- Gold forecast: How is the metal likely to react to today’s CPI data?

- CPI is expected to have moderated in April to 3.4% y/y from 3.5% previously

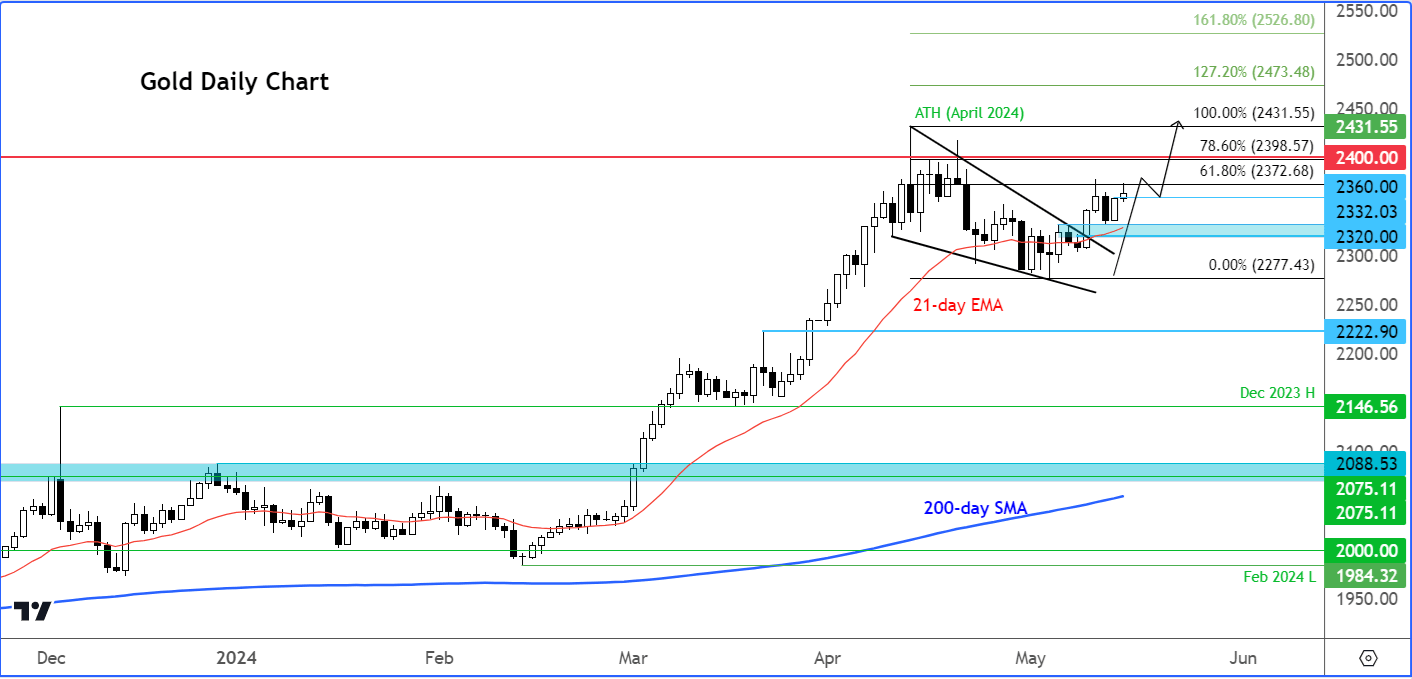

- Gold technical analysis points higher following its breakout from a continuation pattern

Following gold’s 2.5% rise last week, the precious metal has spent the first half of this week in consolidation mode ahead of the release of the key CPI report. Traders have been selling into the dollar’s recovery attempts ever since the release of the April non-farm jobs report, the latest ISM surveys and the weekly jobless claims data, all of which have disappointed expectations. Their rationale is that the US economic recovery is slowing, and this will help bring inflation down, reducing the need to keep monetary policy tight for an extended period of time. The Fed’s tapering of its balance sheet runoff has been an additional bearish factor for the dollar. I think there is definitely a broader macro driver behind gold forecast and other commodities we have seen of late, like copper and silver. China seems to have turned a corner and we have seen improvement in Eurozone and UK data too. Thus, gold’s recent gains partly reflect a weaker dollar and increased odds of a rate cut by the Fed, although the bulk of its gains have been driven by inflation hedging demand and central bank purchases. Speaking of inflation…

Gold forecast: How is the metal likely to react to today’s CPI data?

The dollar’ selling could accelerate in the event we see a bigger drop in CPI than expected. A weaker dollar would further increase the appeal of precious metals. However, that’s not to say gold will necessarily drop should we see a hotter inflation report.

After all, elevated inflation has been one of the biggest factors behind gold’s ascend in recent times, as investors have attempted to reduce the depreciation of their wealth held in fiat currencies by investing in assets that provide some sort of protection against inflation, such as gold. So, whichever way you look at it, today’s CPI report is likely to benefit gold either due to increased inflation hedging demand (should CPI come in hotter) or a weaker US dollar (in the event of a weaker CPI). Any bearish reaction is therefore likely to be limited on gold, with dip-buyers ready to pounce near short-term support levels.

Before discussing what to expected from the CPI and the dollar in greater detail, let’s have a quick look at the chart of gold ahead of the CPI report.

Gold forecast: Technical levels to watch

Source: TradingView.com

Following the breakout from the falling wedge continuation pattern, the gold chart has been edging higher, although unable yet to break above its 61.8% Fibonacci retracement level of $2372 against April’s all-time high. A close above this level could pave the way to a new all-time high above $2431, with $2400 likely to offer some resistance in the interim. Short-term support is seen around $2360, followed by the area between $2320 to $2330, which marks the base of the breakout from the wedge pattern. The short-term gold forecast could deteriorate in the event the metal closes below $2320 support.

What are analysts’ CPI expectations?

Analysts expect CPI to have moderated in April for the first time in six months. If so, it will offer hope that price pressures will start to ease again after back-to-back upside surprises throughout 2024. CPI is expected to have eased to 3.4% year-on-year in April, down from 3.5% the previous month. On a month-over-month basis, a 0.4% increase is anticipated. The Core CPI, which excludes food and fuel, is seen rising 0.3% m/m and 3.6% y/y.

The latest consumer inflation data will provide investors a clearer understanding of when and to what extent the Fed might adjust interest rates. Ahead of it, Jerome Powell reiterated that although there was little inflation progress in the first quarter, he anticipates prices will gradually decline on a monthly basis. If he is correct, we could see a more meaningful drop in the dollar, and this could only be good news for major FX pairs like the EUR/USD and AUD/USD, as well as gold and silver. Otherwise, the dollar bears will need to remain patient until more evidence emerges in the months ahead that inflation is on a downward trajectory towards the Fed’s 2% target.

Gold forecast: US dollar weakens ahead of CPI release

The US dollar was coming under a bit of pressure in the first half of Wednesday’s session, following the sell-off on Tuesday. The greenback’s drop has been influenced by a variety of internal and external factors. Despite the publication of April's Producer Price Index (PPI) showing a higher-than-expected increase of 0.5% month-on-month, the dollar remained subdued due to downward revisions for March and declines in certain PPI components affecting the Federal Reserve's preferred inflation gauge, the core Personal Consumption Expenditures (PCE) index. Externally, reports of potential Chinese support for its housing sector have bolstered currencies such as the yuan and the Australian dollar, contributing to the dollar's decline. Additionally, the ongoing global stock market rally has favoured riskier currencies, further dampening the dollar's strength. However, the dollar's decline is not drastic, as it maintains its upward trajectory in the longer term. Its resilience could, however, reverse should inflationary pressures ease more than expected.

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R