There have been high hopes that Ueda will bring a hawkish twist to the BOJ, but early remarks in his confirmation speech say anything but. He has echoed similar comments from other BOJ officials in recent days, stating that the BOJ’s current monetary easing is appropriate, it takes time for the impact of monetary policy to be felt in the economy and that economic uncertainties are high.

Ueda blames cost-push inflation for rising prices – driven by higher raw materials and wages – and added that the BOJ respond to demand-driven inflation. He also expected inflation to fall below 2% by the middle of the next fiscal year. And let’s hope he is right, as I see no obvious signs of peak inflation looking at today’s figures.

Japan’s inflation continues to rise, with core CPI rising to 4.2% to notch up its 10th consecutive month above the BOJ’s 2% target. Let’s be honest, there’s no immediate sign of any ‘peak’ in sight, and were it any other central bank they’d have hiked 5 or more times already. But this is no other central bank.

I had expected USD/JPY to rally (and the yen broadly weaken) if or when Ueda confirmed that the BOJ’s ultra-loose policies were to remain in place. Yet we saw the opposite, with USD/JPY falling -0.6% from its daily high and finding support at 134. But we’re likely seeing market reactions from pre-emptive bets closed out, so perhaps we can look past the noise and see if USD/JPY can rally later in the session (or when traders across Europe or the US react).

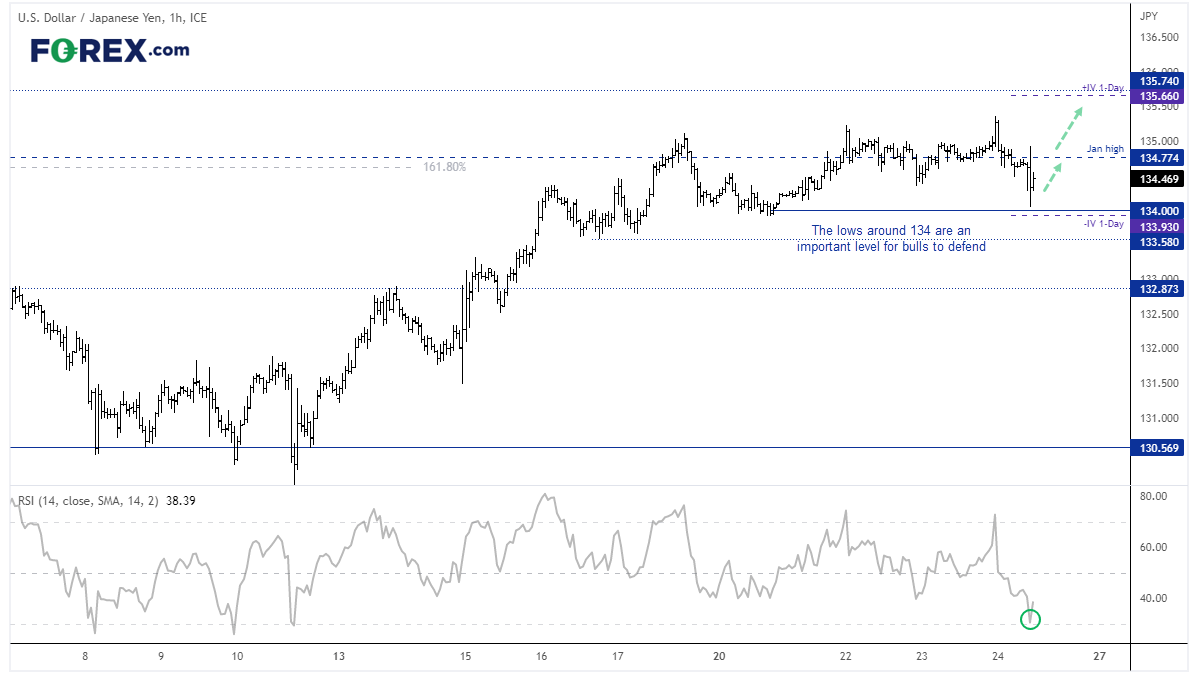

USD/JPY 1-hour chart:

The current daily low stopped just shy of the 143 handle, and the lower band of the overnight implied volatility levels at the start of the session. Assuming Ueda continues to tow the party line of ultra-loose policy, bulls may want to consider dips above 134 for an anticipated break back above the Jan high and 135 handle. And with US inflation data very much in focus today, a hot print could potentially see the pair break to new high.