Japanese Yen, USD/JPY Talking Points:

- It was a big week for USD/JPY as the pair broke out to a fresh 34-year high.

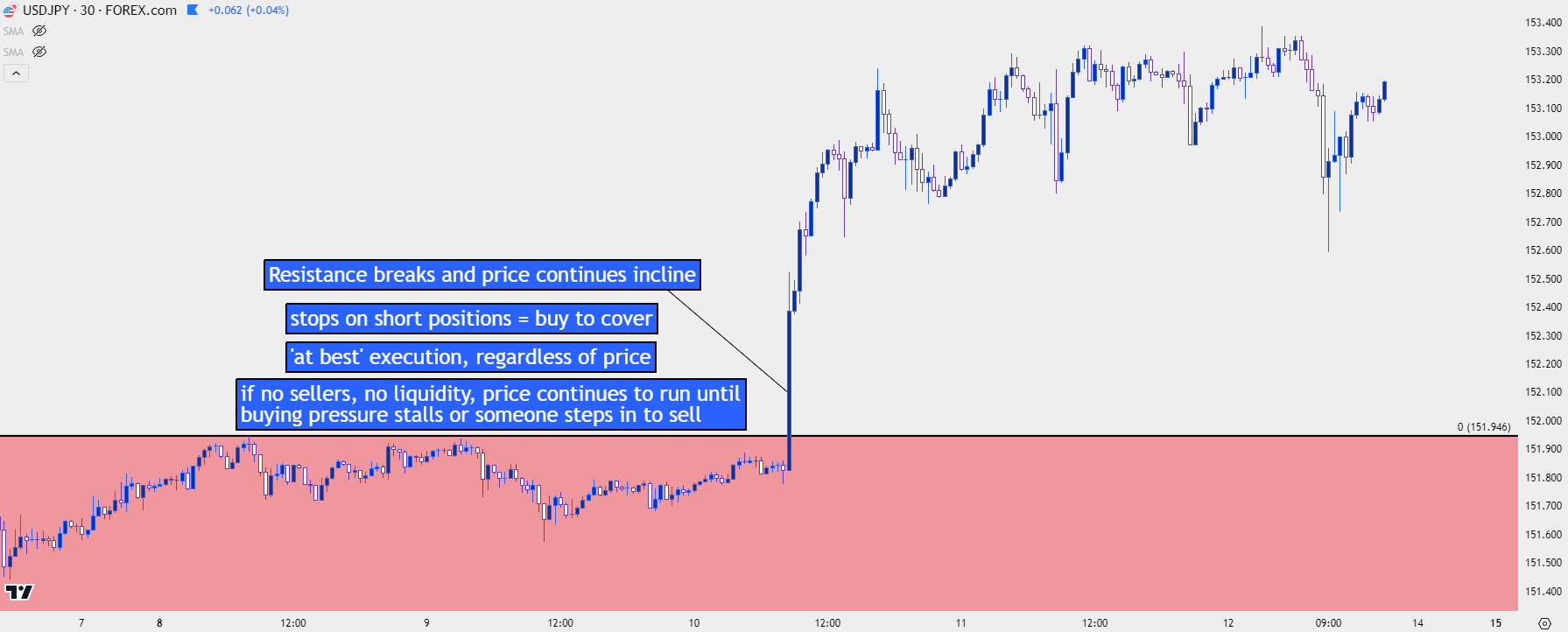

- I had discussed the backdrop behind the pair just after the BoJ rate decision, as an ascending triangle formation held with that contentious level of resistance sitting overhead. As I had shared there, a break of resistance could trigger stops, and stops on short positions with buy-to-cover logic coming in to execute ‘at best’ could mean a sharp topside move.

- The big question now is whether the Finance Ministry orders an intervention or whether they draw the line-in-the-sand a little higher, such as we saw with the 145 and 150 levels in 2022. I talked about this at-length in the U.S. Dollar Price Action Setups article along with a number of other U.S. Dollar pairs.

USD/JPY has broken out to a fresh 34-year high and, so far, there’s been no sign of intervention from the Bank of Japan. As we move into next week, that will likely remain as the big question. And we may be at the stage where threats from the Finance Ministry aren’t enough to back bulls off the bid in USD/JPY. But, even if the BoJ does intervene, the question remains as to whether that can reverse the move.

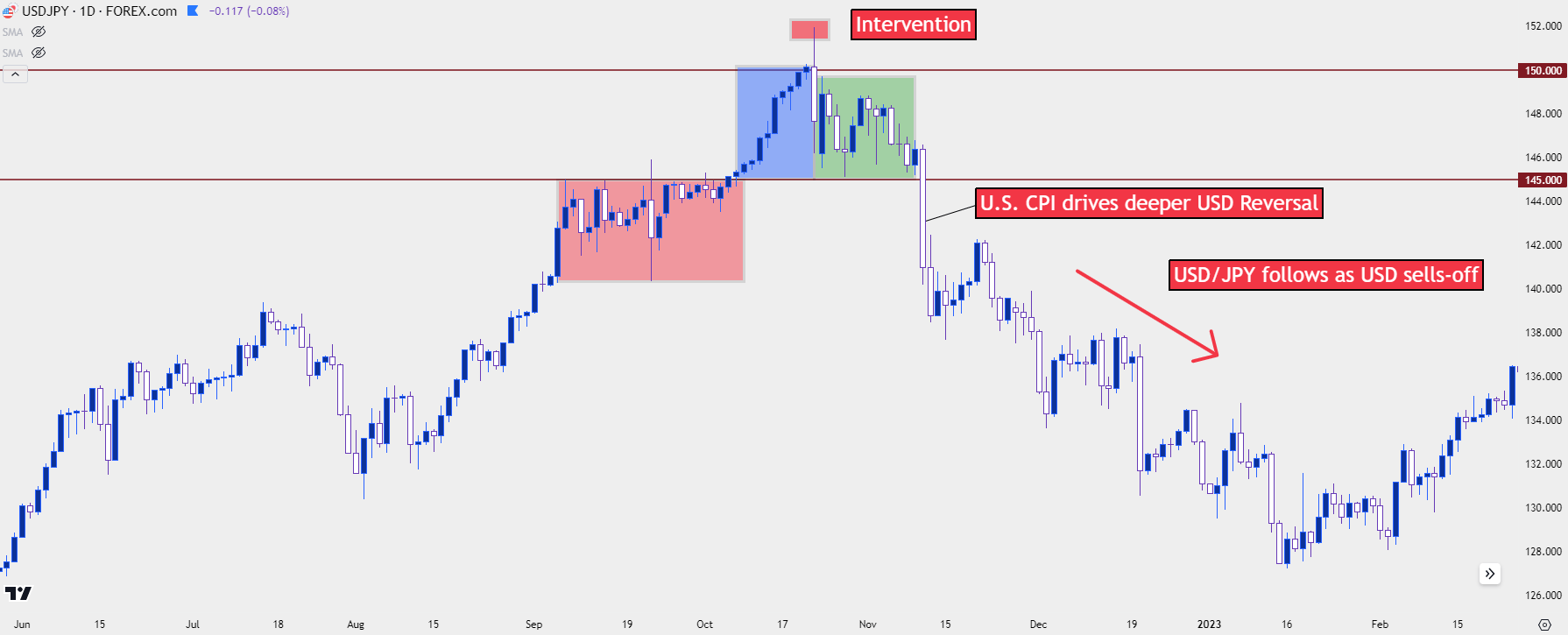

There was a similar episode back in 2022 when USD/JPY was climbing as driven by the carry trade. Once price hit the 145.00 level there were grumblings of intervention and that price ended up stalling the move for about a month in September. But bulls continued to push and in early-October the pair was jumping up to the 150 handle and that’s ultimately where the BoJ stepped in to intervene. That intervention helped to hold the highs and it put buyers on their back foot, but it wasn’t until November that the market actually began to reverse and that was driven by a larger USD-reversal on the back of a softer-than-expected CPI report.

USD/JPY June 2022 – March 2023

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Intervention Dynamics

So, if the BoJ does intervene there remains the question as to whether it would produce a simple pause point or whether that’ll have the ability to drive a larger reversal into the market. As we saw in 2022, intervention merely stalled bulls on put them on their back foot as support held above the same 145.00 level that was previously resistance. And then when a broader bear-USD item appeared, there was context for a larger reversal.

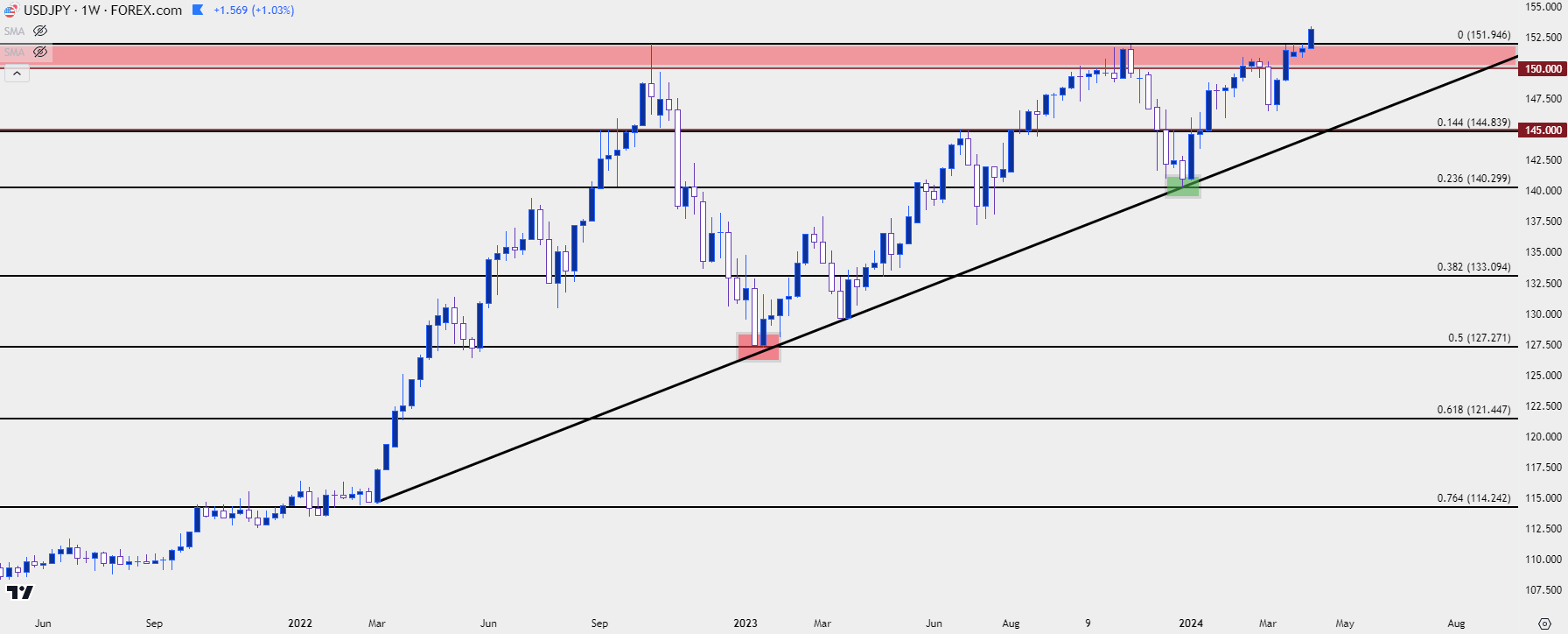

The pullback from the high in 2022 spanned into the 2023 open, and then support played-in from the 50% mark of the 2021-2022 major move in mid-January of last year. Since then, bulls have remained in-control as can be seen from the bullish trendline below. That led to another test of resistance last year, but this time, the BoJ didn’t have to intervene as it was another softer-than-expected CPI report in November, combined with a dovish shift at the Fed that helped to produce a pullback in the move. But, this time the pullback ran for only a little more than 1,000 pips with support showing at the 23.6% Fibonacci retracement of that same move (highlighted in green).

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

The pullback in November of last year helped to further establish that bullish trendline, and so far in 2024 bulls have been back in the driver’s seat. The trendline, when combined with horizontal resistance, produces an ascending triangle formation which is often approached with aim of bullish breakout.

I talked about this in late-March, just after the Bank of Japan rate hike. I had highlighted bullish breakout potential on the basis that buyers continued to remain active and the fact that there were likely some stops sitting above 152.00. And stops on short positions are buy-to-cover logic, and stops often execute ‘at best,’ which means regardless of price level. So, if there’s little liquidity in the market and if there aren’t sellers coming in to offer, well then, that breakout can extend, which is what we saw in late-week trade in USD/JPY after the CPI report on Wednesday.

USD/JPY 30-Minute Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Next Week

If there’s no BoJ intervention, which would be ordered by the Finance Ministry, the next natural level to track would the be the psychological level at 155.00; and if that doesn’t hold, then the 160 level that was last in-play in 1990 would come into view.

If there is an intervention, much like we saw in 2022, that could produce a pullback to support and that can be tracked around the 150.00 level or perhaps even as deep as 145.00. But – whether it can reverse the move will likely draw back to U.S. Dollar dynamics such as we saw in each of the past two years.

--- written by James Stanley, Senior Strategist