USD/JPY Key Points

- Japanese policymakers again warned against the yen’s ongoing depreciation, but USD/JPY traders are not acting concerned.

- Remember that “the boy who cried wolf” ultimately did see a wolf…but no one believed him!

- For USD/JPY, the next test to watch will be at 155.00, and if the MOF/BOJ fail to act if USD/JPY breaches that level, traders may start to turn their eyes up to 160.00 next

Japanese policymakers were, once again, on the wires overnight, bemoaning the ongoing depreciation of the Japanese yen.

In a “cut and paste” reiteration of countless proclamations over the last few months, Japan’s Chief Cabinet Secretary Yoshimasa Hayashi noted that “rapid FX moves are undesirable” and that it’s “important for currencies to move in a stable manner, reflecting fundamentals.” Separately, South Korea’s Finance Ministry issued a join statement saying that the country and Japan “share concerns about recent depreciation of [their] currencies” and that “they can deploy measures to stabilize any excessive FX volatility.”

At this point, markets are treating Japanese policymakers like the proverbial “boy who cried wolf” and mostly ignoring their ongoing warnings…but wise traders will remember that in the fable, a wolf did eventually come and eat all the villagers.

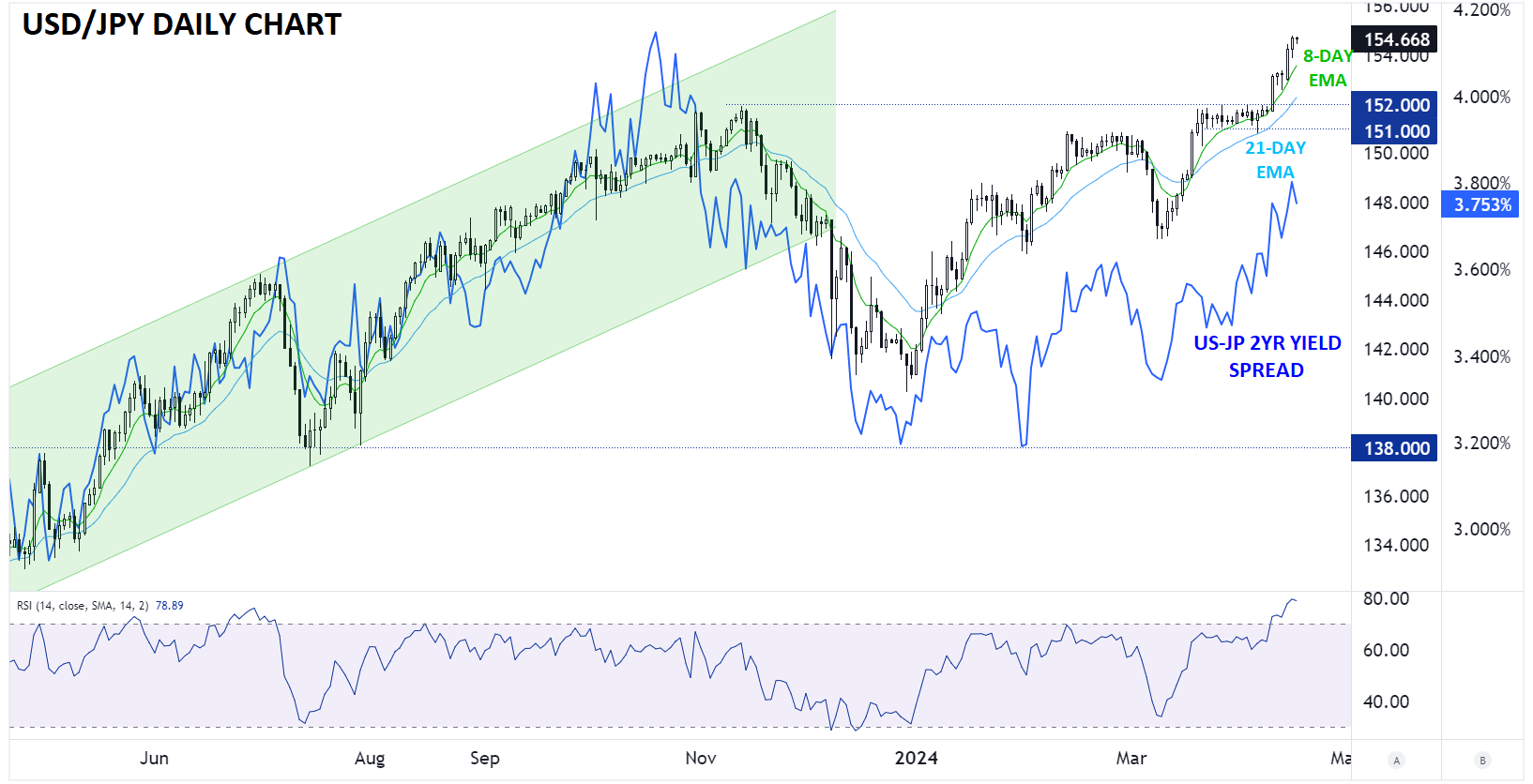

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

Tying that possibility back to the FX market, it’s entirely possible that the Bank of Japan and Ministry of Finance will ultimately intervene to support the yen (push USD/JPY lower). As the chart below shows, the US-JP 2yr yield differential is notably smaller than it was when USD/JPY peaked at 152.00 in Q4 of last year, suggesting that USD/JPY’s surge may have outrun a key driver of fundamental value this year.

With USD/JPY at its highest level in 95%+ of FX traders’ careers, there’s little in the way of relevant technical resistance levels, so traders are keying in psychologically-significant “round numbers.” Therefore, the next test to watch will be at 155.00, and if the MOF/BOJ fail to act if USD/JPY breaches that level, traders may start to turn their eyes up to 160.00 next. Meanwhile, traders may view any short-term dips on outright BOJ intervention as “lower risk” buying opportunities until USD/JPY’s streak of higher highs and higher lows breaks.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX