Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold snaps three-week winning streak- closes more than 3.4% off fresh record highs

- XAU/USD threat for exhaustion / price inflection off uptrend resistance- PCE on tap

- Resistance 2415/31, 2516, 2565 – Support 2326/33, 2278/93, ~2200s

Gold is set to snap a three-week winning streak with XAU/USD turning sharply lower from fresh record highs. A third failed attempt to mark a weekly close above trend resistance leaves the bulls vulnerable here near-term, and the focus remains on possible inflection off this key pivot zone in the weeks ahead. These are the update targets and invalidation levels that matter on the XAU/USD weekly technical chart heading the close of July.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Weekly Price Forecast we noted that XAU/USD had been, “in consolidation just above the 75% parallel for the past month . . . For now, the immediate focus is on a breakout of the 2300-2333 range- losses should be limited to the median-line for the October uptrend to remain viable with a close above 2431 needed to mark uptrend resumption.” The consolidation formation broke higher the following week with gold prices surging more than 8.6% off the June lows.

The rally registered a record intraweek high at 2483 before reversing sharply with price now posed to close the week well below key resistance (down more than 0.5% on the week despite a weekly-range of more than 3.75%). The move signals the threat for further exhaustion here and the focus is on this pullback after the failed breakout attempt.

Initial weekly support rests with the objective monthly open / May high-week close (HWC) at 2326/33 and is backed by a more significant technical confluence at 2278/93- a region defined by the 23.6% retracement of the broader 2022 advance and the 38.2% Fibonacci retracement of the 2024 yearly range. A break / close below this key pivot zone would be needed to suggest a larger bull-market correction is underway back towards the median line (currently ~2200).

Key resistance remains at the record high-close / April high at 2415/31 and a breach / weekly close above the upper parallel (blue) will be needed to mark uptrend resumption and fuel the next major leg in price. Subsequent topside objectives eyed at the 1.618% extension of the October rally at 2516 and the 1.618% extension of the broader 2022 advance at 2565.

Bottom line: Gold prices have now failed a third attempt to breach uptrend resistance and while the broader outlook remains constructive, the immediate advance may be vulnerable here while below this slope. From a trading standpoint, losses should be limited to the objective monthly open IF price is heading higher on this stretch with a weekly close above 2431 needed to fuel the next move.

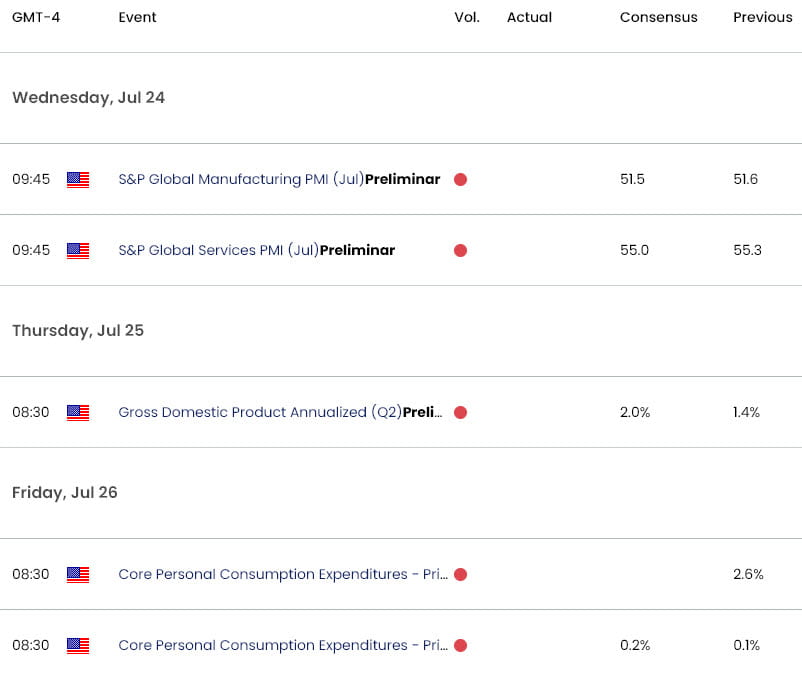

Keep in mind we get the release of key US inflation data next week with the Core Personal Consumption Expenditure (PCE – the Fed’s preferred inflationary gauge) on tap Friday. Stay nimble into the release and watch the weekly close for guidance here. I’ll publish an updated Gold Short-term Outlook once we get further clarity on the near-term XAU/USD technical trade levels.

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- British Pound (GBP/USD)

- Crude Oil (WTI)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex