Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold bulls defends 2K– weekly opening-range in focus just below January downtrend

- XAU/USD risk for deeper correction- looking to confirm a low in the days ahead

- Resistance 2040s, 2050/55, 2075/80 – Support 2006, 1978/87 (key), ~1963

Gold prices have been on the defensive since the start of the year with XAU/USD plunging nearly 3% into the January open. A recovery off short-term, downtrend support is faltering just ahead of resistance and the focus is on a breakout of the weekly opening-range for guidance here. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Price Outlook we noted that XAU/USD was trading just below resistance while highlighting that, “seasonal tendencies historically favor gold into last two weeks of the year. From a trading standpoint, we’re looking to validate an exhaustion low in the weeks ahead with a close above 2080 ultimately needed to mark uptrend resumption in gold.”

Gold ripped through resistance days later with price registering an intraday high at 2088 ahead of the yearly close. However, the bulls were unable to mark a daily close above 2080 with price plunging more than 4.1% off the late-December highs. The decline rebounded off lateral support last week at 2006 with the rally faltering today just ahead of channel resistance. While the threat remains weighted to the downside while within this formation, we are on the lookout to confirm a possible exhaustion low in the days ahead.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD trading within the confines of a descending channel formation with the weekly opening-range now taking shape just below slope resistance. Initial support rests with the October high-day close (HDC) at 2006 backed by a more significant pivot zone at 1978/87- a region defined by the 50% retracement of the October advance, the July high-close, and the 100% extension of the late-January decline (area of interest for possible downside exhaustion / price inflection IF reached).

Resistance is eyed at the upper parallel (currently ~2040s) and is backed by the 2022 high-day close (HDC) / 61.8% Fibonacci retracement at 2050/55- a breach / daily close above this threshold is needed to suggest a more significant low may have been registered last week with a close above 2075/80 still needed to mark uptrend resumption.

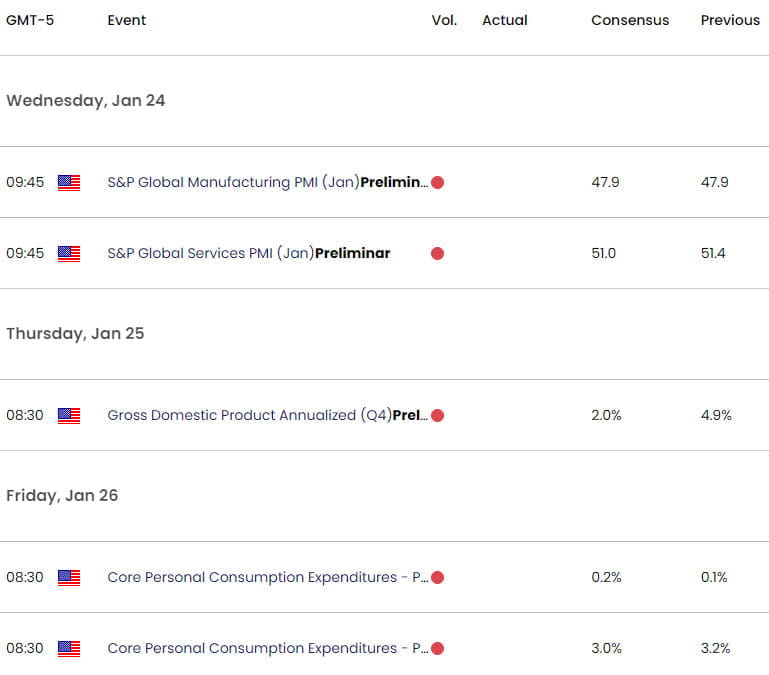

Bottom line: Gold prices remain vulnerable while within this formation. That said, we are on the lookout for evidence of an exhaustion low in the days ahead with the immediate focus on a breakout of the weekly opening-range. From a trading standpoint, look to reduce short-exposure on stretch towards 1978/87 with a breach / close above 2055 needed to suggest a more significant reversal is underway. Keep in mind we get the releases of the US Personal Consumption Expenditure (PCE) on Friday – expect some volatility here and watch the weekly-close for guidance. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term look at the XAU/USD trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Erases December Rally

- Canadian Dollar Short-term Outlook: USD/CAD Rips to Resistance

- US Dollar Short-term Outlook: USD Rally at Make-or-Break Resistance

- Euro Short-term Technical Outlook: EUR/USD Poised for Breakout

- British Pound Short-Term Outlook: GBP/USD Breakout Looms

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex