Japanese Yen Talking Points:

- The Japanese Yen has so far shown strength to start Q2 against all of the US Dollar, the Euro and the British Pound.

- For last quarter, Yen weakness re-appeared against the US Dollar with an assist after the announcement of Kazuo Ueda taking over as BoJ Governor. But that prior theme of Yen-weakness appeared to be repressed to a degree, as falling US rates made the prospect of carry less attractive and this is a fundamental factor that remains in-play for Q2.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

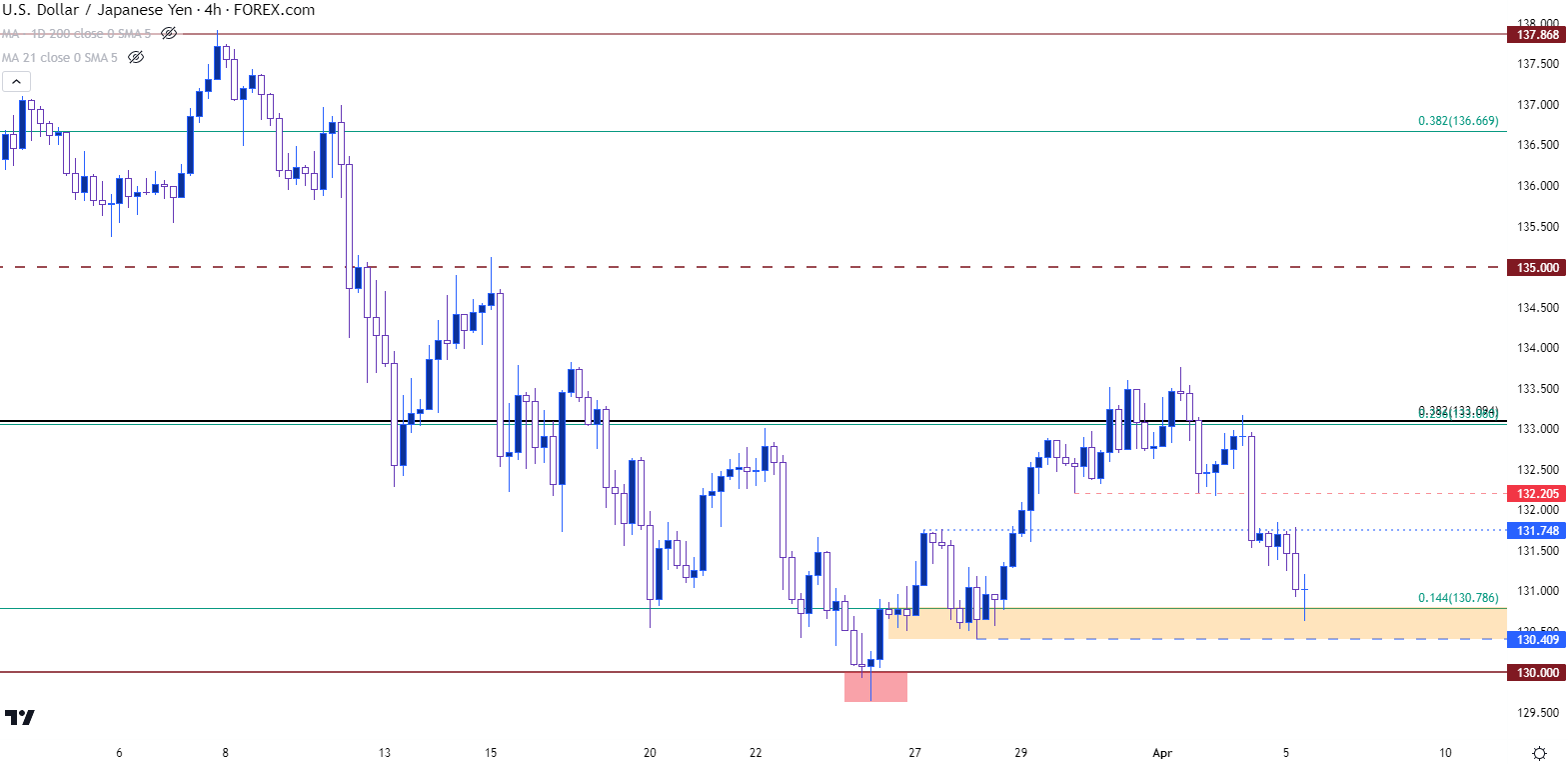

USD/JPY is testing support this morning after a pullback developed in the early portion of this week. To end Q2, I had highlighted a key spot of resistance in USD/JPY at the 133.09 level, and after a bit of struggle that level held as resistance with prices pushing down for a test of support that sits just above the 130 handle.

While the carry trade drove the pair higher for the first nine months of last year, that theme was flipped upside down in Q4 as US rates started to fall. After the first quarter of 2023, that theme very much remains center-stage for global markets.

That move in Treasury rates over the past six months wasn’t prodded by the Fed, however, as the Central Bank continues to talk up the prospect of more rate hikes. But as the horizon grew more opaque last year, capital flows into Treasuries, particularly longer-dated Treasuries, helped to invert the yield curve with longer-term Treasuries yielding less than that of shorter-dated issues.

Yield curve inversion is often tracked as a recessionary signal: Not just from the expectation of lower rates in the future, but for the very act that leads to inversion in the first place. Bond prices and yields are inverse, so yields dropping highlights a push-higher in price, which is of course driven by demand.

And if hedge funds and market participants are willing to buy longer-dated Treasuries – even at a lower rate of return than shorter-dated Treasuries, there’s probably a reason for it. One of the more popular reasons is that those market participants anticipate rate cuts in the future – at some point – which could press yields lower and prices higher. So, while bonds are often invested in for the coupon payments, they could also be invested in or traded in for principal appreciation purposes and this, in essence, becomes a trade based on the expectation of rates.

This is relevant for USD/JPY because as the Fed was lifting rates last year and as the Bank of Japan kept Japanese rates low, the carry trade in USD/JPY was driving prices in the pair higher and higher. That theme lasted for about 21 months, from the 2021 open into mid-October of last year. And then in less than three months, the market had wiped away 50% of that major move even though the Fed kept hiking and remained hawkish.

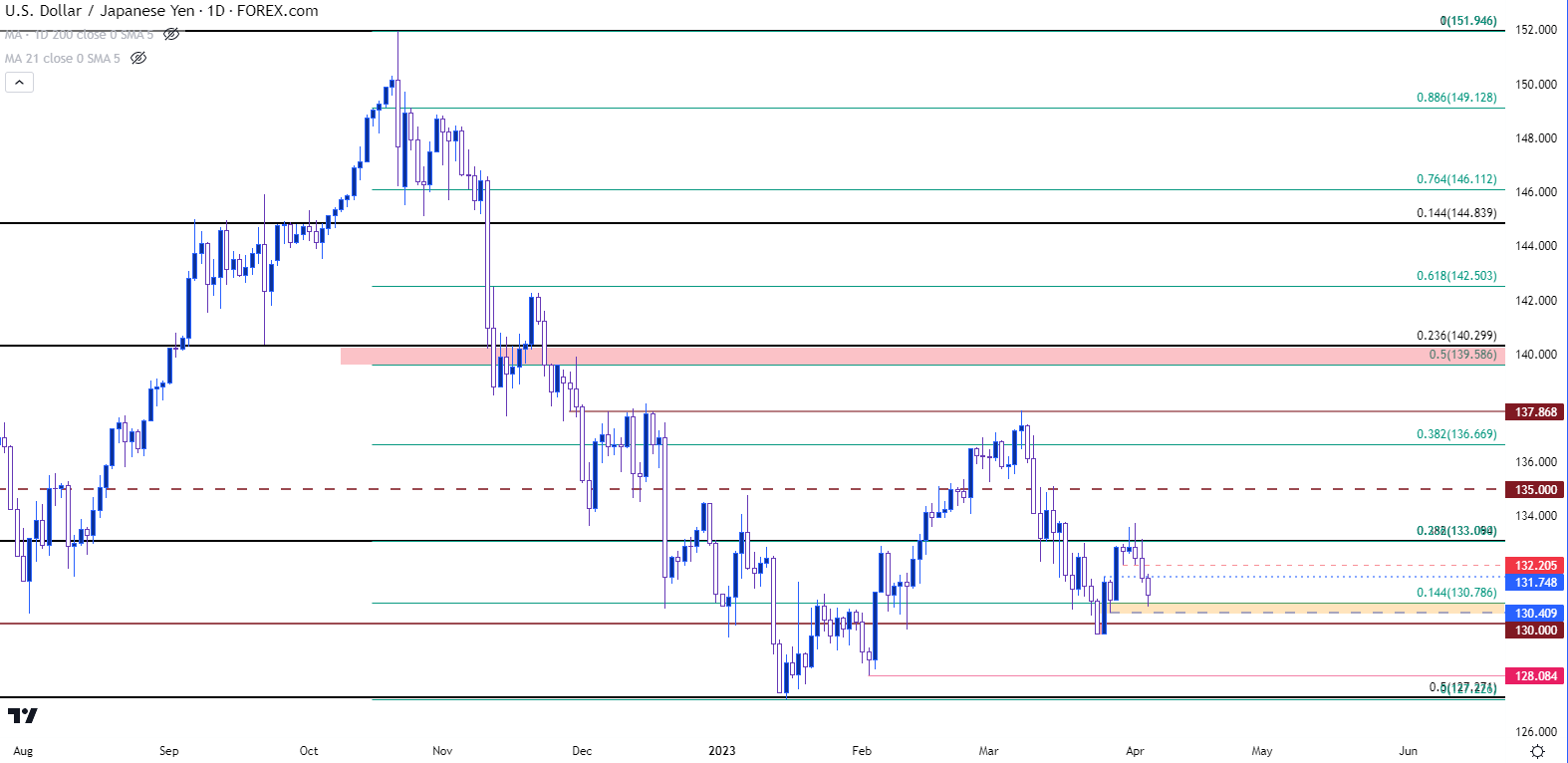

Support eventually showed at the 50% Fibonacci retracement of that major move in January and that remains as a relevant level for USD/JPY price action.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Q1

It was the NFP report that was released in early-February that appeared to bring back themes of USD-strength. This was the report that was rolled out with a massive headline number of +517k against an expectation of +185k. That showed what appeared to be a red-hot labor market, and while expectations were beginning to build for the Fed to slow rate hikes and, perhaps even, start looking at cuts, that data print prodded a quick shot of USD-strength that ran for much of the next five-six weeks, albeit in a somewhat tepid manner.

In USD/JPY, the pair firmed up to test resistance at prior support around the 137.87 level, which helped to hold the Q1 high when it came into play in early-March. After that, another theme came into the picture with weakness in banking, after which sellers went on the prowl, and that ran into a late-quarter test of the 130.00 handle that came into play on the final week of Q1.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Yen Repatriation Themes

When rates markets allow for carry, capital flows can be tilted in that direction for some time, such as we saw with USD/JPY’s 21-month bullish trend. But – when rates start to go the other way and when investors see that door to carry closing, the exit can be fast and dangerous, such as we saw with 50% of that move that took 21 months to build being erased in three short months. This is often referred to as ‘Yen repatriation’ and it can look like the Japanese Yen holds ‘safe-haven’ preference against the US Dollar, although there may be other factors at-play.

The big question now is what might happen that could allow for that bullish trend to return and, if not, what will compel bears to finally take out supports that have built with a series of higher lows over the past three months.

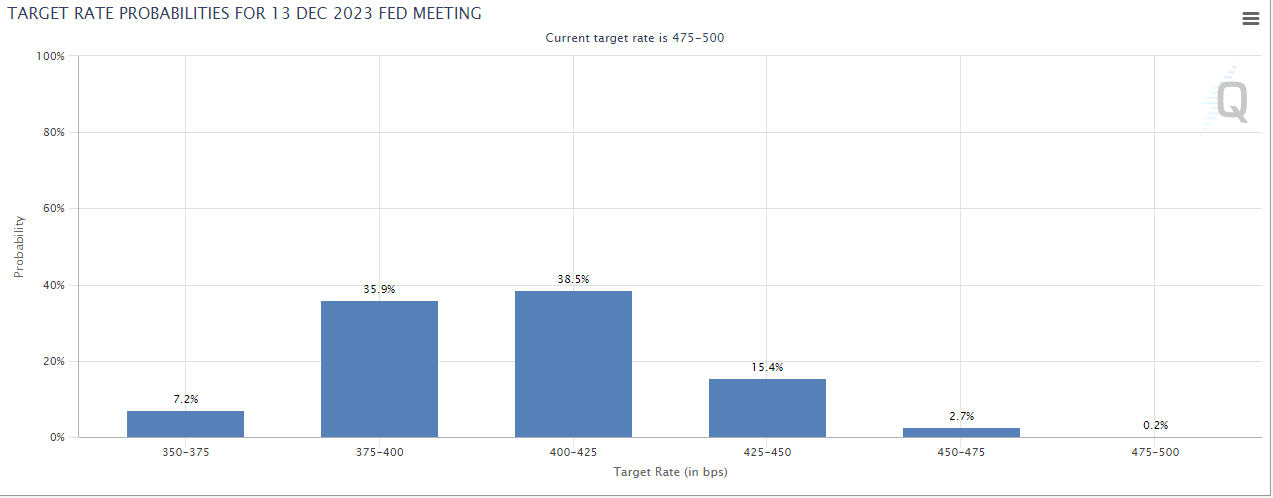

On the return of the bullish trend, it would seem that a couple of things would need to take place. First the Fed would probably need to remain hawkish with at least one more hike expected in May (current probabilities via CME Fedwatch are at 40.8%, as of this writing) – along with pledges towards a plan to keep rates elevated for some time. And then in response, we would probably need to see markets price-in those higher rates – and price out those rate cuts that are currently showing in the second half of the year.

At this point, there is a scant 0.2% probability via CME Fedwatch that rates are at current levels at the end of the year – which also means a 99.8% probability that we see at least one rate cut from current levels.

CME Fedwatch – Target Rate Probabilities for December FOMC

Chart prepared by James Stanley; data derived from CME FedWatch

Chart prepared by James Stanley; data derived from CME FedWatch

This seems like it could be possible as we’ve heard multiple Fed members opine on the topic and, to date, there’s been no significant discussion of rate cuts in 2023, key of which was Jerome Powell’s remark at the last FOMC rate decision in regard to ‘no cuts in 2023.’

That could potentially give some life to the bullish side of the pair, similar to what developed in Q1 and lasted for a couple of months as USD/JPY pushed up to test resistance at 137.87.

The bearish side of the pair would appear to be aligned with larger themes of risk aversion – as falling US rates would indicate continued Treasury buying which would have some relationship with that bearish outlook or perspective. But, additionally, that lower rate backdrop would also likely spell more motivation for carry trades to unwind, as the bullish thesis for USD/JPY would dissipate a bit more with lower rates and less carry to drive bulls into the pair.

From the daily chart in USD/JPY, there are a few notable areas to track for support potential. Right now price is testing a higher-low support zone above the 130 level that held the lows at the end of Q1. That runs from 130.41 up to 130.76. If bears can breach that, the re-test of 130 comes into the picture, after which a swing-low at 128.08 comes into the equation.

The big spot of support is at the 127.27 level – which is the 50% marker of the 2021-2022 major move and also the current nine-month-low in the pair. A breach of that exposes the 125.00 psychological level and a continued break-below the 50% mark of that major move highlights its potential for further unwind.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist

Follow James on Twitter @JStanleyFX