- Gold analysis: Metal held back by strong dollar and rising yield

- US CPI could determine gold direction

- Gold technical analysis: bulls not out of woods yet

Earlier, gold managed to recoup some of its weekly losses as it found support on the back of slight weakness for the dollar and bond yields. However, at the time of writing, it was coming noticeably off its earlier highs and threatening to turn red. It looks like the earlier recovery was driven by short-covering. Overall, the current market environment is not too supportive for gold, and not a lot has changed today.

Gold analysis: Metal held back by strong dollar and rising yield

The precious metal has struggled to move decisively in one or the other direction over the past few months, but thanks to the strength of the dollar and yields, it has been an overall bearish trend for the metal. Will that change as we head into the week ahead remains to be seen. With the yuan weakening further, surely this is not good news for gold as it makes it dearer for Chinese to purchase the metal, while it is also euro negative as it could weigh on Eurozone exports. A lot will now depend on the direction of the dollar. Being up for 8 consecutive weeks, the Dollar Index took a breather on Friday amid lack of any fresh news. But there’s plenty of data next week to trigger a sharp move.

Here's our week ahead preview, by my colleague Matt Simpson.

US CPI could determine gold direction

The next big event for gold, and indeed the dollar, is the CPI data next week, which could influence the Fed’s decision whether to hike further or not. The market appears convinced that the hiking is done. But thanks to the resilience of US economy, they are expecting interest rates to remain at current levels longer than they had previously been expecting. This is what has helped to keep the dollar underpinned and gold undermined. A weaker CPI print could provide welcome relief for gold, while a stronger print is what the bears would be looking for.

Gold technical analysis

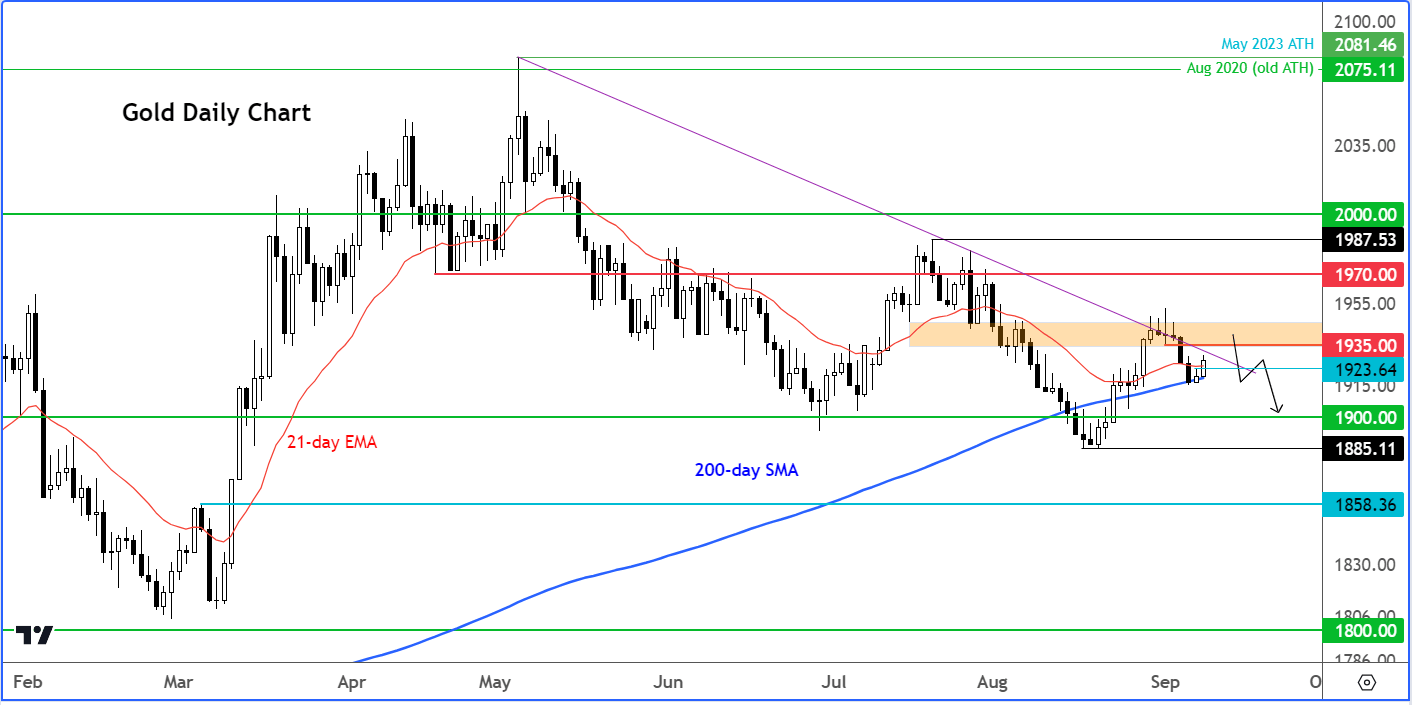

The precious metal has found some mild technical support around its 200-day average around $1915. If it were to break below this level, which appears likely in our view, then we could see another wave of technical selling leading up to that CPI report next week. Short-term support comes in around $1923, Thursday’s high. If gold moves back and holds below this level then this would put the bulls in a spot of bother.

Sources: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R