Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold prices continue to consolidate within June 7 trading range- breakout imminent

- XAU/USD weekly/monthly opening-ranges taking shape just below trend resistance- NFP on tap

- Resistance 2339, 2368, 2387 (key) – Support 2277/86 (key), 2228, 2205

Gold prices are virtually unchanged since the start of the week with XAU/USD carving the weekly / monthly opening-ranges just below resistance. We’ve been tracking a consolidation in gold prices for nearly a month now and the stage is set for a larger breakout in the weeks ahead. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical charts heading into July.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Price Outlook we noted that, XAU/USD was carving the monthly opening-range just above a multi-year slope with key support at, “the May low / open at 2277/86- look for a larger reaction there IF reached with a break / close below needed to suggest a larger correction is underway…” Gold briefly registered an intraday high at 2387 before marking a massive outside-day reversal of nearly 3.5% on the heels of a blow-out NFP print. XAU/USD registered an intraday low at 2286 that day before rebounding with price still trading within the confines of this single-day range. The focus into the start of June is on a breakout of 2286-2387 range for guidance.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD continuing to trade within the confines the descending pitchfork formation extending off the April / May highs. Price has been in consolidation for the past few weeks just under slope resistance – now eyed at 2339. A topside breach above this slope would expose the 50% retracement at 2368 and the 61.8% Fibonacci retracement of the May decline / June high at 2387- a daily close above this threshold would be needed to validate a breakout of the April downtrend and fuel a possible run towards the record high-day close (HDC) / April high at 2426/31.

Key support remains at the May low / open at 2277/86- a break / daily close below this region is needed to mark downtrend resumption with such a scenario exposing subsequent support objectives at the April low at 2228 and 2205- a region define by the 38.2% retracement of the October rally and the 100% extension of the May decline. Both these levels are areas of interest for possible downside exhaustion / price inflection- look for a larger reaction there IF reached.

Bottom line: Gold is trading just below slope resistance into the start of the month with the immediate focus on a breakout of the June 7 trading range. From a trading standpoint, while the broader outlook is still constructive, the threat for a deeper correction remains while within this formation. Ultimately, we are on the lookout for evidence of an exhaustion low in the weeks ahead with a breach above 2387 needed to fuel the next leg in price.

Keep in mind we are just setting the monthly / quarterly opening-ranges with US Non-Farm Payrolls (NF) on tap Friday. Stay nimble into the release an watch the weekly closes here for guidance. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term look at the XAU/USD trade levels.

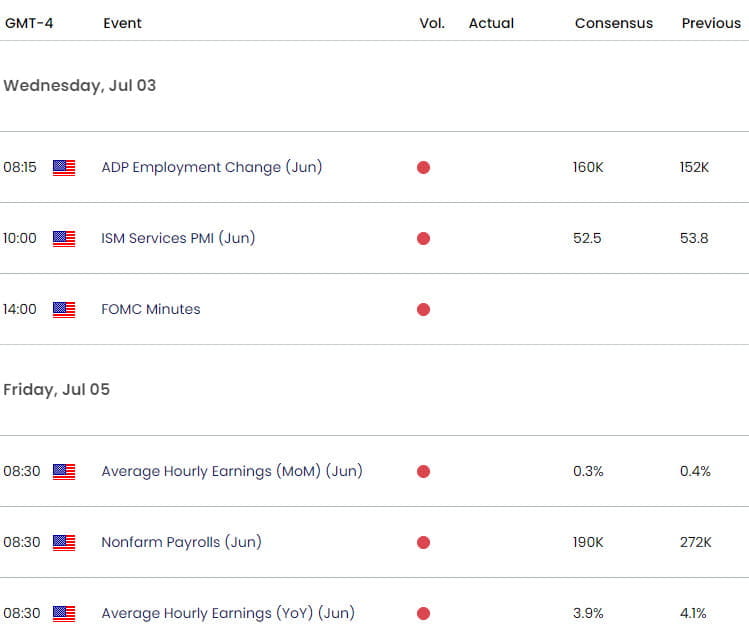

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Keep 2024 Uptrend

- US Dollar Short-term Outlook: USD Rally Reacts to Major Resistance

- British Pound Short-term Outlook: GBP/USD Bulls Vulnerable Post-Fed

- Australian Dollar Short-term Outlook: AUD/USD Fed Battles Lines Drawn

- Euro Short-term Outlook: EUR/USD Bulls Eye the Break- NFP, Fed on Tap

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex