Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold bulls defend 2300 support, rallies back towards record high

- XAU/USD rallies more than 5.2% month-to-date, uptrend resistance hurdle in view

- Resistance 2431, 2516, 2565 – Support 2344, ~2300, 2238/60 (key)

Gold rallied another 2% this week with XAU/USD surging back towards the record highs registered last month. The advance is once again approaching longer-term uptrend resistance and we are looking for possible exhaustion / price inflection into this zone in the weeks ahead. These are the update targets and invalidation levels that matter on the XAU/USD weekly technical chart heading the monthly close.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Weekly Price Forecast we noted that XAU/USD had, “responded to confluent uptrend resistance – while the broader outlook remains constructive, the risk of a deeper correction remains sub-2391. From a trading standpoint, we’re on the lookout for evidence of a possible exhaustion low in the weeks ahead– losses should be limited to 2238 IF price is heading higher on this stretch…” Gold plunged more than 6.3% off the highs with XAU/USD registering an intraday low at 2277 in early-May trade before rebounding sharply.

The subsequent advance is making another run at the highs here with weekly RSI still in overbought territory- the momentum profile continues to favor the bulls for now. Initial resistance is eyed just higher along the upper parallel and is backed by the record high at 2431- a breach / close above this threshold is needed to mark uptrend resumption towards the 1.618% extension of the October rally at 2516 and the 1.618% extension of the broader 2022 advance at 2565- look for a larger reaction there IF reached.

Weekly support rests with the record high-week close (HWC) at 2344 and is backed by 2300. Medium-term bullish invalidation now raised to the Fibonacci confluence at 2238/60- a region defined by the 23.6% retracement of the 2022 advance and the 38.2% retracement of the 2024 range.

Bottom line: Gold prices have rallied more than 20% off the yearly lows and while the rally is maturing here, the broader outlook remains weighted to the topside for now. That said, be on the lookout for signs of possible price inflection into the upper parallels just higher- pullbacks should be limited to 2344 IF gold is heading higher on this stretch with a breach / close above 2431 needed to fuel the next major leg in price. Review my latest Gold Short-term Outlook for a closer look at the near-term XAU/USD technical trade levels.

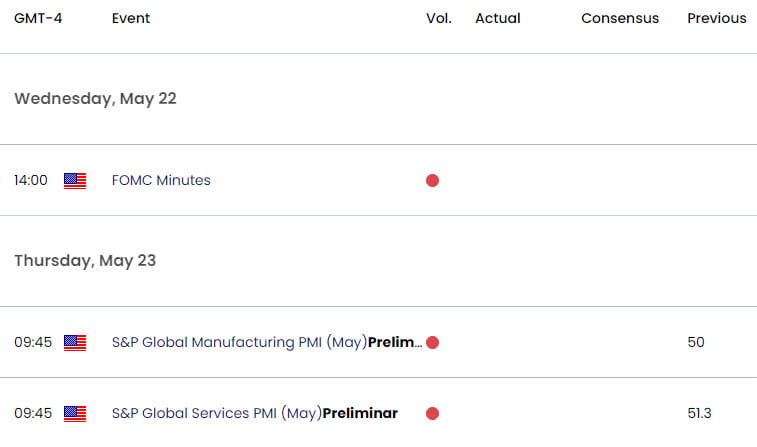

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- Crude Oil (WTI)

- British Pound (GBP/USD)

- Australian Dollar (AUD/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex