Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold snaps back to December monthly open– weekly opening-range breakout pending

- XAU/USD risk for deeper correction- broader outlook remains constructive

- Resistance 2040/50, 2075/80 (key), 2151 – Support 2009/16, 1978, ~1957

Gold prices dare virtually unchanged in December despite a monthly range of more than 8%. While the broader outlook remains constructive, prices have been holding resistance for the past four-days with this week’s opening-range carved just below – looking for the breakout to offer near-term guidance here. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Price Outlook we noted that the, “technical assumption is that this pullback from $2k is corrective in nature. That said, we’re on the lookout for an exhaustion low in the days ahead.” While the immediate threat in gold was weighted to the downside, we highlighted that price was approaching confluent support at, “1933/40- a region defined by the 38.2% retracement of the October rally, the 200-day moving average, and the 1.618% Fibonacci extension of the recent decline. Looking for possible inflection here.” That level held with gold rocketing to a fresh record high into the December-open.

An intraday pop to 2146 saw gold plunge more than 8% in the subsequent days with price rebounding off support last week at the 50% retracement / July high-close at 1978. The focus is on this recovery with gold back at confluent resistance this week at 2040/50- a region defined by the April high-day close, the 38.2% retracement of the monthly range, and the 2022 high-day close (HDC). Looking for possible topside exhaustion / price infection here (note that a daily-close above needed to keep this recent advance viable).

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD trading within the confines of a descending pitchfork formation – while it’s way too early to rely on this slope, it does further highlight resistance into 2040/50 and may offer some guidance IF price does break lower.

Initial support rests with the October swing high / May high-week close at 2009/16 – note that a break below this threshold would be mark an objective weekly opening-range breakout and shift the near-term focus lower again. Subsequent support objectives eyed back at 1978, followed closely by the 200-day moving average (currently ~1957) and a key Fibonacci confluence at 1938/40- both areas of interest for possible downside exhaustion IF reached.

A topside breach here would still need to contend with the 2020 high / 61.8% retracement of December range at 2075/80- a weekly-close above this threshold is needed to fuel the next leg higher in price back towards 2151.

Bottom line: Gold prices have rebounded back to the monthly-open / technical resistance and the immediate focus is on a breakout of the weekly opening-range here for guidance. It’s worth noting that seasonal tendencies historically favor gold into last two weeks of the year.

From a trading standpoint, we’re looking to validate an exhaustion low in the weeks ahead with a close above 2080 ultimately needed to mark uptrend resumption in gold. Stay nimble into the close of the week with key US inflation data on tap Friday. I’ll publish an updated Gold Weekly Technical Forecast once we get further clarity on the longer-term look at the XAU/USD trade levels.

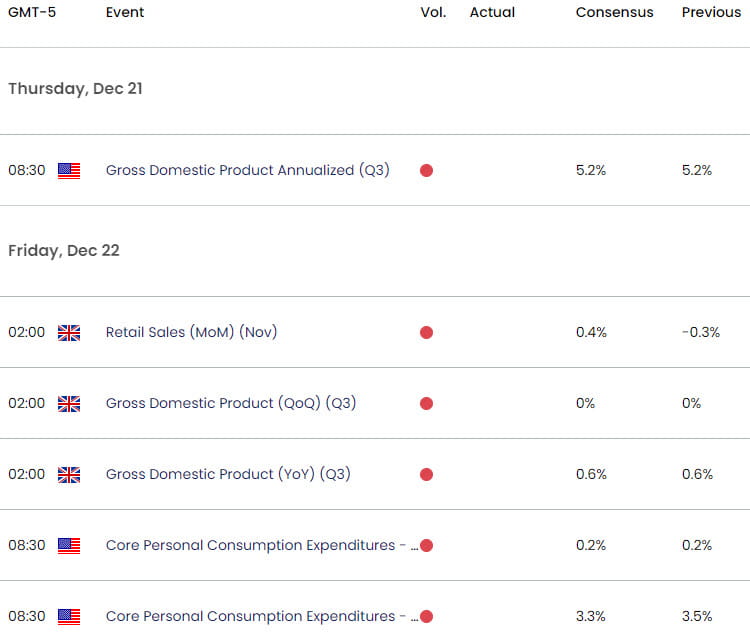

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Bears Straddle Yearly Open

- US Dollar Short-term Technical Outlook: USD Bulls Emerge

- British Pound Short-Term Outlook: GBP/USD Bulls Halted at Resistance

- Oil Short-term Outlook: Crude Fails 80– Bears Charge Support

- Australian Dollar Short-term Outlook: AUD/USD Bulls Eye Resistance

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex