Some of the larger economic data prints out of the EU have not been pretty over the last few days, with most of the attention on Germany. Factory orders released yesterday for the month of August were -7.7% vs and expectation of -2.1% and a July reading of 4.9%. Today, Germany released its Industrial Production figures for August at -4% vs -0.4% expected and +1.3% in July.

Also, note that the Eurozone released Retail Sales yesterday for August. Although the 0.3% reading was better than July’s -2.6%, it was lower than the consensus expectation of +0.4%.

With the end of the ECB’s $1.85 trillion Euro Pandemic Emergency Purchase Program (PEPP) scheduled for March 2022, some board members are concerned of a selloff in bonds ahead of that date (less demand equals lower prices). As a result, the ECB is considering a new plan to coincide with its current QE program, in which the central bank purchases $20 billion of bonds a month based on the size of a country’s economy. The new program would allow the ECB to buy from whichever country needs the most support. The weaker data from the EU (albeit only 2 days’ worth of data) adds credence to the discussion of an additional bond purchase program once PEPP expires.

Trade EUR/USD now: Login or open a new account!

What does that mean for the Euro?

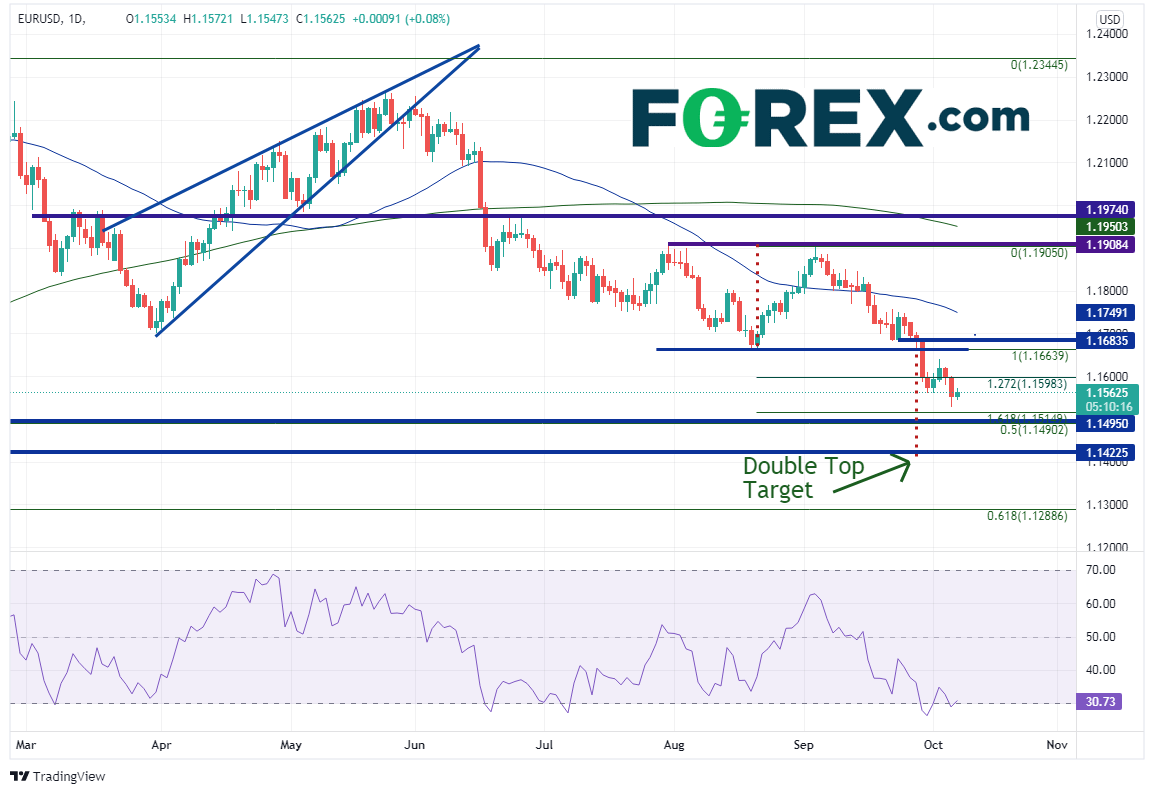

In theory, it should mean a weaker Euro, especially over the long-term. Since the Fed has given notice that they are ready to begin tapering and the ECB still on hold, one would expect a weaker EUR/USD. Thus far, that is what we have seen since September 3rd. On September 29th, the pair broke below support at 1.1683, which formed a confirmed a double top pattern from the highs of 1.1908. The target for the double top is near 1.1410! However, if price is to reach target, it must first pass through a confluence of support at between 1.1490 and 1.1515. There is additional horizontal support near the target at 1.1423.

Source: Tradingview, Stone X

Everything you need to know about bond purchase “tapering”

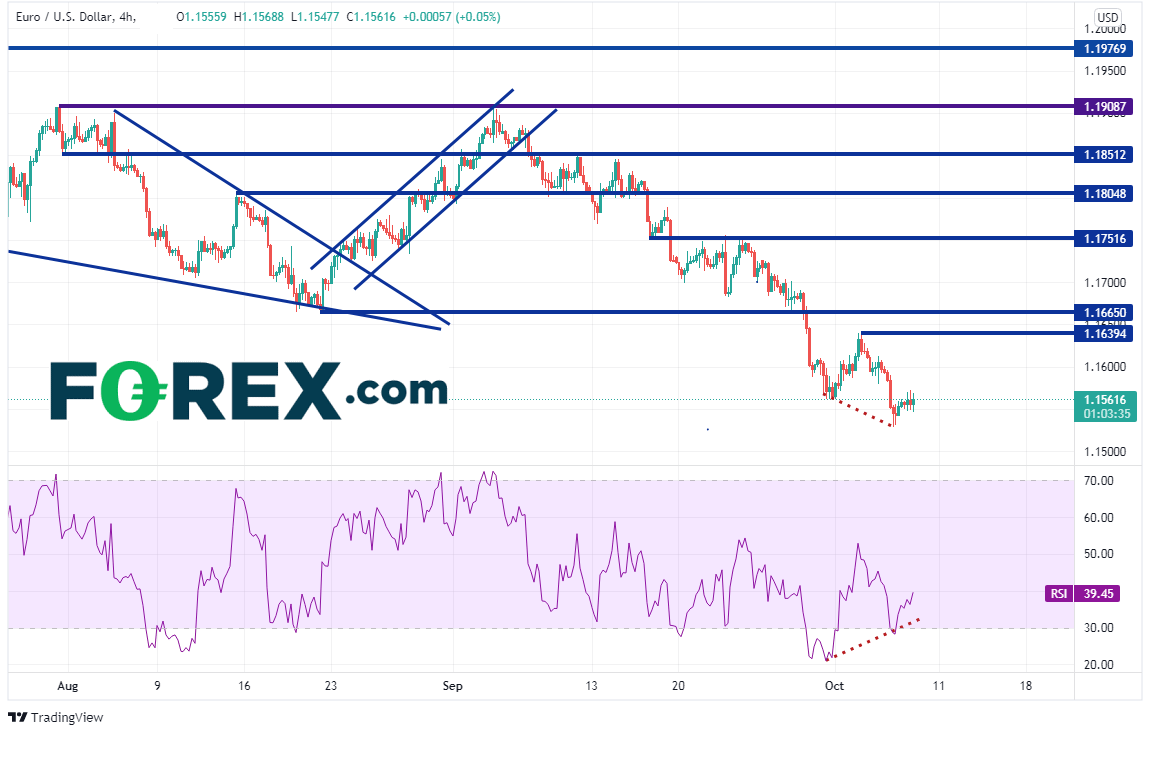

On a shorter-term 240-minute timeframe, the RSI was diverging from price but has already moved back into neutral territory. However, price needs to move higher, possibly above 1.1639 to shake out weak shorts. Horizontal resistance above there is at 1.1752 and 1.1804.

Source: Tradingview, Stone X

If Eurozone data continues to come out weak, the ECB may be forced to compensate for the expiration of the Pandemic Emergency Purchase Program in March 2022 with a new QE program. The US Federal Reserve has already acknowledged that they may begin tapering as soon as the next FOMC meeting. If this is indeed the case, watch for EUR/USD to continue moving lower in the long-term.

Learn more about forex trading opportunities.