that rate differentials between the two economies might narrow. This turned out to be unfounded and three months later, support showed at the 50% retracement of the prior bullish move with buyers loading back-in over the next ten months.

Another pullback showed a year later, in November of 2023 and similarly this was pushed by a below-expected CPI report. But this time, the retracement only ran for 23.6% of the prior trend.

In both cases we saw a glimpse of carry unwind as there was the threat of narrowing rate differentials between the two economies. But, in both, the carry continued as the US wasn’t yet close to cuts and the Bank of Japan wasn’t close to hiking.

That has shifted, however, and as the US begins cutting rates as widely-expected next month, there’s now even less motivation for traders to remain positive on the carry trade in the pair. And we may have more unwind left to yet see.

At this point the pair has retraced a little more than 23.6% of the move that built through the carry, and that retracement level helped to set resistance last week as bears returned on Thursday.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

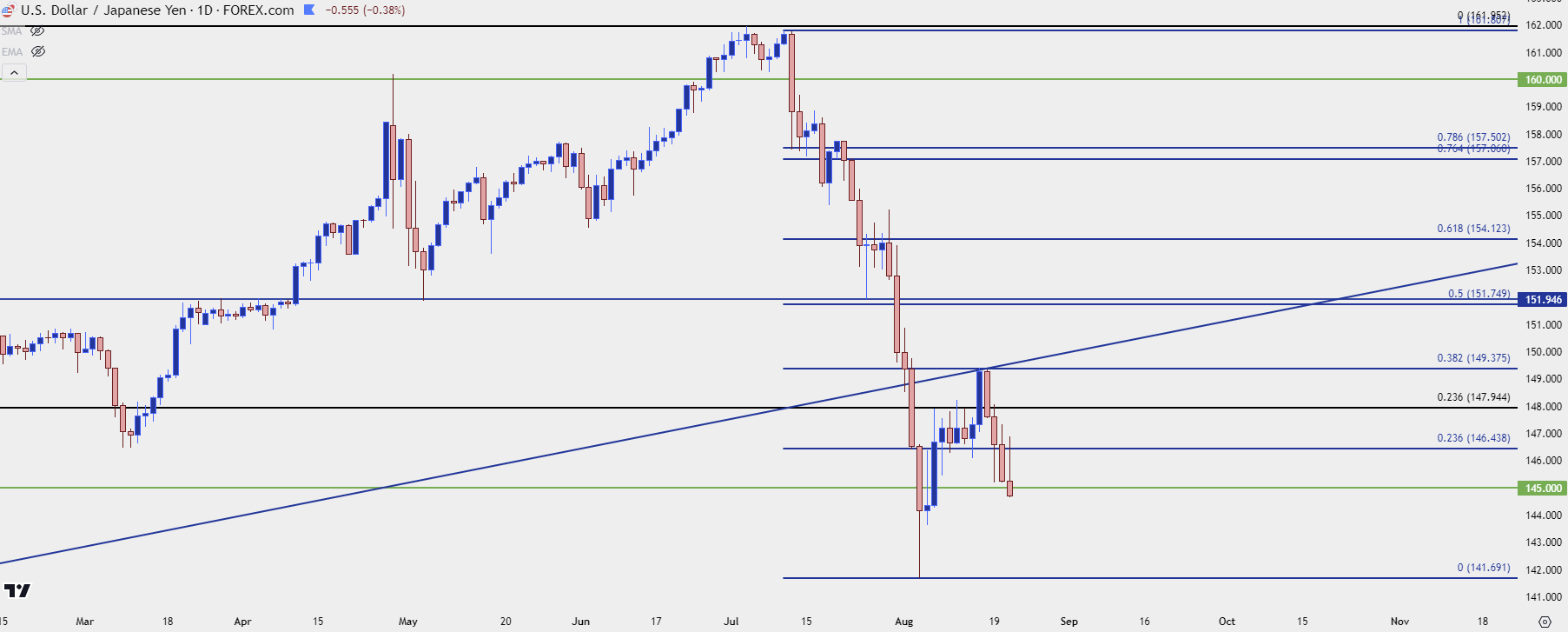

USD/JPY Daily

While headlines were beginning to proclaim that the carry trade had returned following the long-legged doji two weeks ago, which initially saw continuation last week, that’s a difficult argument to muster given the shift in fundamentals.

The bounce from the lows pushed a 38.2% retracement of the sell-off with sellers returning last Thursday. And since that confluent resistance came into play, sellers have continued to push.

As of this writing we have the first re-test below 145.00 since the bounce and this further illustrates the unwind theme that I talked about in yesterday’s webinar.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

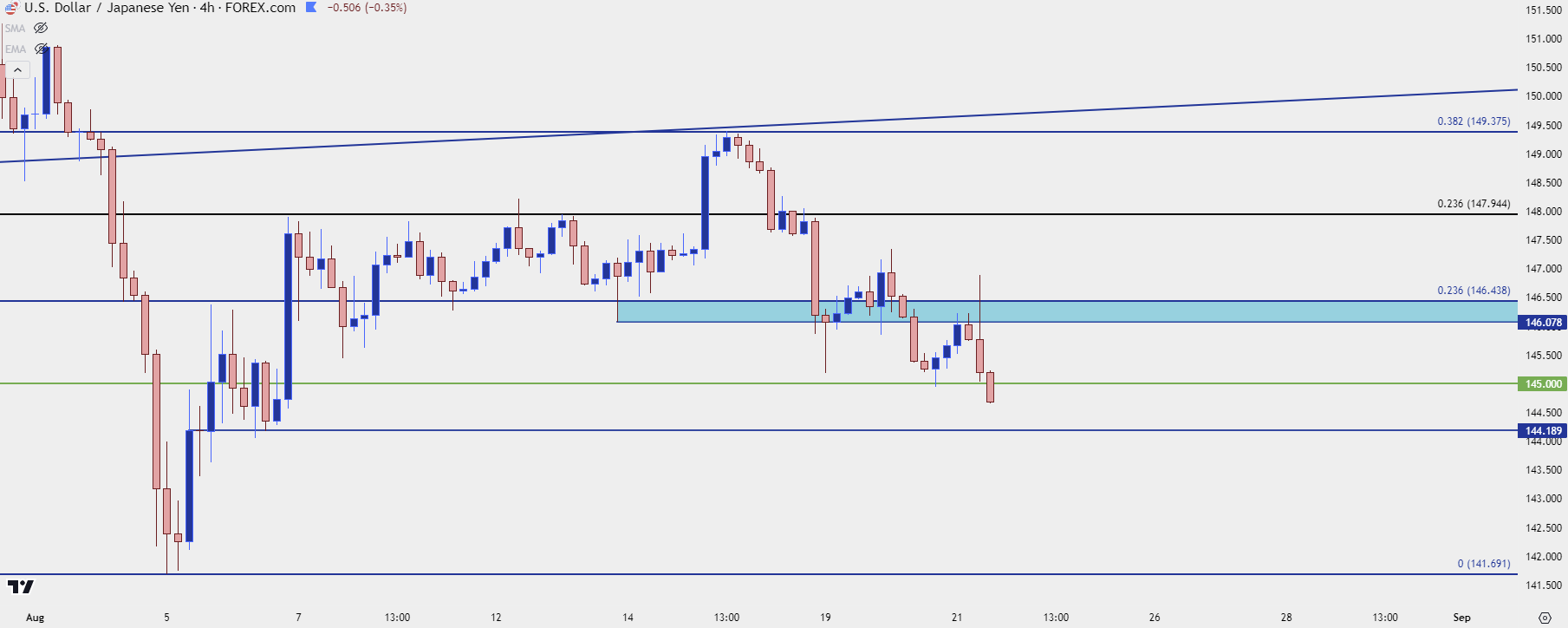

USD/JPY Shorter-Term

Chasing fresh breakouts can prove challenging, particularly from a risk management perspective. At this point, taking the same levels looked at in the above video, and there’s swing potential around 144.19. A show of support here at a fresh lower-low opens the door for a pullback to and a show of lower-high resistance at the same 145.00 level.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist