Gold has started the week with a 2% pullback. The selling started right as trading opened in Asian markets, before extending those losses during the first half of European session. The metal is now on its second consecutive weekly decline. Investors have shown more appetite for risk assets, with Trump’s big election victory adding stability to geopolitical concerns. This reduced gold’s allure as a safe haven, pushing it down 1.9% by last week's end, while silver dropped 3.5%. Both metals have extended those losses today, with gold’s selling accelerating as key short-term support levels broke down. In contrast, Bitcoin surged to record highs last week and has gained further ground early this week. As bond yields and the US dollar climb, precious metals could face a challenging path, cooling off from their recent highs. The dollar’s rise has made gold more expensive for foreign buyers, potentially stifling demand, while higher bond yields increase the opportunity cost of holding non-yielding assets like gold and silver. Although gold’s rally has been significant, recent price action might be a sign of a natural and necessary correction from overextended levels. Against this backdrop, the short-term gold forecast has turned modestly bearish.

Trump’s Election: A Setback for Gold

Last week brought significant volatility across financial markets as Donald Trump’s sweeping election victory took investors by surprise. Despite predictions of a close race, Trump claimed a decisive win, capturing most swing states and pushing a Republican agenda. This has led many investors to anticipate more government spending and potential tax cuts, fuelling optimism around US equities and cryptocurrencies. While equities rallied, gold lost ground as a result, experiencing renewed pressure amid expectations for future fiscal stimulus. This came on top of a Federal Reserve rate cut by 25 basis points, which markets had widely anticipated. Despite the cut, Fed Chair Jerome Powell’s statements offered little new insight into future monetary policy moves, as he remained cautious about the election’s impact on economic direction. Gold’s decline against the backdrop of Trump’s victory marks a shift in sentiment, with some investors now choosing to diversify away from safe-haven assets. However, this is only likely to be a temporary obstacle, and the long-term gold forecast remains bullish in light of ongoing rate cuts by central banks.

Rising dollar and bond yields weigh on gold forecast

Gold’s price is also bowing to pressure from recent increases in bond yields and a strengthening US dollar. Higher yields on bonds mean that assets like gold, which do not provide interest, become relatively less attractive, as investors can obtain fixed returns from government debt. Additionally, the rising dollar, which is the pricing currency for gold, makes the metal more expensive for buyers holding other currencies, reducing global demand. Last week saw some stronger-than-anticipated US economic data, such as the ISM services PMI at 56.0 versus a forecast of 53.8, and an improved UoM Consumer Sentiment index at 73.0. Despite these data points, election outcomes dominated investor focus, temporarily softening the dollar on Thursday before it bounced back Friday. This dollar rebound lifted the Dollar Index close to above the important 105.00 level, a key technical marker. A closing break above this level could encourage further gains, potentially pushing gold lower as dollar strength impacts demand.

US inflation and retail data to steer sentiment this week

This week, US inflation and retail sales figures are expected to be significant market drivers, though today’s macro calendar is light due to the Veterans Day holiday in the US – this hasn’t stopped gold from falling 2%, however. Investors continue to process the Fed’s rate cut and Trump’s election victory, as the potential for policy shifts keeps traders on edge. Chair Powell’s cautious comments last week left some ambiguity regarding future rate cuts, especially in light of Trump’s win, which could prompt greater government spending. The combination of rate cut expectations, stronger consumer sentiment, and Trump’s proposed policies has strengthened the dollar, resulting in downward pressure on gold. Let’s see if we will witness further data strength this week to keep the current trends intact.

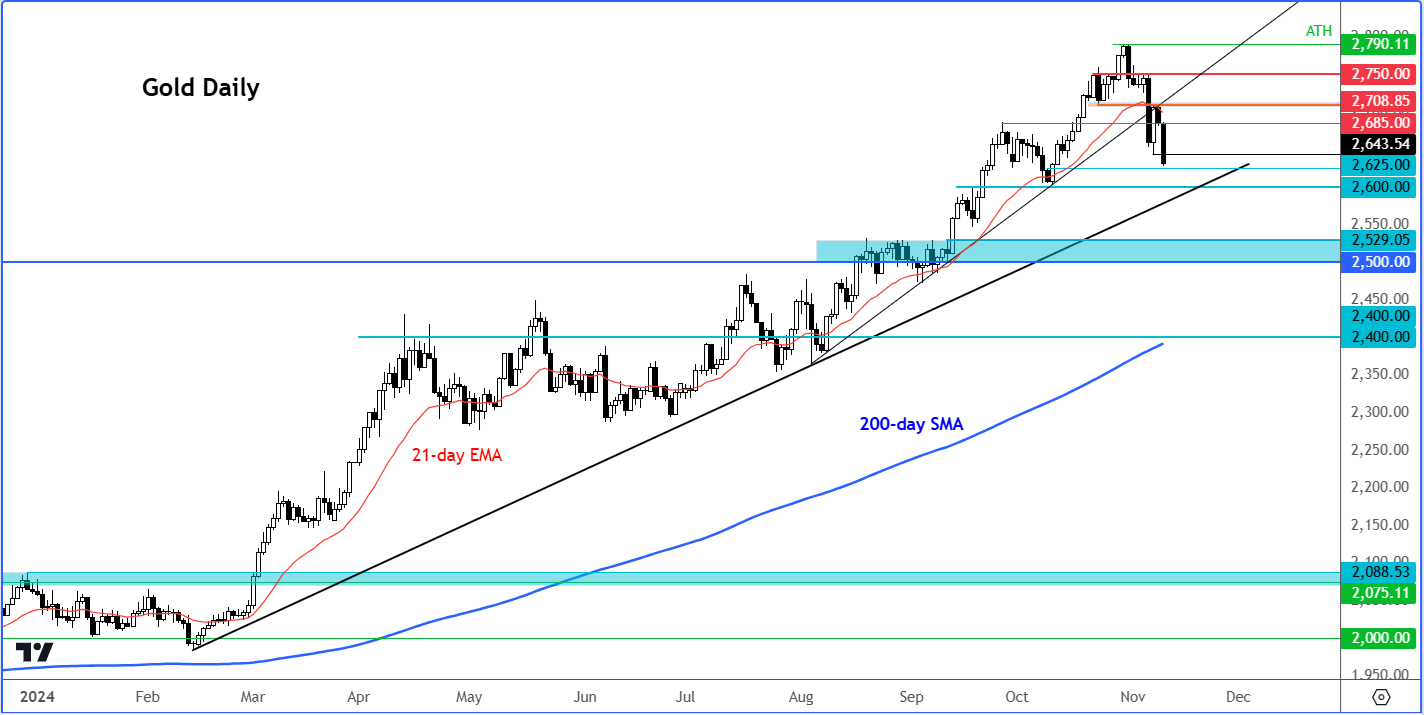

Technical gold (XAUUSD) forecast: Cooling off from overbought levels

Source: TradingView.com

Gold’s slide has led to a loss in bullish momentum, although the long-term trend remains positive. Indicators such as the RSI show easing but remain in or around overbought territory on the log-term charts like the weekly or monthly, suggesting further consolidation or a selloff may be needed before gold becomes attractive again for dip buyers. Recently, gold broke below a bullish trend line established in August and moved under the 21-day exponential moving average. This technical shift suggests a bearish turn in the short-term XAUUSD forecast, with broken support levels at $2,750 and $2,708 now acting as resistance. Key levels to watch include $2,600, where potential buyers might remerge, and the $2,500-$2,530 range if deeper corrections continue. A decisive break below $2,600 could prompt a retest of the lower end, possibly setting up for a more substantial pullback.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R