Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold bulls testing uptrend resistance at record highs- risk for price infection early in the month

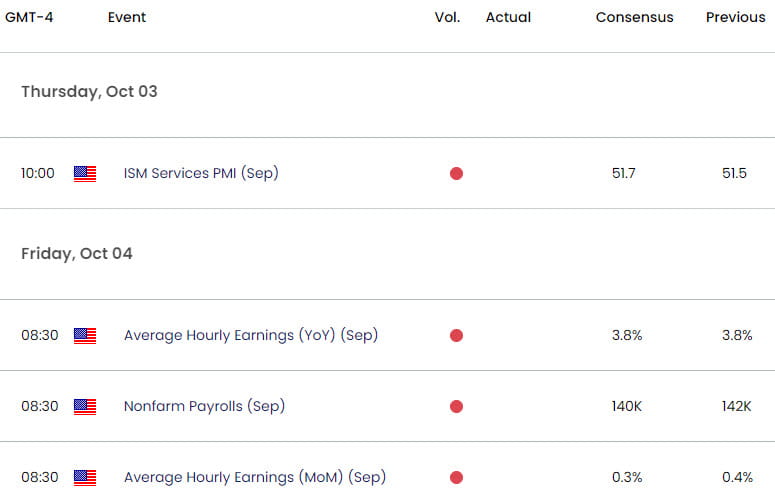

- XAU/USD weekly / monthly opening-range taking shape- US Non-Farm Payrolls on tap

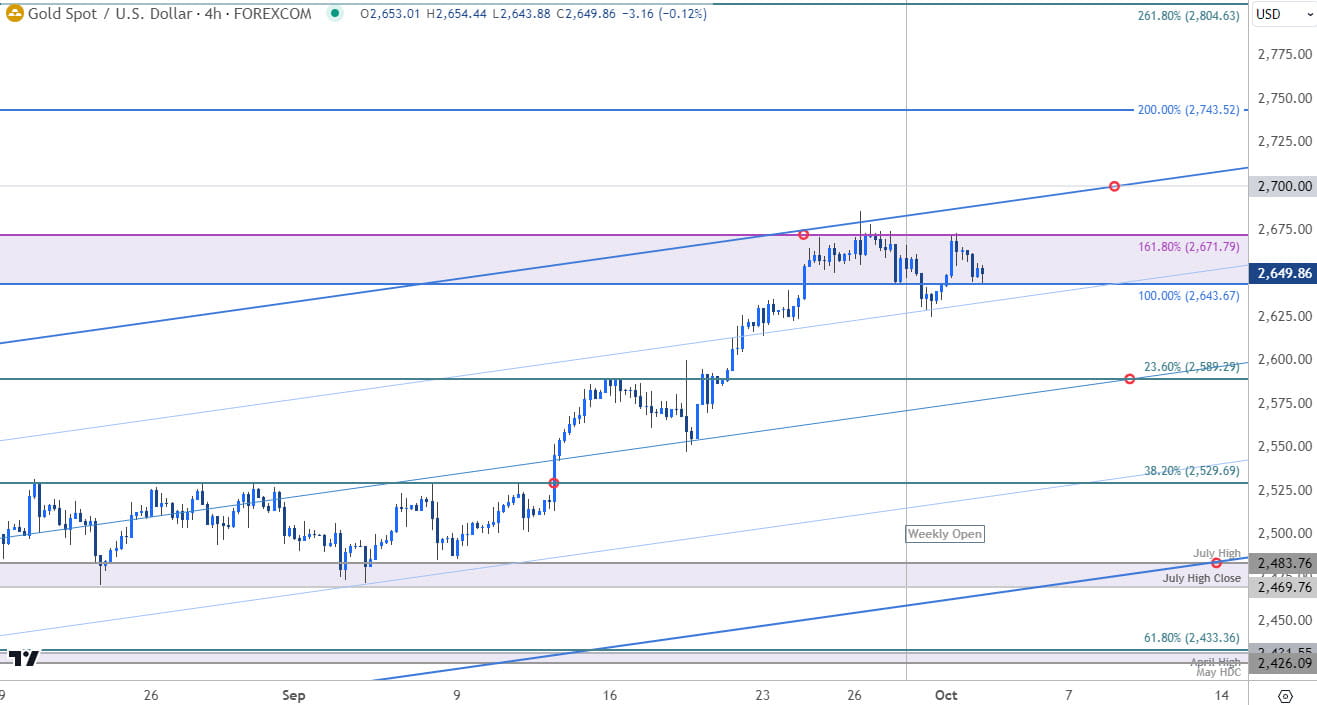

- Resistance 2643/71 (key), 2700, 2743- Support 2589, 2530, 2469/83 (key)

Gold prices surged more than 5.2% last month with XAU/USD rallying into technical resistance at fresh record highs. The weekly opening-range remains intact just below and the focus is on a possible near-term breakout into the days ahead. Battle lines drawn on the XAU/USD short-term technical charts heading into NFP.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Price Outlook we maintained a constructive outlook while noting that, “A breach above 2600 would keep the focus on a major Fibonacci confluence up near 2643/71-a region defined by the 100% extension of the 2015 advance and the 1.618% extension of the June rally. Note that numerous slopes converge on this threshold over the next few weeks and further highlight its technical significance- look for a larger reaction there IF reached.”

The rally halted at this key inflection zone last week with gold unable to mark a daily close above (record intraday high registered at 2685). The focus is on possible price inflection off this zone with the weekly / monthly opening-range taking shape just below.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD trading within the confines of an ascending pitchfork extending off the April / June lows with the upper parallel further highlighting key resistance last week. A break below the weekly opening-range would shift the focus towards a test of the median-line / 23.6% retracement of the May rally at 2589- look for a larger reaction there IF reached. Subsequent support rests at 2530 with broader bullish invalidation now raised to the July high close / July high at 2469/83.

A topside breach of the weekly range exposes the upper parallel near ~2700- a daily close above this slope is needed to mark uptrend resumption with such a scenario likely to fuel another accelerated rally towards subsequent resistance objective at 2743 and the 2.618% extension of the 2022 range at 2804.

Bottom line: Gold is trading just below uptrend resistance into the start of the month with the weekly opening-range taking shape just below. From at trading standpoint, the focus is on a near-term breakout for guidance- losses should be limited to 2589 IF price is heading higher on this stretch with a close above 2700 needed to fuel the next major leg.

Keep in mind we are just carving the monthly opening-range with US Non-Farm Payrolls on tap Friday. Stay nimble into the release and watch the weekly close here for guidance. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term look at the XAU/USD trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Technical Outlook: EUR/USD Plunges into October

- US Dollar Short-term Outlook: USD Defends Support at Fresh Yearly Low

- Australian Dollar Short-term Outlook: AUD/USD Reversal off Resistance

- British Pound Short-term Outlook: GBP/USD Breakout Eyes Resistance

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex