Gold Price Outlook: XAU/USD

The price of gold increased for the seventh consecutive week even as a bearish outside day emerged on a daily timeframe, but bullion may consolidate over the remainder of the month as the Relative Strength Index (RSI) falls back from overbought territory.

Gold Price Forecast: RSI Falls Back from Overbought Zone

The price of gold appears to be stuck in a narrow range after registering a fresh record high ($2759), and the RSI may show the bullish momentum abating should the oscillator continue to hold below 70.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, bullion may continue to serve as an alternative to fiat currencies amid the threat of a policy error by major central banks, and the price of gold may reestablish the bullish trend from earlier this year as it still tracks the positive slope in the 50-Day SMA ($2599).

With that said, the range bound price action in gold may end up short lived as it continues to hold above the moving average, but month-end flows may also influence the precious metal amid the uncertainty surrounding the upcoming elections in the US.

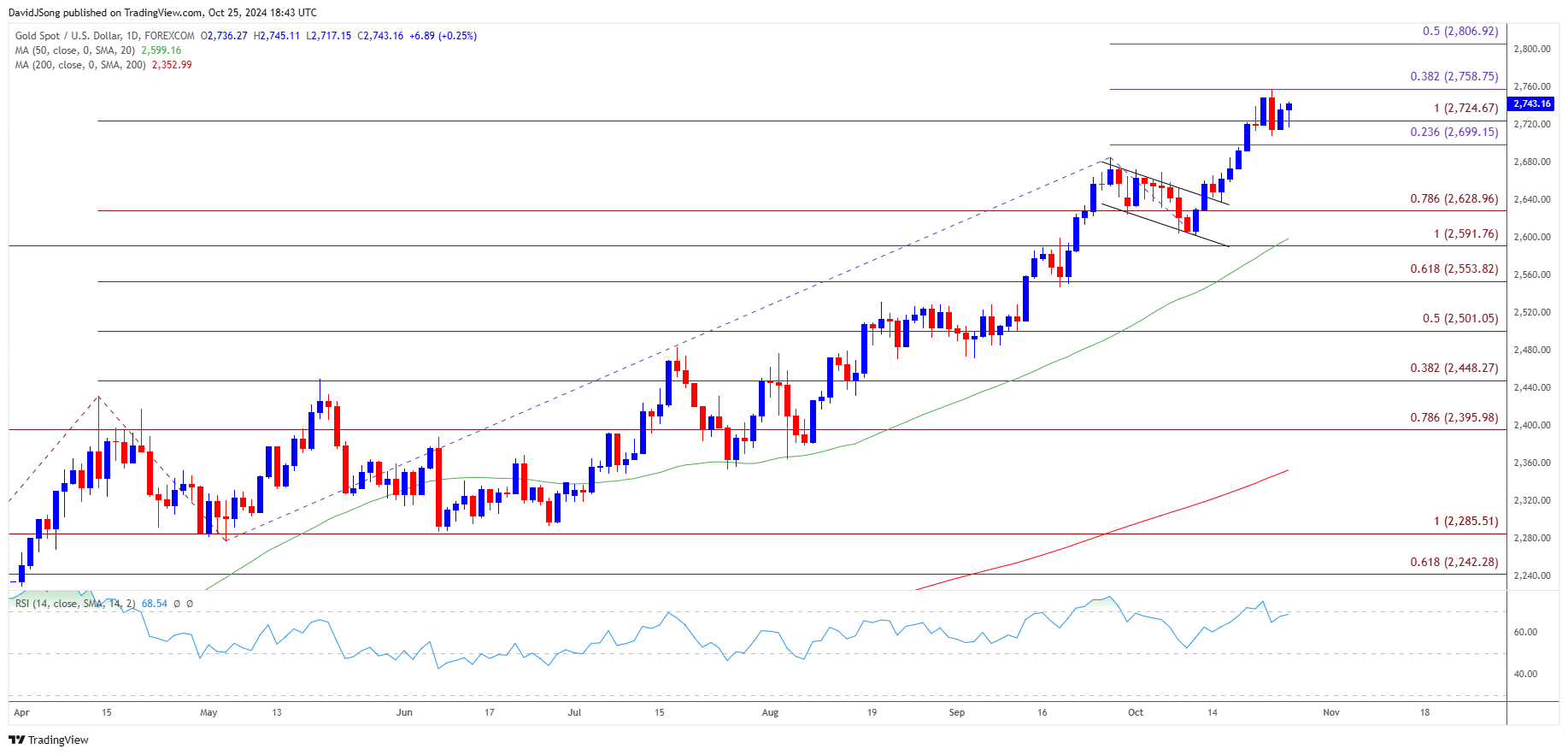

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; XAU/USD on TradingView

- The price of gold consolidates following the failed attempt to push above $2760 (38.2% Fibonacci extension), and bullion may continue to track sideways should it hold above the weekly low ($2709).

- Need a close above $2760 (38.2% Fibonacci extension) to open up $2810 (50% Fibonacci extension), with the next area of interest coming in around $2860 (61.8% Fibonacci extension).

- At the same, failure to hold above the $2700 (23.6% Fibonacci extension) to $2730 (100% Fibonacci extension) region may push the price of gold back towards $2630 (78.6% Fibonacci extension), with the next area of interest coming in around the monthly low ($2603).

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

Euro Forecast: EUR/USD Recovery Pulls RSI Out of Oversold Zone

USD/CAD Defends Post-BoC Reaction to Eye August High

GBP/USD Vulnerable as Bearish Price Series Persists

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong