How to automate forex trading on TradingView

Learn how to automate your forex trading strategies using TradingView alerts and Capitalise.ai—an innovative no-code trading automation, analysis and signaling tool.

Learn how to automate your forex trading strategies using TradingView alerts and Capitalise.ai—an innovative no-code trading automation, analysis and signaling tool.

Watch the video guide below or read the guide to learn how to use Capitalise.ai with TradingView through your FOREX.com account.

You can easily automate trades on TradingView by combining the no-code automation capabilities of Capitalise.ai with TradingView alerts to create automatic trading strategies.

Capitalise.ai is a trading analysis and automation tool that enables you to define, test and automatically execute your trading strategy using simple if-then language. Capitalise.ai translates natural language into fully automated trading bots—so you can easily create automated trading strategies based on price action or technical indicators without coding knowledge.

TradingView alerts are immediate notifications that trigger when the market meets your custom criteria. With a Webhook, the TradingView alert can trigger any Capitalise.ai strategy allowing you to effectively put a plan in place, test it, and then sit back as your TradingView strategy executes automatically.

Forex trading involves significant risk of loss and is not suitable for all investors. Past performance is not indicate of future results. Although appealing for a variety of reasons, automated trading systems should not be considered a substitute for carefully executed trading. Technology failures can happen, and as such, these systems do require monitoring. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems and you should understand the risks involved.

1. Log-in to TradingView and Capitalise.ai.

For leveraged FX trading in the US, Capitailise.ai is only available to FOREX.com account holders. You can create a Capitalise.ai account and link to your FOREX.com account.

Learn how to connect your FOREX.com account to TradingView.

Learn how to connect your FOREX.com account to Capitalise.ai.

2. Start by creating a trading strategy in Capitalise.ai.

The Capitalise.ai software allows a trader to use regular English text to define a strategy in simple if-then terms.

For example, you might write “If Webhook triggers, then buy 1,000 USD of JPY/USD.” These trading strategies are extremely customizable: including the timeframe, order size and order type(s). You can include multiple potential triggers for entry and exit points.

3. Create a TradingView alert and connect the Webhook tags.

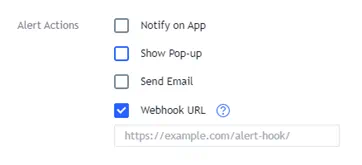

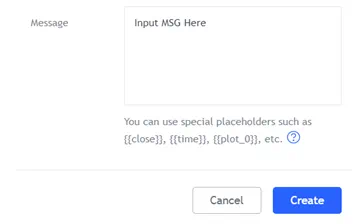

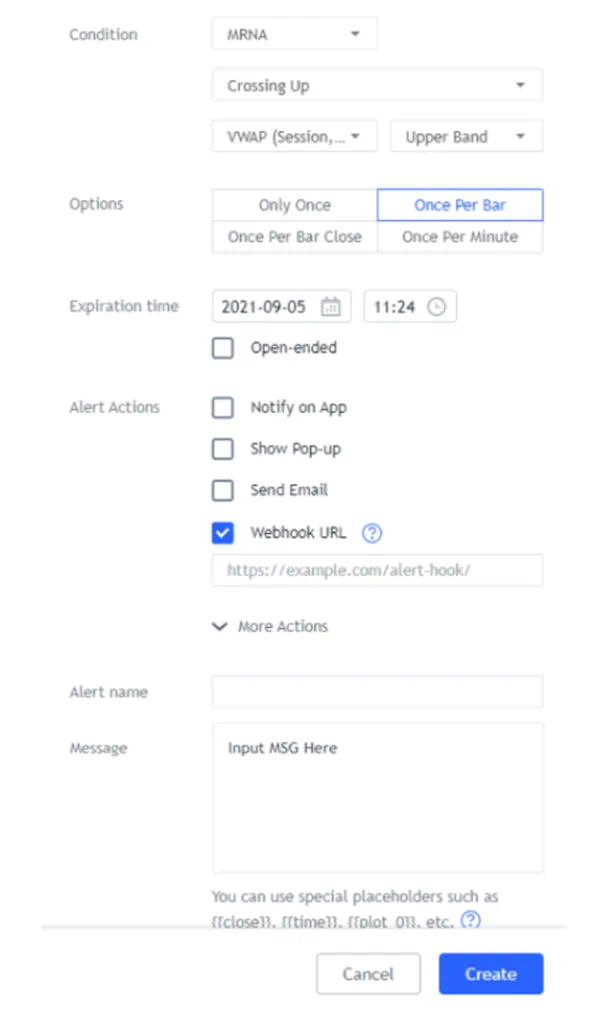

When you first write “Webhook” on Capitalise.ai, a box will appear showing a URL and MSG tags. Copy both into the TradingView alert interface. You can find this option under “Alert Actions” in TradingView.

When creating the alert on TradingView, you’ll also have to select the conditions that trigger the alert. When thinking of a trading strategy, these conditions would be the “if” portion of the ‘if-then’ strategy you previously wrote “Webhook” into in Capitalise.ai.

Be sure to include both the URL tag in the box provided below “Webhook URL” and the message tag in the “Message” box on TradingView.

When finished, click “Create.”

4. Follow the same process to set your exit strategy on Capitalise.ai and as a TradingView alert with separate Webhook URL and MSG tags.

NOTE: While a strategy is in the entry phase, any Webhook msg triggered belonging to the exit will be ignored. The same will happen for entry triggers during the exit phase. Whenever a message is received by Capitalise.ai for a certain Webhook, that Webhook condition will remain triggered until the entire strategy moves to the next phase (from entry to exit and vice versa).

Remember to include any stop loss strategies here as well. With Capitalise.ai automated trading you can enter multiple entry and exit points, meaning there is room to include stop loss and take profit orders within your trading strategy. The exit conditions can be set through either TradingView or directly from the Capitalise.ai platform.

5. Return to Capitalise.ai and set your strategy to loop mode.

This will allow your strategy to keep entering and exiting trades continuously.

6. Verify your strategy on the confirmation page.

Carefully check to ensure your entry and exit alerts are properly set up then save your strategy accordingly.

TradingView is a cloud-based trading platform popular among traders for its integrated market information and compatibility with all major brokers. Used by over 50 million traders around the world, TradingView is compatible with numerous other applications, allowing you to set up automated trading bots with the use of tools like Capitalise.ai.

TradingView alerts are a customer tool you can configure to receive notifications when certain parameters are hit by a market. These alerts function by tracking live charts on TradingView and signaling you or the automated trading software you’re using when your conditions are met. Alerts can be based on any of a chart’s visual elements, price action or indicators.

Capitalise.ai is a text-based trading analysis & automation tool that allows you to backtest, monitor and automatically execute live trading strategies without coding or technical background. Input any trading strategy in plain English, and Capitalise.ai will translate it into a fully automated trading bot.

Learn more about Capitalise.ai.

The backtest functionality offered by Capitalise.ai has inherent limitations that may cause the actual percentage gains/loss experienced by investors to be materially different than the percentage gain/losses presented on the Capitalise.ai backtested results. The price feed which is used to perform back test results is a composite feed provided by Capitalise, which may vary from the tradable price feed relative to your account. The backtested results do not factor in additional trading costs such as commissions. See the full disclaimer for more information about the limitations of relying on hypothetical results.

Although appealing for a variety of reasons, automated trading systems should not be considered a substitute for carefully executed trading. Technology failures can happen, and as such, these systems do require monitoring. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems and you should understand the risks involved.

Exclusive for US-based, retail leveraged spot FX trading.

Third-party software and/or apps are obtained from companies not affiliated with FOREX.com, and are provided for informational purposes only. While the information is deemed reliable, FOREX.com does not guarantee its accuracy or completeness for any purpose, and makes no warranties with respect to the results to be obtained from its use. Neither FOREX.com nor its information providers make any representations about the suitability of the information, software, products, or services. As such, if you elect to use any third party trading software and applications, you do so at your sole discretion and risk. FOREX.com is not responsible for any damages or losses arising from the use of any third party software, apps and services elected for your personal use. FOREX.com makes no representation or warranties of any kind associated to any software and/or app.