Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold prices rebound off uptrend support- December opening-range in focus

- XAU/USD threat remains for larger correction with broader uptrend

- Resistance 2736 (key), 2804, 2900– Support 2607, 2532, 2450/82 (key)

Gold prices are virtually unchanged since the start of the week with XAU/USD trading just above multi-year slope support. The focus now shifts to the December opening-range with the broader uptrend still vulnerable to a deeper correction while below the record high-close. Battle lines drawn on the XAU/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Weekly Price Forecast we noted that the gold sell-off was, “testing initial trend support at the median-line- risk for near-term price inflection here.” XAU/USD surged nearly 7.3% off those lows before exhausting into the close of the month. A decline of nearly 4.3% rebounded off the 61.8% retracement of the November rally at 2607 last week with price holding a tight range (virtually unchanged) into the weekly / monthly open.

Weekly resistance is eyed with the record high-week close (HWC) at 2736- a breach / close above this threshold is needed to mark uptrend resumption towards subsequent resistance objectives at 2.618% extension of the 2022 range breakout at 2804 and 2900 / the upper parallel.

Support remains at 2607 with a break / close below the median-line needed to suggest a more significant correction is underway. Subsequent support objectives rests with the August high at 2532 and 2450/82- a region defined by the April high and the 38.2% retracement of the 2024 yearly range. Losses should be limited to this zone for the 2022 uptrend to remain viable with a close below the 52-week moving average (currently ~2361) ultimately needed to suggest a larger trend reversal is underway / put the bears in control.

Bottom line: Gold is trading just above multi-year uptrend support into the start of the month and while the broader outlook remains constructive, the advance may be vulnerable to a larger correction within the broader uptrend. From a trading standpoint the immediate focus is on a breakout of the 2607-2736 range for guidance.

Keep in mind that we are in in the early throws of the December opening-range with US non-farm payrolls on tap Friday. Stay nimble into the release and watch the weekly close for guidance here. Review my latest Gold Short-term Outlook for a closer look at the near-term XAU/USD technical trade levels.

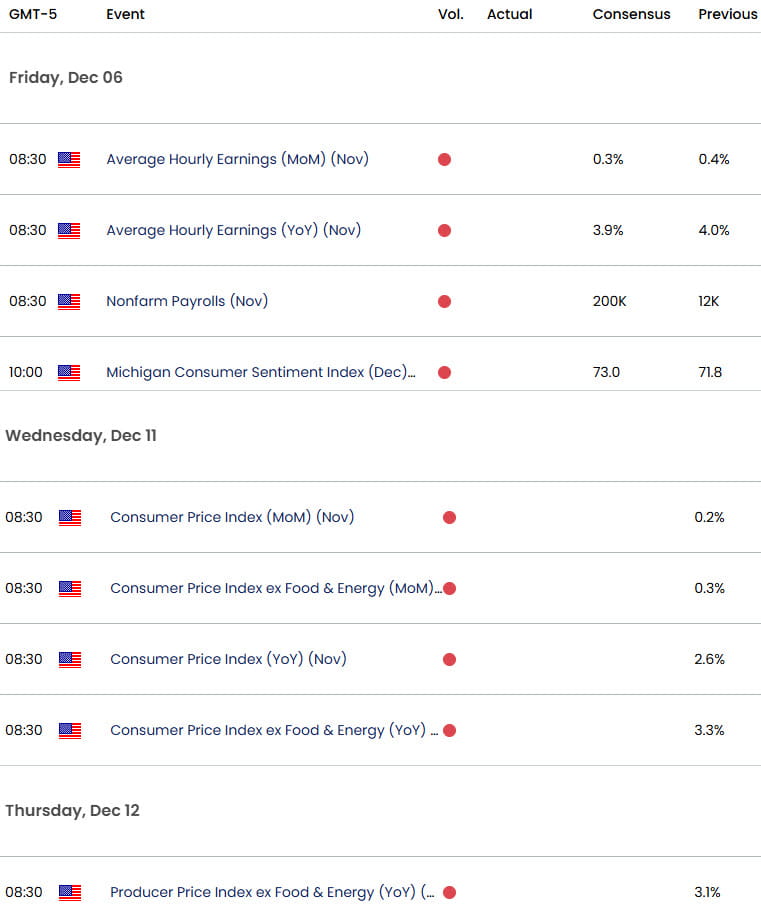

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- British Pound (GBP/USD)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- Swiss Franc (USD/CHF)

- US Dollar Index (DXY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex