- Gold analysis: Metal finds support as dollar eases off best levels

- NFP easily beat on the headline front, but wages grew less than expected

- Gold not this ‘oversold’ since September 2022

Gold initially fell in reaction to a stronger nonfarm payrolls data, but it then bounced off its lows equally sharply to trade in the positive territory at the time of writing. The dollar was also easing back down, after rising sharply across the board when the data was released. Silver was the first precious metal to turn positive, and gold followed, even as bond yields rebounded, which is supposed to increase the opportunity cost of holding precious metals. The metals’ gains, if can be sustained, would suggest that bond yields may be about to peak, with the Fed’s hawkish repricing near completion.

As I mentioned in my previous report gold is starting to look relatively attractive again after its big falls. If you liked gold at $2K+, it is now on sale near $1.8K. But will it continue to find buyers from here on is the key question. The sharp $130 (6.7%) drop in the space of a couple of weeks (from its 21st September high) means gold prices are technically oversold and potentially due a short covering rally from these long-term support levels. With the big sell-off in oil prices this week (which is disinflationary), there are now solid reasons for some potential bargain hunting. But what I am not so sure about yet is whether we will see sustainable gains this time, or whether it is too early for the metal start its next bullish leg up.

Is gold’s long-term outlook still bullish?

It is important not to get too carried away by today’s bullish-looking price action, as it can easily reverse like we have seen multiple times in the past. But what about gold’s long-term out? Well, to me, there are no questions about gold’s long-term bullish outlook. Given how much inflation has further devalued fiat currencies since the start of the year, when gold last staged a big rally, the metal should be shining more brightly anyway, if it truly is as an effective inflation hedge. The fact that it hasn’t, this is almost entirely because of the big falls in government bond prices, lifting their yields to multi-year highs and thereby increasing the opportunity cost of holding the non-interest-bearing commodity. But much of the Fed’s hawkish repricing of interest rates are now done, meaning that the downside for bonds and, by extension, gold should be limited moving forward. That’s not to say gold will necessarily find a bottom imminently. But equally, we are now not too far either, I believe. So, be on the lookout for fresh bullish signals to emerge from here on, and today’s recovery could be the start of that process.

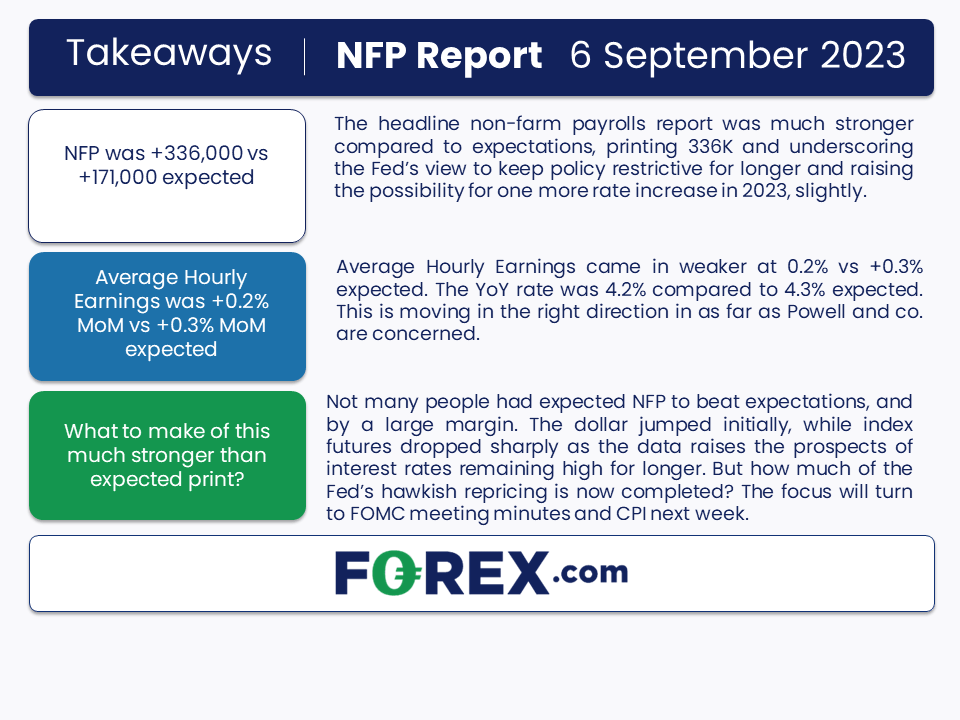

NFP beats expectations, but dollar off best levels

Not many people had expected NFP to beat expectations, and by a large margin. The dollar jumped initially, while index futures dropped sharply as the data raised the prospects of interest rates remaining high for longer. But the fact some of those moves reversed suggest much of the Fed’s hawkish repricing is now completed. The focus will turn to FOMC meeting minutes and CPI next week.

All told, today’s jobs report was strong, and the market’s initial reaction made total sense. What is not known however is the inevitable revisions we will see next month. Also, the fact that wages grew less than expected doesn’t sharply increase the odds of another rate increase before the year is out, despite the headline beat.

In case you missed it, the headline non-farm payrolls report was much stronger compared to expectations, printing 336K vs. 171K eye. This is underscoring the Fed’s view to keep policy restrictive for longer and raising the possibility for one more rate increase in 2023, slightly. Average Hourly Earnings came in a touch weaker, at 0.2% vs +0.3% expected. The YoY rate was 4.2% compared to 4.3% expected. This is moving in the right direction in as far as Powell and co. are concerned.

Given that the wages grew less than expected, I wouldn’t be too surprised if the dollar were to weaken more, ahead of the long weekend in the US, and ahead of more important macro pointers next week.

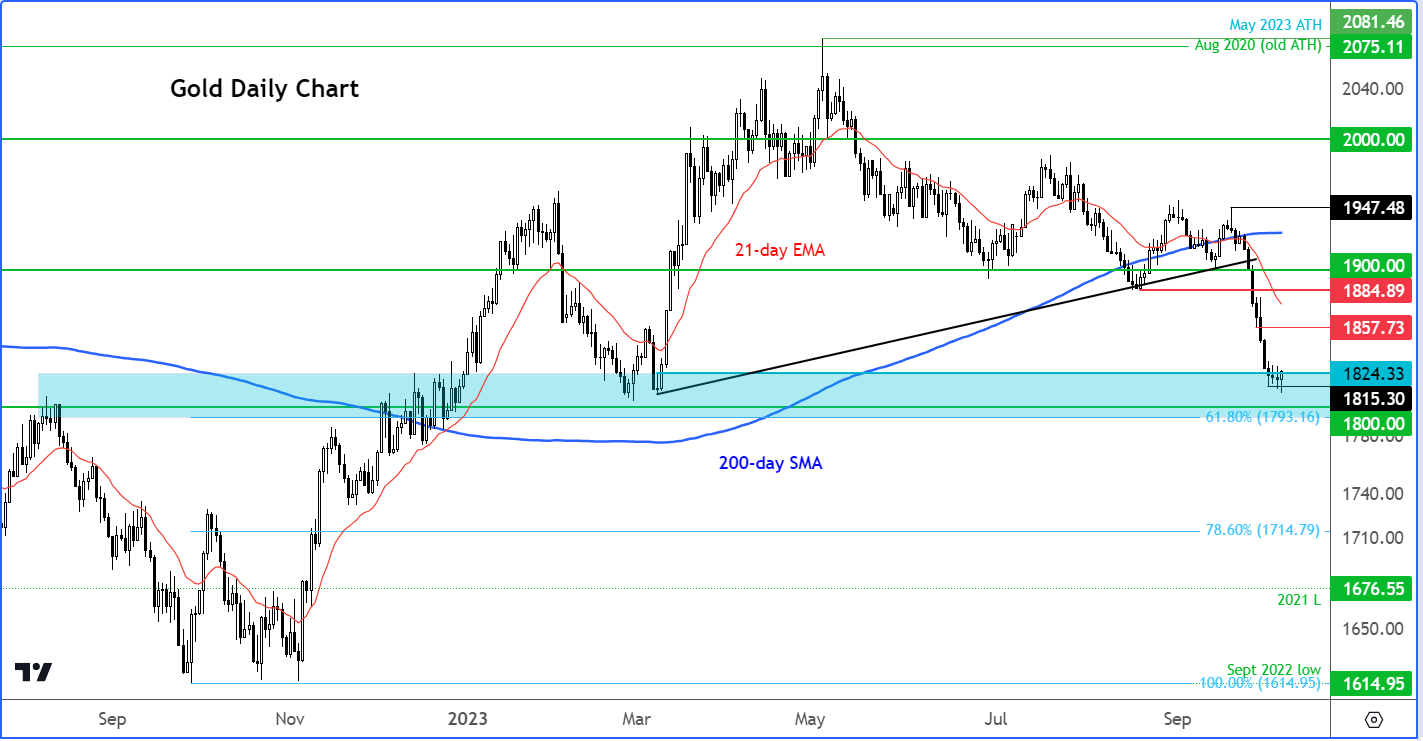

More on that later, but first let’s have a look at the chart of gold…

Gold technical analysis: key levels to watch

Source: TradingView.com

Interestingly, gold is now finding support in the area around $1805 to $1820, where gold had rallied from back in the first few months of the year. Will this zone turn out to be the lift off area again, or will the additional gains we have seen in bond yields cause it to break down this time?

Another scenario is we could see a temporary rebound, followed by more losses, before gold bottoms out. You don’t need to look at any technical momentum indicators like the RSI (Relative Strength Index) to figure out whether gold is oversold or not. But if you must, you will notice that the RSI has not been this ‘oversold’ since September 2022, when gold bottomed out at $1615. After falling so rapidly in recent days, even the bears may now be expecting to see an oversold bounce. So, profit-taking from the bears alone could trigger at least a temporary move higher.

For me to turn decidedly bullish on gold, we now need to see a solid bullish reversal candle on the daily time frame, and this needs to be backed by further evidence that yields have topped out.

Next week’s key data highlights

There will be bank holidays in US, Canada and Japan on Monday, meaning volatility is likely to be very limited. Things should be pick up later in the week with the release of some key market moving data. These include the following:

1) FOMC meetings minutes

Wednesday, October 11

19:00 BST

The Fed’s hawkish pause last month sent the dollar surging higher alongside bond yields. At that meeting, the FOMC trimmed their interest rate cut projections in 2024 from 4 to just 2 and left open the possibility of one more rate increase before the end of 2023. As a result, the market was forced to revise higher its prior dovish expectations. The minutes of that meeting will reveal more insights into the Fed’s thinking and thereby help to fine-tune market’s expectations.

2) UK GDP

Thursday, October 12

07:00 BST

Things can only get better, right? The UK economy is on its knees, and this is reflected in the pound weakening across the board. On Thursday, we will get the latest monthly GDP estimate, along with several other UK economic pointers. Last time, the monthly GDP estimate for August showed a much larger drop of 0.5% than expected, which wiped out the gains from July. Let’s see how the warm weather impacted growth in September. GBP bulls will need to see a sharp rebound.

3) US CPI

Thursday, October 12

13:30 BST

The market appears convinced that the Fed’s tightening cycle is over, but equally they are not expecting any rate cuts any time soon. This is because macro indicators in the US have remained relatively upbeat compared to the rest of the world. The dollar bulls will be looking for further evidence in incoming data, such as Thursday’s CPI print, to support the Fed’s view in keep rates high for long. Last month, CPI surprised to the upside, rising to 3.7% from 3.2%, ending a 14-month run of falling price pressures. But if there’s renewed weakness observed in CPI then this could provide relief for major FX pairs and gold.

4) UoM Consumer Sentiment

Friday, October 15

15:00 BST

Since the middle of last year, consumer sentiment has generally been improving despite borrowing costs continuing to rise and price pressures remaining elevated. In more recent weeks, concerns over interest rates remaining high for longer in the US has caused lots of volatility in across financial markets. We have seen a sharp sell-off in stocks while bond yields have hit levels last seen before the global financial crisis. If these concerns filter through to the consumer, then spending is likely to fall on no-essential items, potentially causing the economy to come to a standstill. The UoM survey will give us an advanced indication on the front.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R