Gold Talking Points:

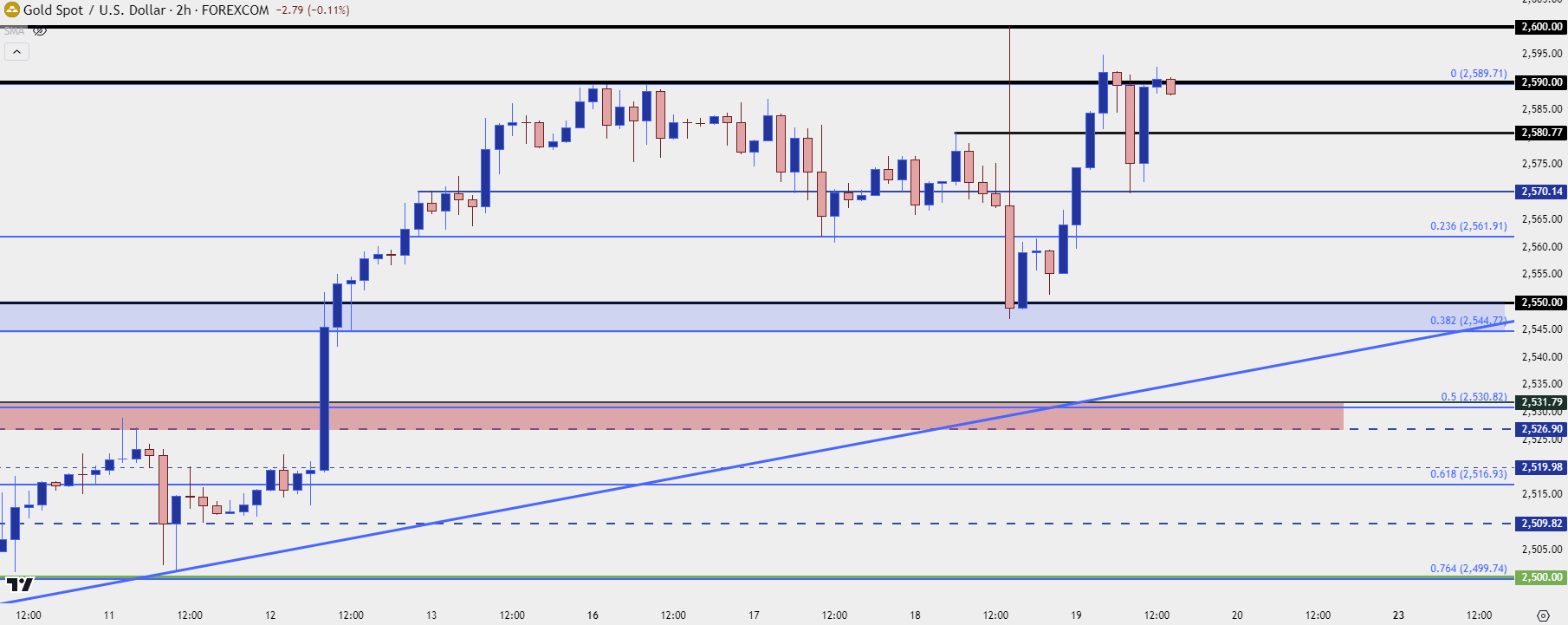

- Gold prices touched 2600 briefly after the release of the FOMC statement yesterday, followed by a fast pullback to the support zone I’ve been tracking around the 2544-2550 area.

- The reaction to that support was intense and technically is still on-going, as the initial bounce stalled at 2590 and the pullback from that quickly shot back up. Bulls have not relinquished the reins yet, even if they haven’t been able to take out the 2600 psychological level up to this point.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

FOMC reactions can be messy and the past 24 hours illustrates that well if looking at gold prices. Initially, on news of the 50 bp rate cut, gold prices were bid, up to a test of the 2600 level for the first time ever. But that test only lasted for a few minutes before bears took over, creating a sizable sell-off until gold eventually found support at the 2544-2550 zone.

That was a big area on the chart, and I had highlighted that ahead of the announcement in the article entitled ‘Gold Price Outlook: Pullback Potential into FOMC.”

That test lasted for a little bit longer; for about 13 minutes towards the end of the US trading day. But a rally began to build during the Asian session and as European markets opened for the day, gold prices jumped, pushing right back-up towards the same 2590 that had marked resistance ahead of the rate announcement yesterday.

It’s been messy since then: A pullback from 2590 found support at 2570 and, once again, bulls responded, driving back to 2590.

Gold Two-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

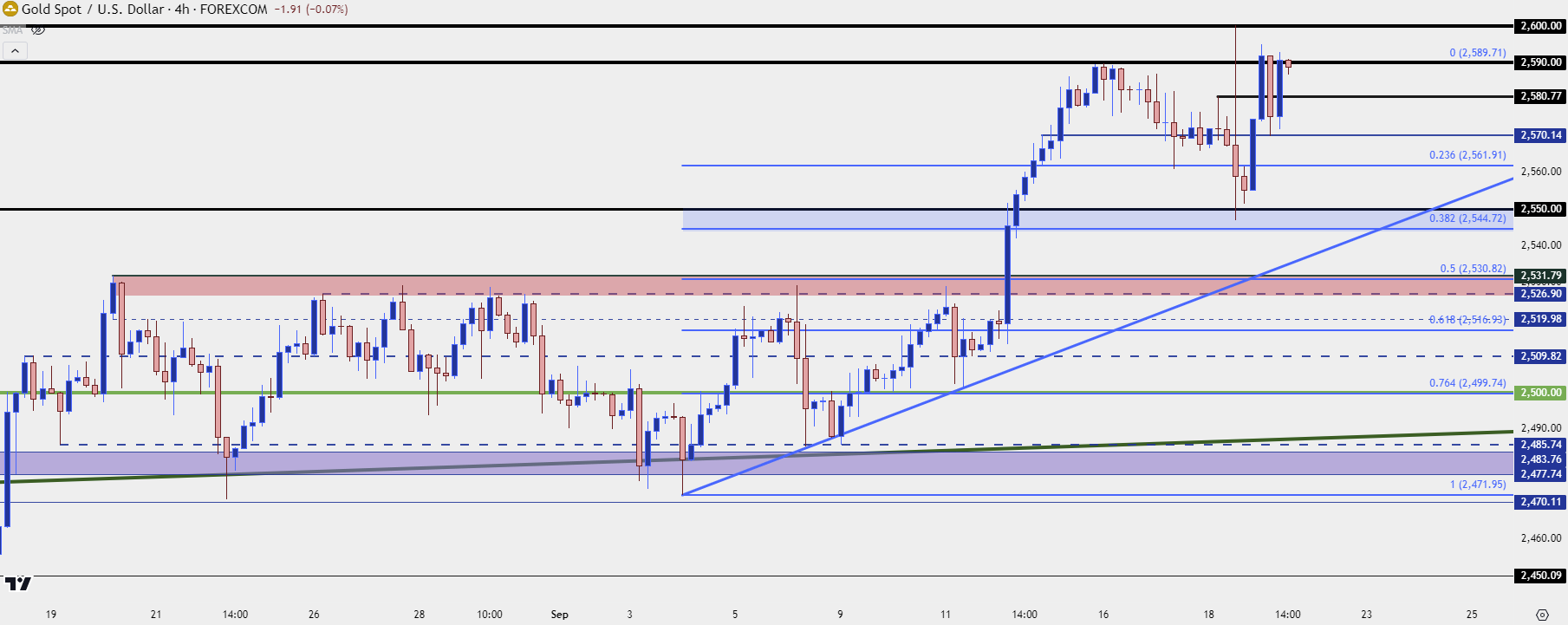

Gold: Lower-High Potential but Bears Haven’t Had Much Run Of Late

It’s been a really bullish year for gold and even pullbacks from major and significant breakouts have been rather minor, in the big picture. And as I said in that pre-Fed article I’m not exactly looking to be extremely bearish on gold given how strong bulls have been so far this year.

But – that also doesn’t mean that I’m looking to chase when price is far away from any nearby swing-lows. And given the potential for profit-taking on Friday ahead of the weekly close, there could be motive for trying to be patient, waiting for support and then looking at continuation scenarios.

At this point that same 2544-2550 zone could suffice but given that it’s already seen a bounce, if that does come into play then we’d be looking at a lower-high provided bulls weren’t yet able to re-test 2600. That would point to the possibility of a bounce from that zone up to another lower-high, if it bounces at all. For that, I would then look to short-term resistance of 2570 or 2580, both levels that have had some degree of interest over the past couple days.

As for key support, this isn’t all that creative but much like we saw from the most recent major move – it was prior range resistance that helped to set the floor that bulls drove from. That was in the 2477-2483 zone and the resistance to go along with that support (at prior resistance) was the 2527-2531 level.

This was also a zone I had discussed in the gold strategy piece ahead of FOMC yesterday but it hasn’t yet come into play. A deeper pullback to that level would have a few items of interest for bullish continuation scenarios. And, notably, the 2531 level is confluent with the 50% mark of the Fibonacci retracement produced by the September major move; and both the 23.6% and 38.2% marks of that same study have had some claim for support already.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist