Safe-haven gold was shining brightly again after a grim session the day before.

It was boosted in part by a struggling stock markets, as investors awaited the start of high-level trade talks between the US and China scheduled for later this week. With Donald Trump putting several more Chinese technology companies in a blacklist, investors are erring on the side of caution in case the talks collapse again without any agreement.

The precious metal found additional support from a weaker dollar, ahead of the upcoming US inflation data. The greenback fell against a number of foreign currencies including the euro, with the latter being underpinned by above-forecast German industrial production data, released this morning.

Meanwhile, benchmark government bond yields were looking weak again after Monday’s bounce. This also helped to boost the appeal of the noninterest-bearing commodity.

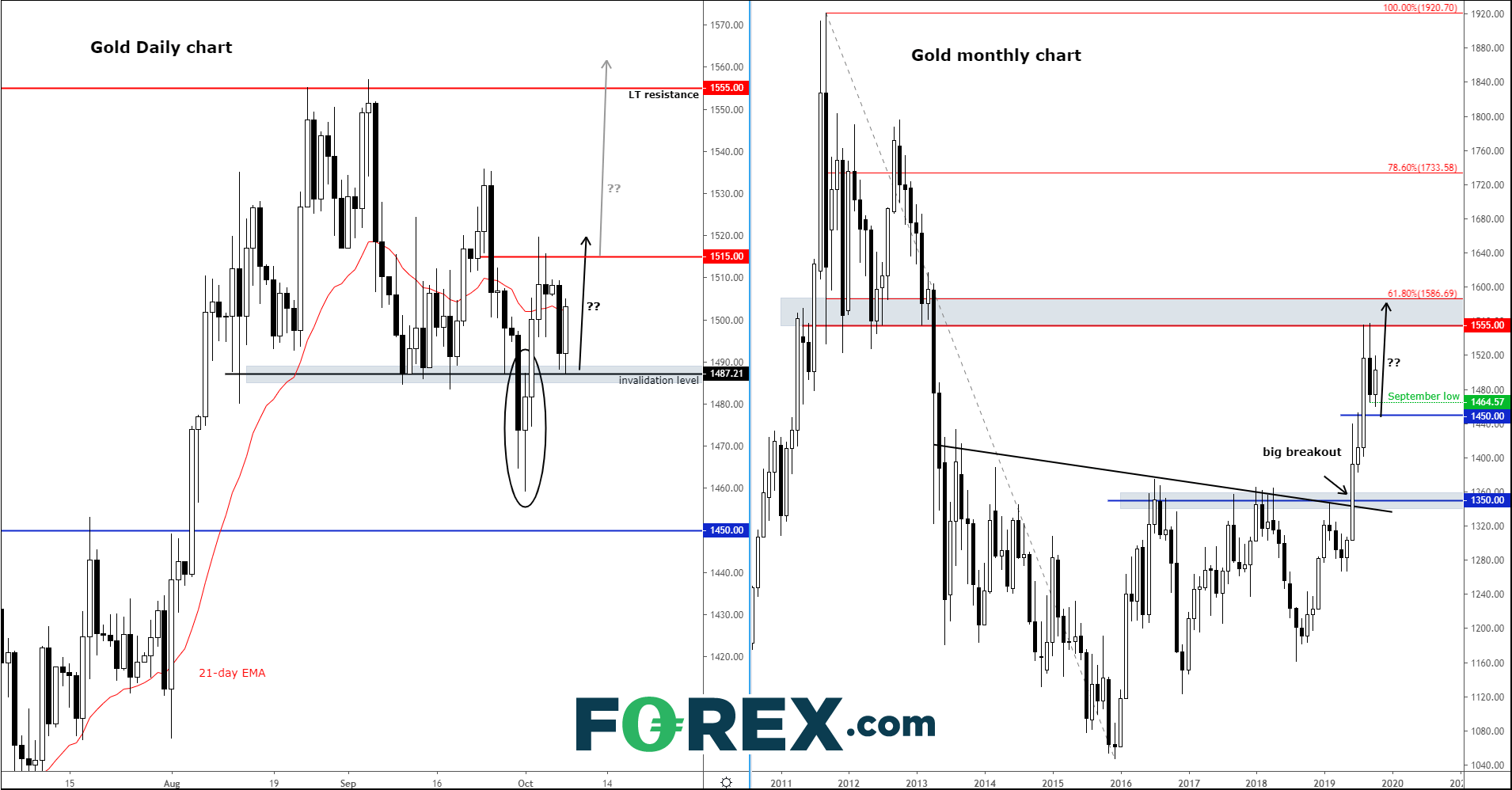

From a technical point of view, it is interesting to note that gold has found support from the neckline of that Head and Shoulders pattern at around $1485/90 area, below which the sellers were evidently trapped in early last week. The fact that price is holding above this area means the bulls will therefore be happy. For more technical analysis on gold, please refer to our previous article HERE. Below is an update chart of gold.

#Source: Trading View and FOREX.com.

#Source: Trading View and FOREX.com.