Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold marks V-shaped recovery off downtrend support- rallies 2.42%

- XAU/USD approaching monthly open-resistance- risk for near-term exhaustion

- Resistance 2039, 2048/50, 2075/80 (key) – Support 2013, 2004/06, 1975/78 (key)

Gold is attempting to mark a five-day rally with XAU/USD nearly erasing the entire monthly decline. A rebound off downtrend support is now within striking distance of resistance and the battle lines are drawn heading into the close of February. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Price Outlook we noted that XAU/USD was vulnerable but that we were, “on the lookout for evidence of an exhaustion low in the days ahead with the immediate focus on a breakout of the weekly opening-range. From a trading standpoint, look to reduce short-exposure on stretch towards 1978/87 with a breach / close above 2055 needed to suggest a more significant reversal is underway.” Gold registered a high-close precisely at 2055 on February first before plunging nearly 4% with XAU/USD registering an intraday low at 1984 last week before rebounding off channel support. The recovery marks the first five-day rally since November, right before the surge to record highs.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows a five-day rally now approaching former support / initial resistance into the objective February-open at 2039. More significant resistance is eyed just higher at 2048/50- a region defined by the 61.8% Fibonacci retracement of the late-December sell-off and the 2022 high-day close.

A breach / daily close above this channel is needed to suggest a more significant low was registered last week with such a scenario exposing the December 28 reversal-close at 2065 and key resistance at the 2020 high / 61.8% retracement of the decline off the record high at 2075/80.

Weekly-open support rests at 2013 backed by the record high-week close (HWC) / October high-day close (HDC) ad 2004/06. A close below this threshold (lower parallel) would threaten resumption of the December downtrend towards key support at 1975/78- a region defined by the 50% retracement of the 2023 range, the July high-close and the 100% extension of the decline off the late-December high. Look for a lager reaction there IF reached.

Bottom line: Gold has rallied more than 2.4% off the monthly lows with the advance now approaching initial resistance objectives- risk for possible topside exhaustion in the days ahead. From at trading standpoint, losses should be limited to the 2004 IF price is heading higher on this stretch with a breach / close above 2050 needed to invalidate the December downtrend. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term look at the XAU/USD trade levels.

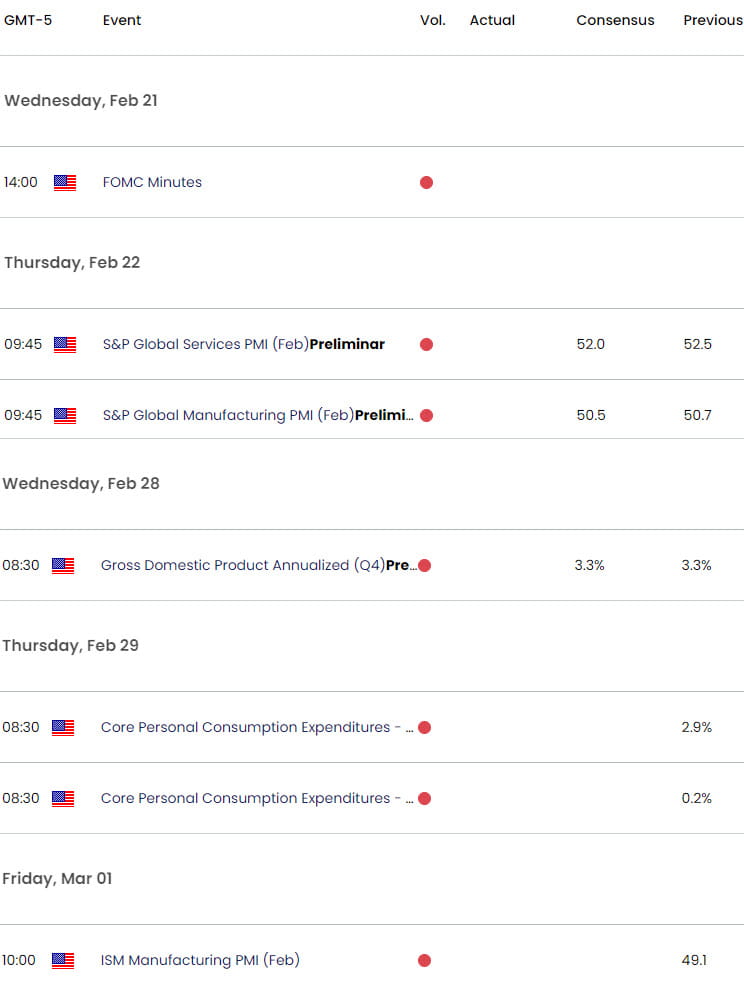

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Bulls Re-Appear

- Canadian Dollar Short-term Outlook: USD/CAD Battle Lines Drawn

- US Dollar Short-term Outlook: USD Bulls Eye Major Resistance

- Euro Short-term Technical Outlook: EUR/USD Plunge Pauses at Support

- British Pound Short-Term Outlook: GBP/USD Slams to Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex