Gold Talking Points:

- Gold bulls were not left unscathed by the rally in Treasuries, as each trading day in August has been a ‘red’ day until today.

- While this pushed another test below the $2,400 level, buyers have so far held a higher-low and price has bumped back above the big figure today. The question now is whether buyers can hold short-term momentum to allow for tests at $2,431 and $2,450, with the major psychological level of $2,500 looming overhead.

- This is an archived webinar and you’re welcome to join the next installment: Click here to register.

Gold prices are bouncing today and that’s a change-of-pace for August trade. The yellow metal came into the month looking ready to challenge the all-time-high that was set a couple weeks prior. But, like we saw in mid-July, as spot XAU/USD got closer and closer to the major psychological level of $2,500, bulls lost the handle.

That was right around the time that the rush for yields began with a fast hastening of that theme following the Friday NFP report. While ‘bad news’ has often been considered as a positive for risk assets, with the Fed getting closer to rate cuts, that paradigm has shifted. If the Fed is nearing the start of a rate cutting cycle, then logically there could be a bid in Treasuries as market participants attempt to get in-front of Fed loosening. And much like we saw in stocks, capital can flow from several areas in that chase for yields.

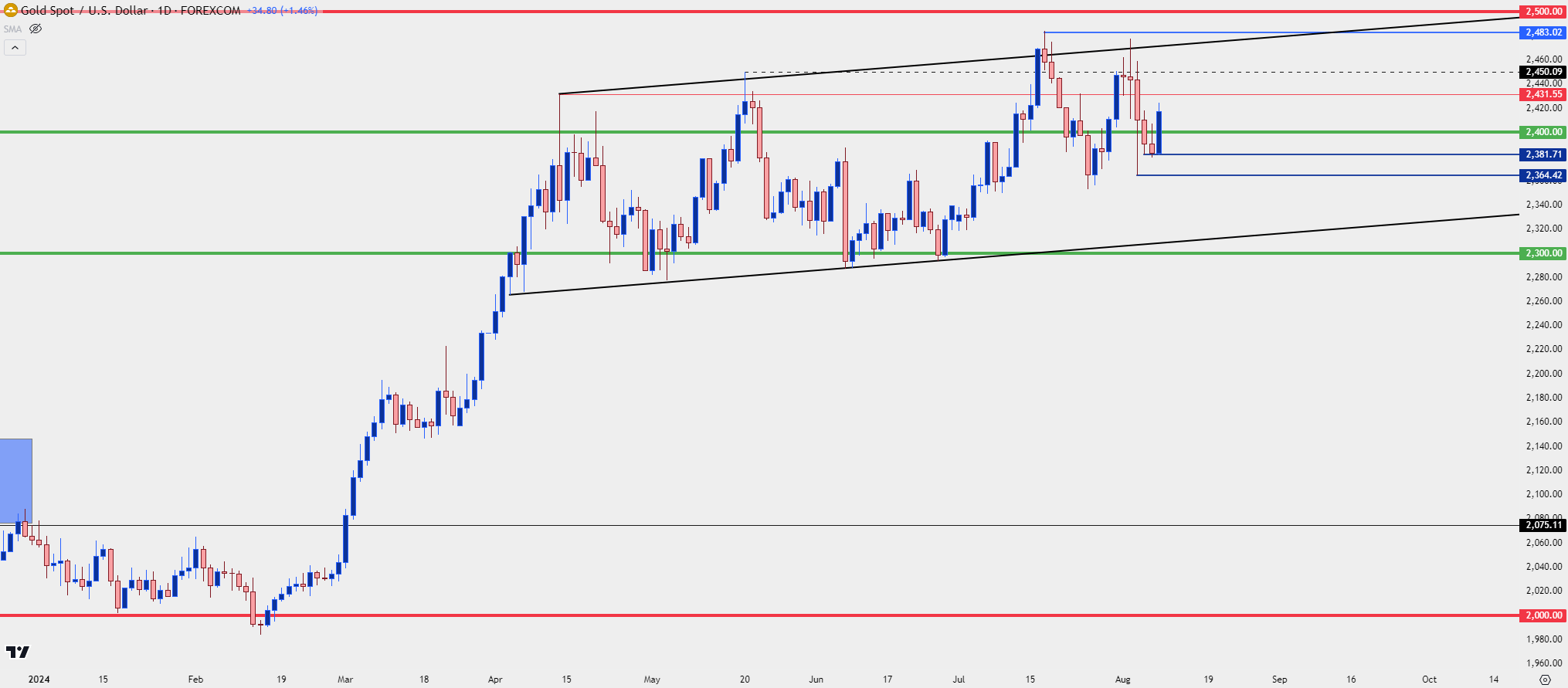

From the daily chart below, we can get better view of the consolidation that’s taken-hold of gold prices since the Q2 open. At that point, spot gold set a fresh all-time-high at $2,431, which remains a level of note today.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

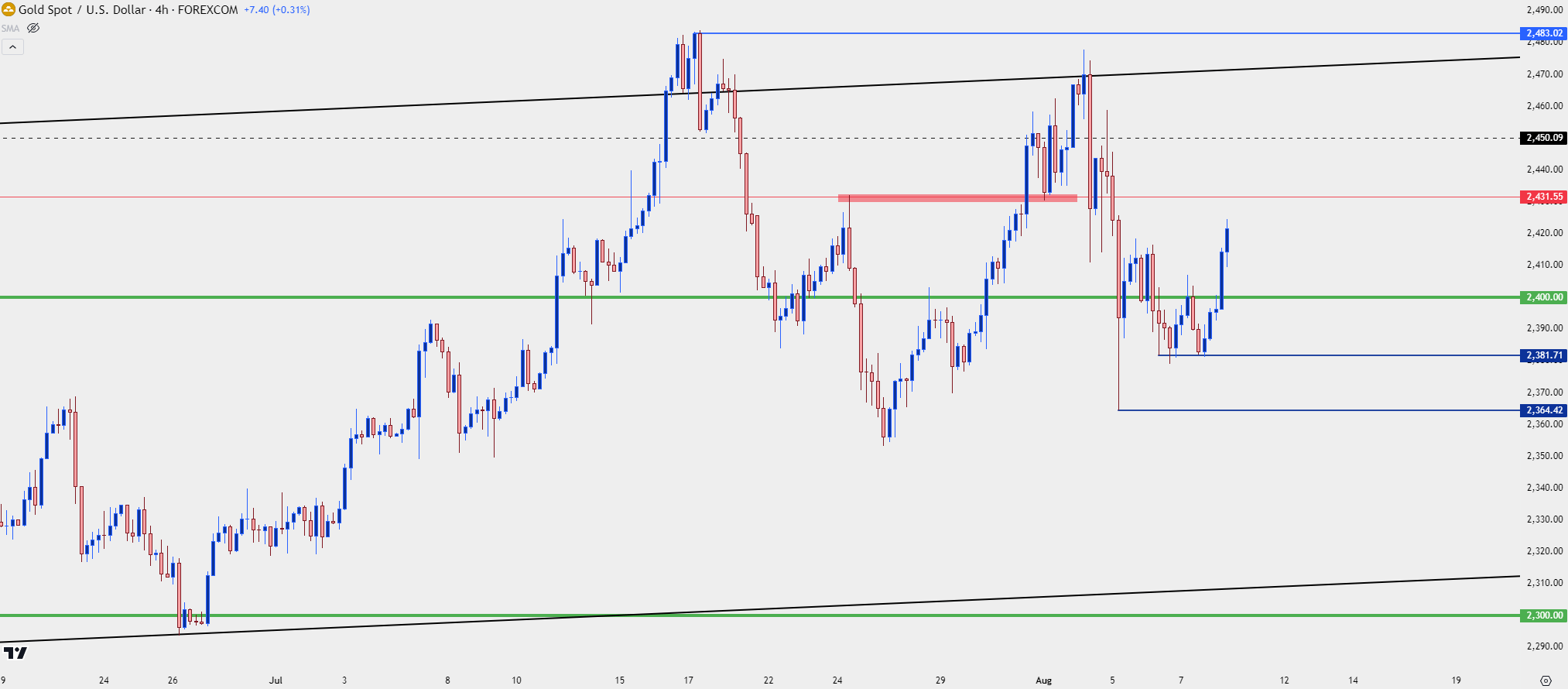

Gold Higher-Low Supports

In the Tuesday webinar, I shared a couple of annotations highlighting higher-low potential in gold. The lowest low on Monday printed at $2,364, and then on Tuesday we had a test at $2,381, which has since held, allowing for a push back above the $2,400 level. This gives bulls short-term control and as shared in the video, this puts emphasis on the $2,431 level that had functioned as the all-time-high in mid-April.

Since then, there’s been even more interest at that price, as the late-July swing high plots right at that level, as does a higher-low support test in the opening days of August.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

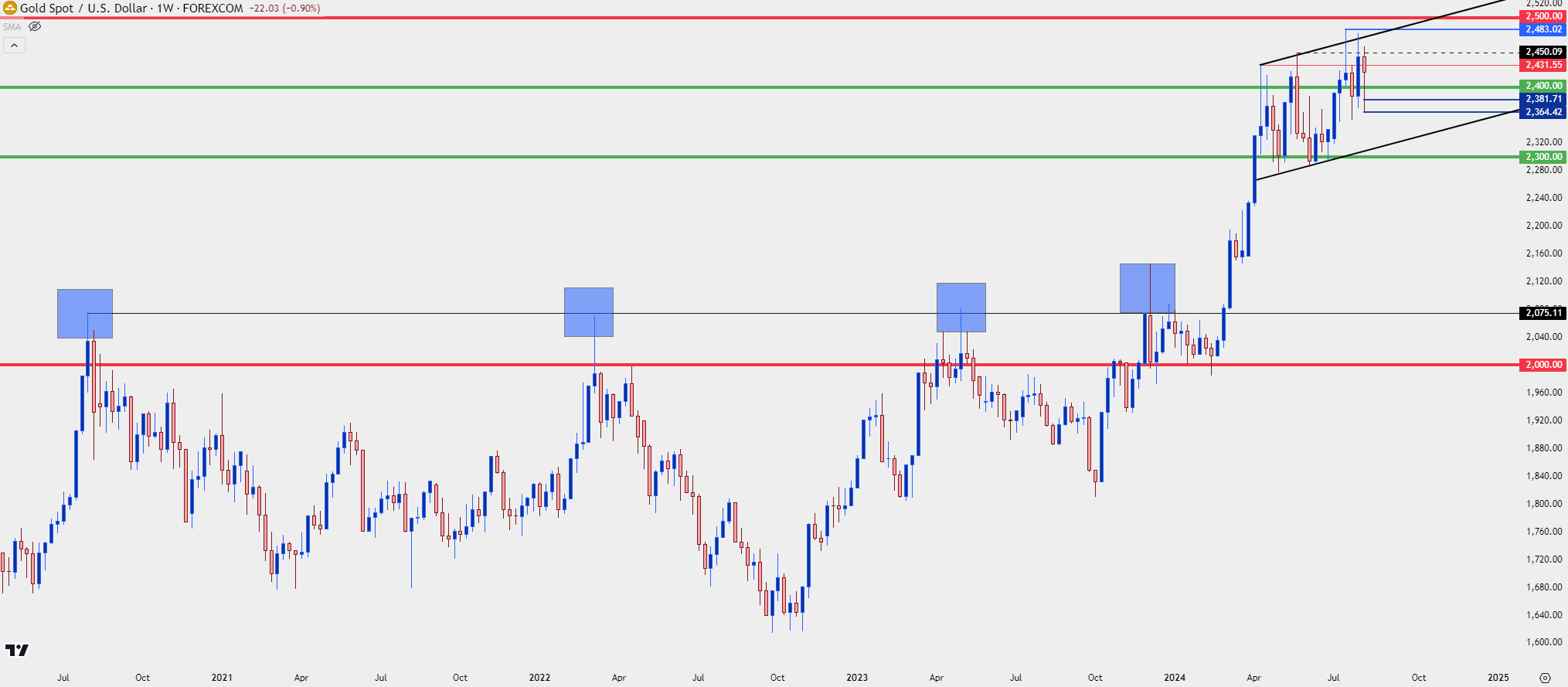

Gold Big Picture

Taking a step back to the big picture, and the prospect of acceptance from bulls above the $2,400 level remains of interest. The level was first tested in April which led to a pullback but, similarly, there was lacking acceptance from bears below $2,300, which ultimately helped to hold the lows throughout Q2 trade.

In May, bulls went in for another test but, again, failed and price pulled back. But – so far in Q3, the tests of that level have increased in frequency and there’s been a growing bullish lean, giving the appearance that buyers may soon have the open field to push up to a fresh high.

There could be another issue looming at $2,500, which is also a major psychological level, similar to $2k. And that spot held the highs for more than three years until buyers were ultimately able to drive a breakout; but only after that price had come into show support at prior resistance.

The risk to this thesis would appear to draw back to Treasuries. If we do see a continued rush for yield then there could be a valid case for capital coming out of many of these risk markets, such as we caught a glimpse of last week and on Monday of this week. But – if $2,500 trades, there could be an additional risk factor to the long side of gold as a psychological level of that nature can often take time to gain acceptance across markets.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist